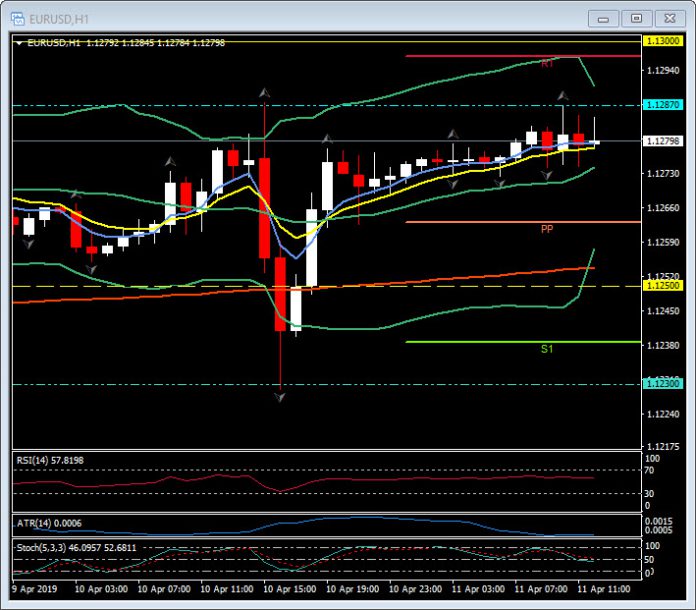

EURUSD, H1

Forex markets where at attention yesterday as the worlds two most important central banks had statements, announcements and minutes of meetings to be digested. A few hours later and we are very much “as we were”.

EURUSD has been plying a narrow range in the upper 1.1200s, matching yesterday’s 12-day high at 1.1287. The pair had dropped by some 50 pips yesterday, which left a low at 1.1229, following downbeat remarks by ECB President Draghi following his post-policy meeting press conference, which was followed by perky US CPI data, though the Dollar retraced lower as markets digested that still-benign core CPI reading, which lifted EURUSD back into the upper 1.1200s. The Fed has thus pinned its dovish turn in large part on an outlook for soft inflation.

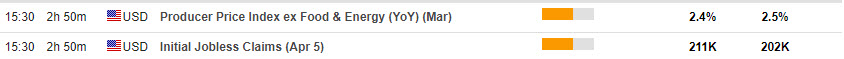

The final reading of Eurozone March HICP came in unrevised, at 1.4% y/y, as expected. Focus will now shift to today’s US PPI and jobless claims data releases, which are expected to be net bullish for the Dollar. Initial jobless claims are expected to rise 9k to 211k in the week ended April 6, from a 49-year low of 202k in the prior week. PPI is expected at a rate of 2.0% y/m in March, up from 1.9% in the month prior, with the core reading seen at 2.4% after 2.5% in February.

In the bigger picture, the pairing is in a bear trend, which has been unfolding since February last year, although downside momentum has abated notably in recent months. Support comes in at 1.1230, and resistance at 1.1300. “As you were!”

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.