On Wednesday, the focus will be on the Emergency EU Council summit,which coincides with an ECB meeting.

The EU has,overall, held a united front through the negotiations on the UK Withdrawal Agreement, but on the question of further extensions, differences of opinion become apparent. EU Council President Tusk is promoting a “flextension” based on a 1-year extension, which ends automatically when and whether the UK has ratified the withdrawal agreement. EU President Juncker meanwhile has been on record as demanding that the withdrawal agreement is signed off in London before another extension is granted.

UK PM May on the other hand is once again asking for an extension until June 30. In her letter she promised to continue preparations to hold EU Parliament elections, but suggests she is still trying to get an agreement and leave before May 23, in which case the elections would be cancelled.

The June 30 date suggests that May still wants to avoid having to hold elections, as the first sitting of the European Parliament will not be before early July, so there has been some suggestion that the UK could get away without having to hold elections at the end of May if it leaves the EU by the end of June.

The problem with that argument, though, is what happens if there is no agreement in London by the end of June. In that case the EU would be forced to accept either:

- a no-deal scenario or

- allow the UK to stay on without having representatives in the EU Parliament, which could cause legal problems.

The same holds if the UK were to hold another referendum and ultimately decide to stay within the EU.

- A long extension is not acceptable to everyone in the EU, as there are fears that Brexit supporters would turn EU Parliament elections in the UK into another protest vote and seek to actively disrupt the work of EU institutions as long as the UK stays within the EU.

The unusual timing of the ECB policy setting meeting, on a Wednesday and closer than usual to the last meeting, would give the central bank the opportunity to sign off emergency measures in preparation for a no-deal scenario, although while the nature of the future relationship between the UK and the EU remains unclear it seems that at least the risk of a cliff edge exit on April 12 is diminishing. This should leave the ECB pretty much on hold on Wednesday.

The ECB already announced another round of targeted long term loans (TLTRO III) at the March meeting, but these won’t start until September and the central bank is expected to wait until June to announce details.

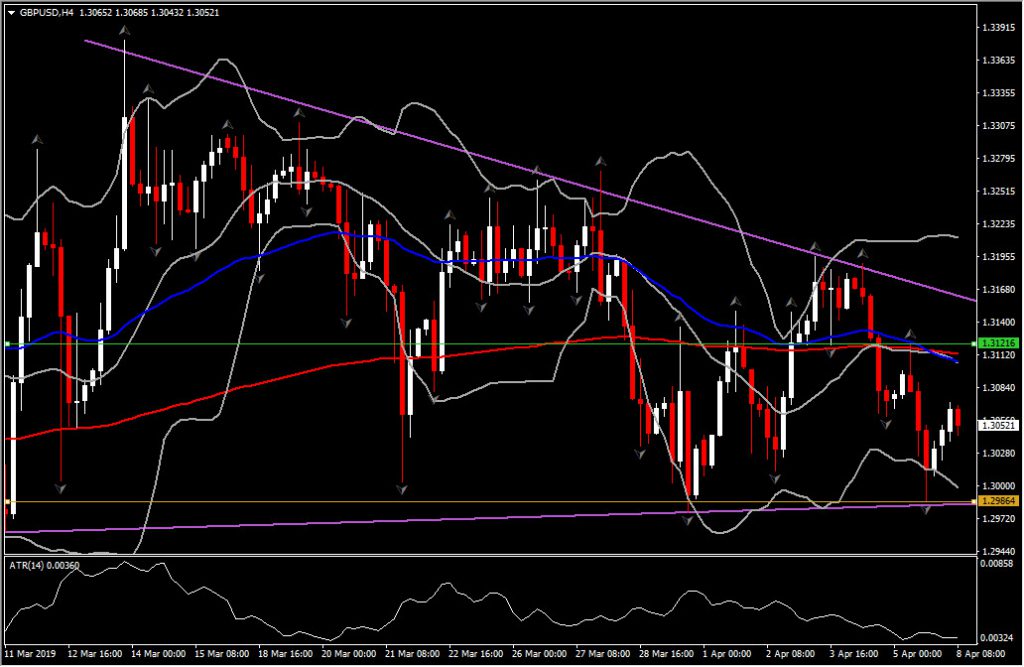

In the market front, Sterling has seen moderate firmness, recouping some of the declines seen over the last couple of days last week. Cable lifted back above 1.3050 to put in some distance from Friday’s 10-day low at 1.2987.

UK Prime Minister May is expected to hold further meetings with Labour’s Corbyn today amid ongoing efforts to find a cross-party compromise on Brexit. May is due to appear at the EU’s emergency Brexit summit on Wednesday. As ehe situation remains fluidi, if the talks with Labour fail, May has committed to putting in a series of Brexit options to Parliament.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.