Gold came under pressure, owing to the US dollar’s strengthening and sustained Treasury Yields, which led to losses down to a one-month low of $2,001.72 per ounce. The recent surge in the value of the dollar, triggered by hawkish statements from the Federal Reserve, lowered expectations of upcoming interest rate cuts, which boosted Treasury yields and the dollar.

The dollar index, which is near its highest level in a month, was further supported by Fed Chairman Christopher Waller’s caution against rapid rate cuts to keep inflation low. The yield on 10-year Treasury bonds increased simultaneously. The market is quite pessimistic about the possibility of a timely rate cut, which will pressure gold prices. The impact of this cut is delayed due to the strong dollar, making it difficult for gold to continue rising.

In a statement on Thursday, Federal Reserve Bank of Atlanta President Raphael Bostic said, due to the unexpected rise in inflation, he anticipates a rate cut by the central bank in the third quarter of 2024 and not in the fourth quarter.

“Because I am data-dependent, I have incorporated unexpected advances in inflation and economic activity into my forecast and thus increased my projected timing to begin normalizing the federal funds rate to the third quarter of this year from the fourth quarter,” Bostic noted at the Atlanta Business Chronicle’s Economic Outlook 2024 event.

However, Bostic further cautioned against adopting a “decisive approach” to monetary policy amid an “unpredictable environment…I believe we should let events continue to unfold before beginning the process of policy normalization,” he added.

Despite these difficulties, geopolitical concerns keep gold prices above the $2,000 mark as a counterweight. The precious metal has a strong future ahead, despite continued tensions around the world and commodity purchases by banks reaching record highs. Global geopolitical tensions are rising, yet banks are still accumulating unprecedented amounts of gold.

Market reactions to dollar strength and the Fed’s cautious stance towards rate cuts highlight the complex dynamics at play, although the current climate provides headwinds for gold. The environment in which investors operate is one in which the results of economic decisions take time to materialize. Gold’s staying power is demonstrated by its ability to hold its value in the face of strong currencies and a volatile market atmosphere.

In short, the dynamic environment for gold is created by the interaction of several factors, such as dollar strength, geopolitical tensions and central bank operations. Investors hoping to take advantage of the precious metal’s potential in an ever-changing market environment need to pay attention to critical resistance levels and understand the subtle responses to economic cues as these difficulties are worked through.

XAUUSD on Thursday’s trading closed +0.75%, supported by geopolitical risks in the Middle East, as Houthi rebels continue to attack ships in the Red Sea off the coast of Yemen. Additionally, rising inflation expectations boosted demand for gold as an inflation hedge after the 10-year breakeven inflation rate rose to a 2-month high of 2.348% on Thursday. Gold’s gains were capped by a stronger dollar and higher global bond yields. In addition, the December 13-14 ECB meeting report released on Thursday was bearish for gold, as it showed ECB officials rejected market expectations of an ECB rate cut.

