The Bank of Japan is the only central bank that has not raised interest rates, although inflation has exceeded the 2% target for the past year and a half, Japan has not been declared deflation-free.

The Japanese economy experienced a larger-than-expected contraction in Q3, raising questions about the strength of the Japanese economy at a time when the BOJ is considering ending negative interest rates.

Japan’s economy shrank 0.7% q/q in Q3 of 2023, the first GDP contraction since the third quarter of 2022, amid rising cost pressures and increasing global headwinds. The consumer price index rose to 3.3% y/y in October and the Tokyo CPI figure due on Friday is likely to slow in November as well. The main cause of this weakness is slowing family spending. Over the past two quarters, consumption declined drastically as rising costs put pressure on household finances. On the other hand, the Japanese government recently announced a large stimulus package aimed at easing the burden on households from high inflation, so a turnaround in consumer spending is likely in the coming months.

The uncertain economic conditions are a headwind for policymakers, but ultra-loose policies will eventually stop as wages rise. However, the outcome of the yield curve control (YCC) policy is a bit more complicated. Although raising the upper limit of the 10-year yield target to 1.0% in October gave the BoJ considerable leverage over the yield curve, it is unlikely that the BoJ will completely give up on the YCC policy to maintain its ability to prevent sudden swings in yields. The recent decline in global bond yields has also removed the pressure for policymakers to further modify their YCC strategy.

A rate change from the BOJ is expected in Q2 2024, most likely at the June meeting. By then, the BOJ will be able to ensure solid wage increases based on the Shunto results. Trend inflation is expected to ease at the beginning of next year, but core inflation is expected to remain above 2%. Even if the BoJ does hike rates, the Bank’s JGB purchase operations will likely continue to avoid a sharp rise in long-term yields.

However, Ueda’s narrative suggests a bias towards policy normalisation. Given the BoJ’s history of surprising markets, the risk of a surprise decision in early 2024 to raise rates or end the YCC, or both cannot be discounted. Meanwhile, the risk is so low for the December meeting that most of the market reaction will depend on the change in Ueda’s statement. Any hint that a rate hike will happen as early as 2024 could trigger a US Dollar sell-off against the Japanese currency.

On the other hand, the chance of a Fed rate cut as presented by Jerome Powell at the last meeting, has benefited the Yen currency by recording a large gain for the second time, after the first, when Ueda’s meeting with the Prime Minister the previous week, caused a fairly rapid shift in market sentiment. It looks like the BOJ is paving the way towards gradual normalisation and signalling to markets, that the time is near.

In the FX market, USDJPY on Friday’s trading was up +0.16% (15/12). The yen gave up earlier gains and turned lower as the Fed’s hawkish comments pushed the Dollar higher. The Yen on Friday initially moved higher on falling T-note yields and Japanese Finance Minister Suzuki’s comments that triggered Yen short-covering, as he said the government will continue to monitor currency movements “closely.” Japanese economic news on Friday was mixed for the Yen. The BOJ Jibun Manufacturing PMI for December fell -0.6 to 47.7, the weakest level in 10 months. However, the December Jibun Bank services PMI rose +1.2 to 52.0.

Technical Analysis

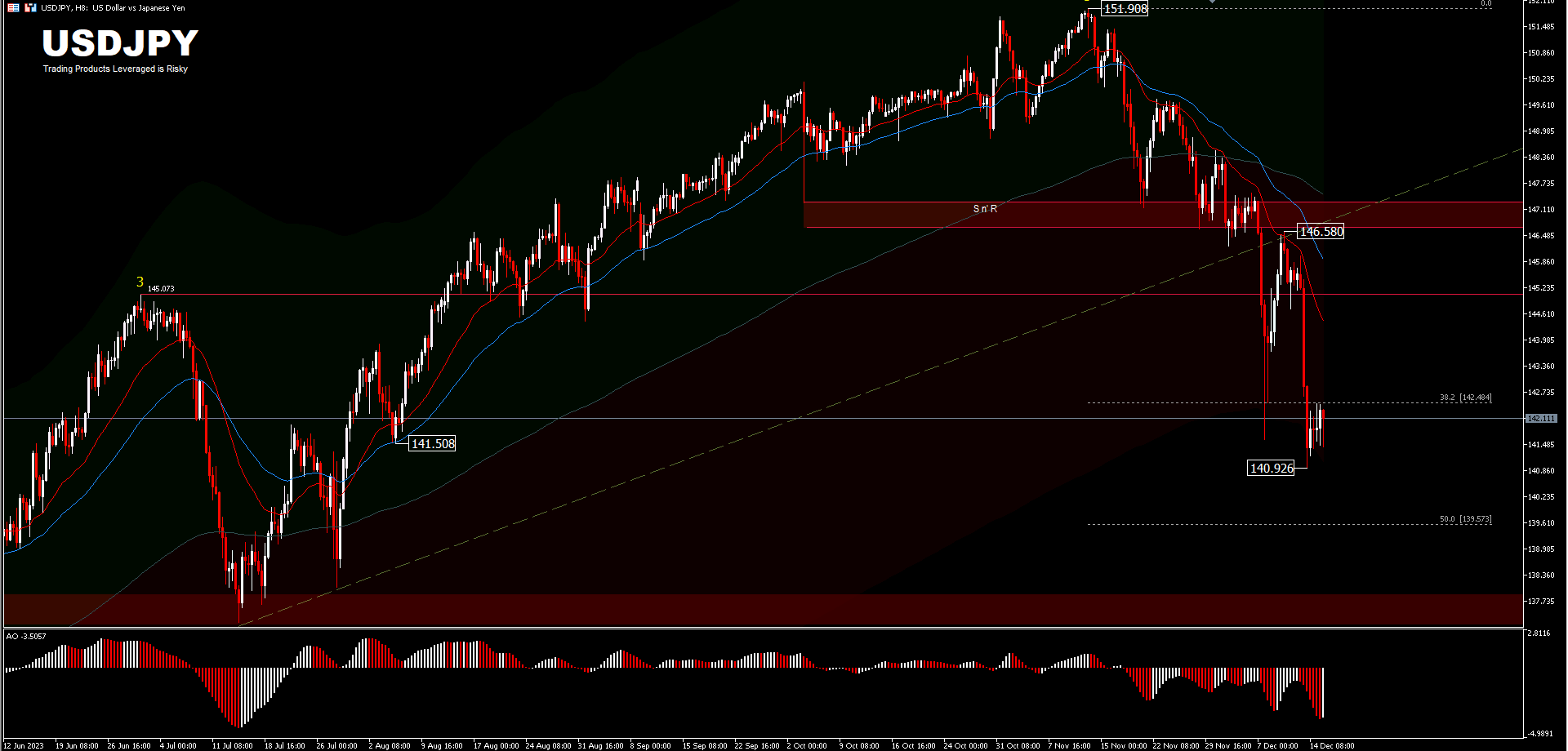

USDJPY’s decline from 151.90 is seen as the third part of a corrective pattern from the 2022 peak of 151.93. A deeper drop could test the 50%FR or 61.8%FR level, from 127.20 to 151.90 pullback. A sustained break there will open the way to 127.20 support. The level will now remain the focus of attention as long as 146.58 resistance holds.

USDJPY (H8) decline from 151.90 is still ongoing. But as a temporary low was formed at 140.92, the bias early this week is neutral first for consolidation. The upside should be limited by 146.58 resistance to bring the decline back. A break of 140.92 will target the next Fibonacci level at 139.57 and the resistance which is now support at 137.90.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.