Front-month WTI crude prices are down 0.9% at $63.30, earlier printing a one-week low at $63.23. This extends the correction from the 5-month high seen last Tuesday at $64.79.

This 5-day dip could be interpreted so far as a correction in a bull market. Prices are still up by over 8% from month-ago levels, and are up by 39.4% on the year-to-date following what was the biggest quarterly rise in crude prices in Q1 in over 10 years. OPEC-led supply curtailment, US sanctions against Iranian and Venezuelan oil exports along with still-strong global demand have been underpinning the market.

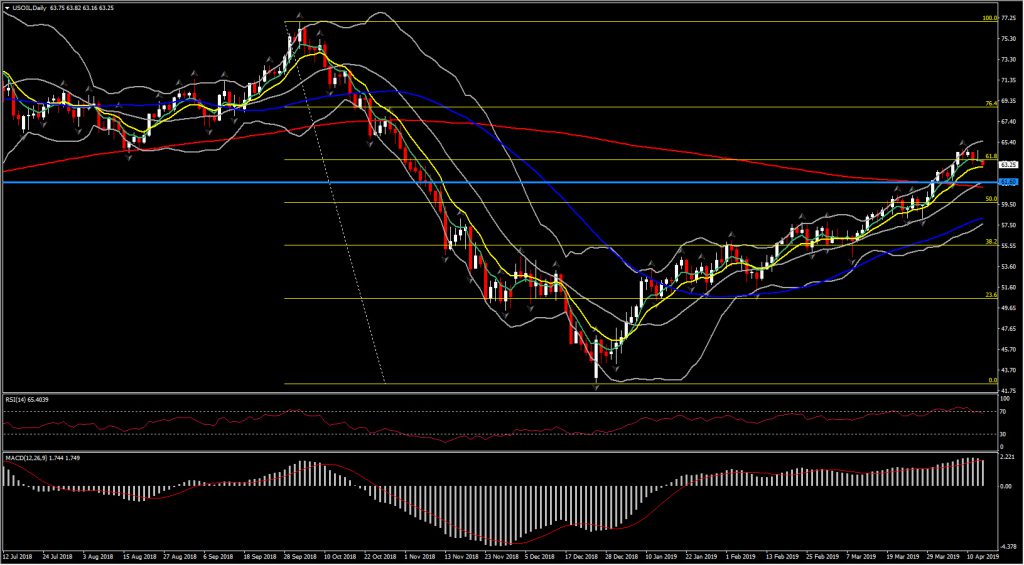

From the technical perspective, USOIL is holding well above an increasing 20-day SMA, while 50-day SMA also extends further to the upside confirming the bullish momentum rise. The daily momentum indicators have slipped slightly, however they hold at the high positive area, suggesting that this is a small pause of the 3-month steep rally.

Hence as for the past 3 months, every pullback was well supported by bulls, the overall sentiment stays bullish unless there is a strong breakout of the 200-day SMA at $61.10. Intraday Support is held at $63.00, while the medium term one is set at 20-day SMA, at $61.60.

A move to the upside above last week’s high at $64.70 could retest the next Resistance at $66.60 (January 2018 peak) and $68.80 (76.4% Fibonacci retracement set by the downleg from 77 highs).

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.