FX News Today

- The broad rise in Asian long yields holds as local stock markets rallied in catch up trade after a strong close on Wall Street.

- Trade talk hopes, signs of improving growth and low inflation, coupled with positive earnings reports continued to underpin stock market sentiment. Mnuchin suggested over the weekend that US-Sino talks are nearing the final round and that the final agreement would go “way beyond” previous efforts to open China’s markets to US companies.

- US futures are narrowly mixed while European stock markets are underpinned.

- Japanese markets are closing for 10 consecutive days from April 27 to May 6, inclusive.

- After the strong first quarter earnings report from JPMorgan on Friday the focus is now turning to Goldman Sachs, Citigroup and Bank of America.

- The front end WTI future is trading at $63.53 per barrel.

- USD and JPY lower vs most currencies, risk appetite up on strong China import data.

- GBP steady after EU Brexit extension; risk is it won’t resolve UK political gridlock.

Charts of the Day

Technician’s Corner

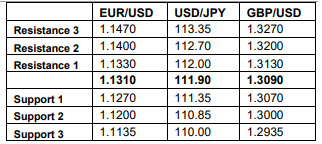

- EURUSD keeps trading close to 3-week highs of 1.1323. Stochastics, RSI and the MACD show signals of further improvement intraday. Next Resistance point holds at 1.1330.

- GBPUSD pulled back under 1.3100 after leaving a high at 1.3120. It is supported from the confluence of 200-period EMA and PP level the past 7 consecutive hours, at 1.3084. Next Support is set at 1.3065.

- USDJPY settled at around PP level at 111.90 . However after Friday’s high the positive sentiment is decreasing with intraday RSI and MACD turning lower as the overall outlook remains positive. The upside Resistance level is set at 112.19, while Support now comes in at 111.68.

Main Macro Events Today

- FOMC Member Evans Speaks – Federal Reserve Bank of Chicago President Charles Evans is due to speak in a television appearance on CNBC’s Squawk Box.

- BOC Business Outlook Survey – The BoC’s outlook survey is expected to show an economy still moving along at a decent pace, but facing a number of challenges. This is a key report for the upcoming BoC announcement and MPR, as the Bank makes frequent references to the findings of the survey. A survey consistent with modest but still respectable growth, well contained inflation expectations and an unwinding in capacity pressures would line-up with our expectation for no change in rates later this month and through year-end.

- Empire State index – It is estimated to jump to 9.0 in April from a 2-year low of 3.7 in March.

Support and Resistance

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.