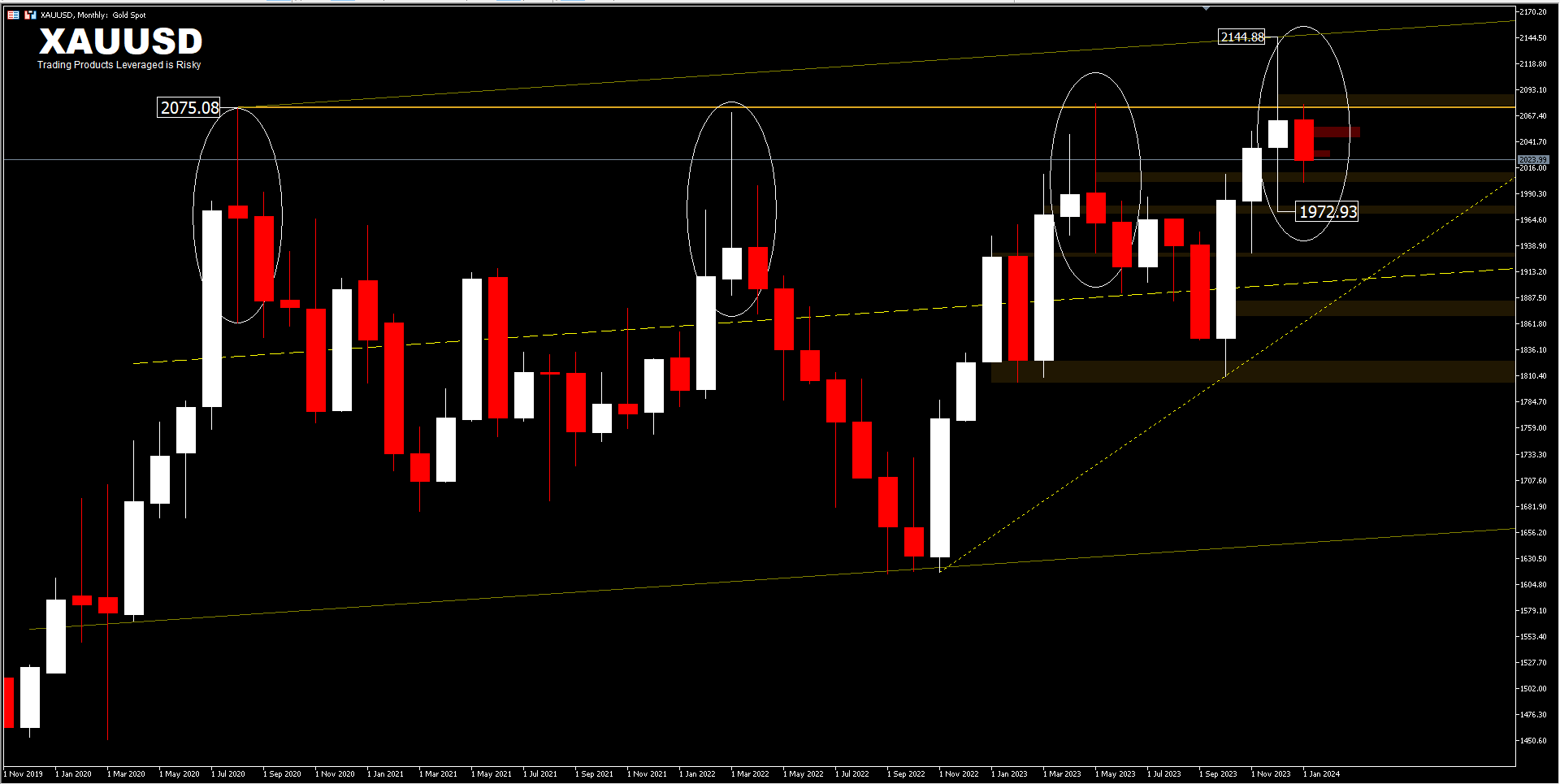

GOLD, MN

From a technical perspective, on the monthly chart, the average peak price is at a price range of $2075.00. Ignoring the ATH of $2144.88, the yearly price level would be a bear stronghold that would challenge the bulls to create new defenses above it. Of the several monthly peak price patterns, the August 2020 high-wave candle, the March 2022 shooting star candle and the April-May 2023 outside pin bar gave birth to a price decline. The presence of the December 2023 high-wave candle (1972.93-2144.88) temporarily overshadows the January 2024 drop.

