US equities padded pre-open gains in a relief rally after the US payrolls report confirmed a 196k headline gain and mild upward back revisions, along side a steady jobless rate at 3.8% and dip in earnings. Other weather distortions were also unwound, with hours-worked bounces in the goods sector overall and construction in particular, and a down-tick in the y/y hourly earnings gain to 3.2% from the weather-boosted 3.4% cycle-high. The firm March data capped the significance of the weak February figures, leaving a solid path for most “hard data” measures (retail sales aside) that are at odds with the market’s recession fears and speculation about Fed easing.

Trump cited welcome progress on the trade talks following high level meetings yesterday, but no timeline for a summit with Xi. Global equities had been relatively quiet ahead of payrolls and with many Sino-exchanges closed for a holiday.

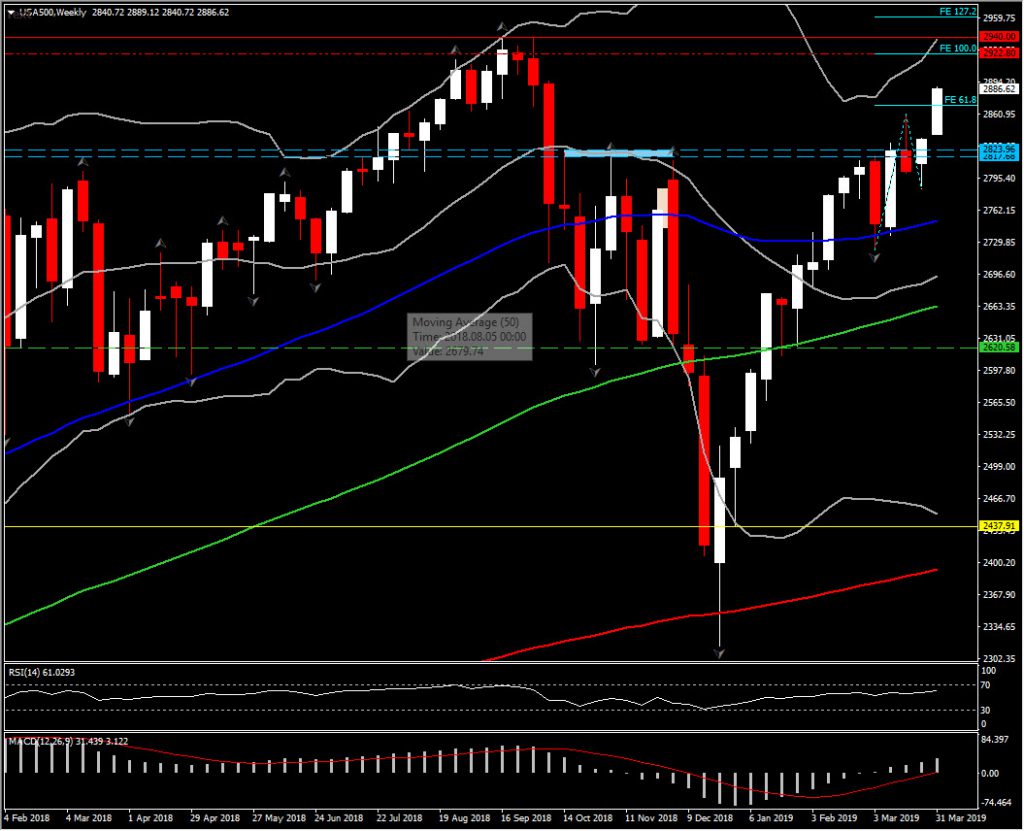

The USA30 is 96-points higher, USA500 gained 8-points and USA100 is up 29-points in pre-market action. USA500, which has recovered nearly all losses seen in the second half of 2018, is classed as being in a strong positive bias that’s been persisting since January. Momentum indicators, despite the sharp rally, suggest that there is further steam to the upside until they reach overbought area. Asset’s next Resistance is at 2,922.80 (FE100.00), and August 2018 peak at 2,940. It has an immediate Support at 2,818-2,824. Further down the Support comes at 2,750 (50-week SMA).

This is not a bad result for the Fed, which is on an extended pause, though it remains optimistic on growth. Intel sank 1% in pre-market trade after a Wells analyst downgrade, while Bed, Bath and Beyond rose over 2% on a MS upgrade. On tap next is consumer credit later in the session, along with Fedspeak from dove Bostic.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.