- Tensions rise in the Middle East as three US Soldiers are killed in a base near the Syrian-Jordan border after being attacked by Iran-backed militants. Crude Oil price opens 1.15% higher.

- Gold rose 0.63% on Monday due to rising tension in the Middle east. Traders are evaluating whether the market will witness a “risk-off” sentiment this week.

- All eyes on the Federal Reserve’s press conference on Wednesday. Analysts expect the Federal Fund Rate to remain unchanged, but the Press Conference will signal the Fed’s future path.

- The US economy grew 3.3% in the latest quarter, beating expectations of 2.0%. In addition to this, Pending Home Sales rose 8.3% and the Core PCE Index rose from 0.1% to 0.2%.

XAUUSD – Geo-Political Tension Again on The Rise

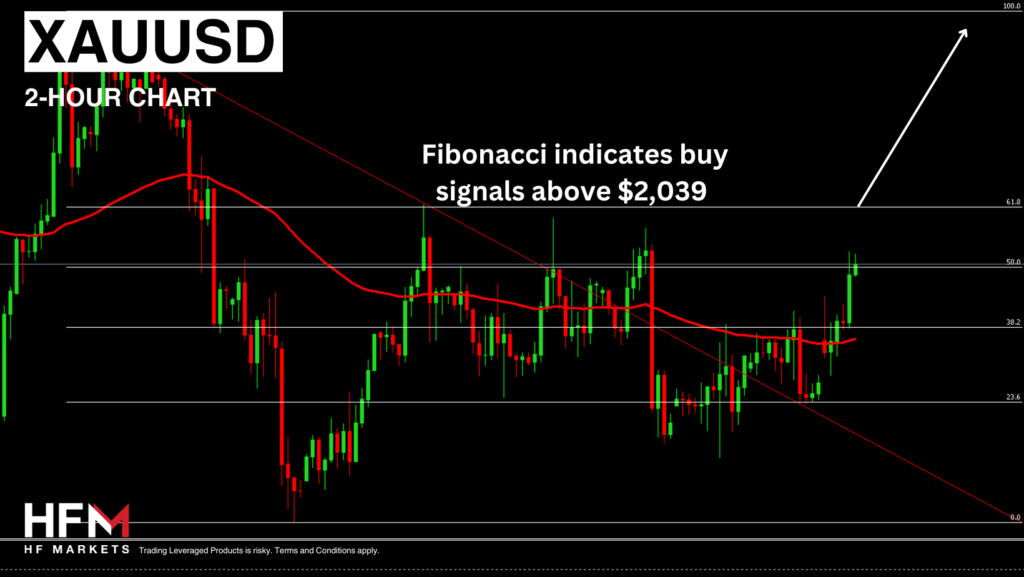

The US Dollar Index did open Monday’s trading slightly higher, however, has fallen 0.10% over the past 2 hours as of the time of writing. Instead, investors are increasing exposure to Gold. Gold prices are trading 0.63% higher during this morning’s Asian Session and have risen above the most recent resistance levels. When evaluating technical analysis, the price of the commodity is trading above price sentiment indicators, above the neutral on most oscillators and above the day’s VWAP. Here we can see potential “buy” signals, however, investors also should note significant resistance points at $2,037.80. This level has triggered declines on eight occasions over the past month. If the price maintains momentum and crosses this level, Gold will move into the “buy” region of the Fibonacci levels.

The price is largely being driven by two factors: the decline in the Dollar and lower investor sentiment due to rising Middle East tensions. The group which conducted the attack is not yet known, however, President Biden has already advised the US will retaliate. According to the White House, the group is most likely an Iranian-backed militant group which is the main concern for investors. Though investors should note that this will only have a short-term effect if the situation does not escalate.

The next price drive will be the Federal Reserve’s Press Conference and the central bank’s forward guidance on interest rates. This will determine if institutions decide to further expose their funds to the Dollar or look for alternatives. The main alternatives will be Gold and US Bonds. If investors are unconvinced the Fed will keep rates high, Gold could benefit from a weaker Dollar. Tomorrow’s JOLTS Job Openings could also create further volatility.

USA100 – Investors Eye Earnings and Fed Press Conference

US investors are concerned about the developments over the weekend and as a result the rising oil price. Another concern for investors is also if the Fed gives an ultra-hawkish signal on Wednesday after strong economic data last week. Last week, the US PMI rose higher than expectations as did the economy’s Gross Domestic Product. Though stocks and shareholders will equally be monitoring this week’s quarterly earnings reports from major companies.

Tuesday Quarterly Earnings Report

Microsoft – +1.01% over the past week.

Alphabet – +3.30% over the past week.

AMD – +1.58% over the past week.

Wednesday Quarterly Earnings Report

Apple – Unchanged over the past week.

Amazon – +1.35% over the past week.

Meta – +1.61% over the past week.

The performance of the USA100 will largely depend on whether the above earnings are higher than Wall Street’s expectations and on the Fed’s Press Conference. If the Fed is viewed as “ultra-hawkish”, stocks are likely to experience significant pressure if earnings do not exceed expectations.

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.