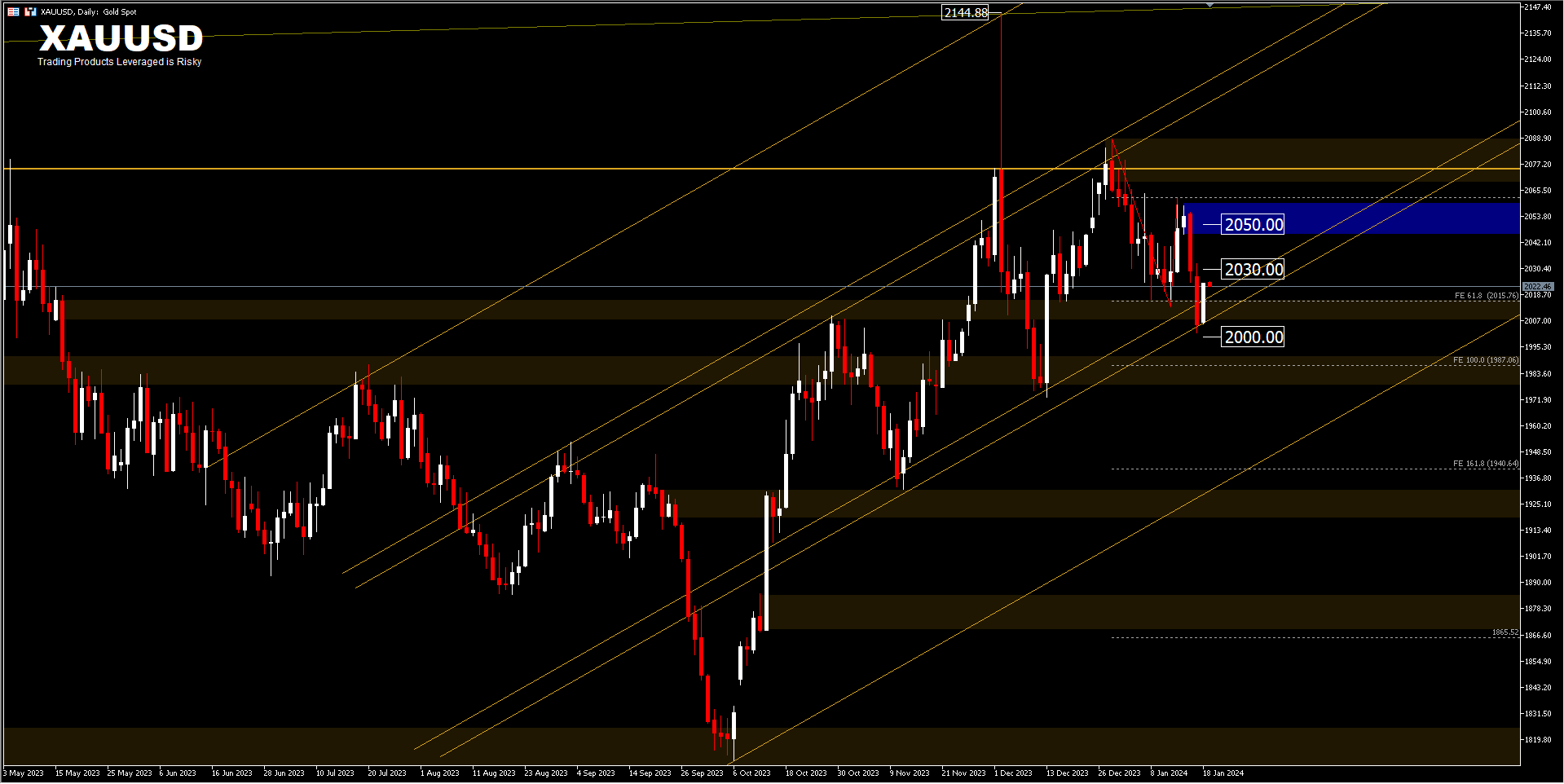

XAUUSD, D1

Gold price dynamics depends on the American interest rate market, but geopolitical factors also have a great influence. On the upside, a move above the level of $2032.83 directs attention to $2,050. Going beyond this level could create a different phase for traders to chase the average high of $2075.00.

On the other hand, a break below $2000.00 as a substantial support gives good prospects for the bulls to price lower with projections for FE100% at 1987.08 [from 2088.34-2013.22 and 2062.18 pullback]. However, as long as the price is above $2000.00, it would signal the potential for the market to oscillate in a range between $2,000-$2,050 first. The current price is characterized by a daily inside bar pattern.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.