The risk-on vibe in global stock markets was boosted by a strong set of data out of China this week and strong Labor data out of Australia overnight, which gave buoyancy to the Australian and Canadian Dollars. However, as Aussie outperforms, the sub-forecast CPI data out of New Zealand yesterday have underpinned the New Zealand Dollar, and sent NZDUSD to a 3-month low at 0.6665.

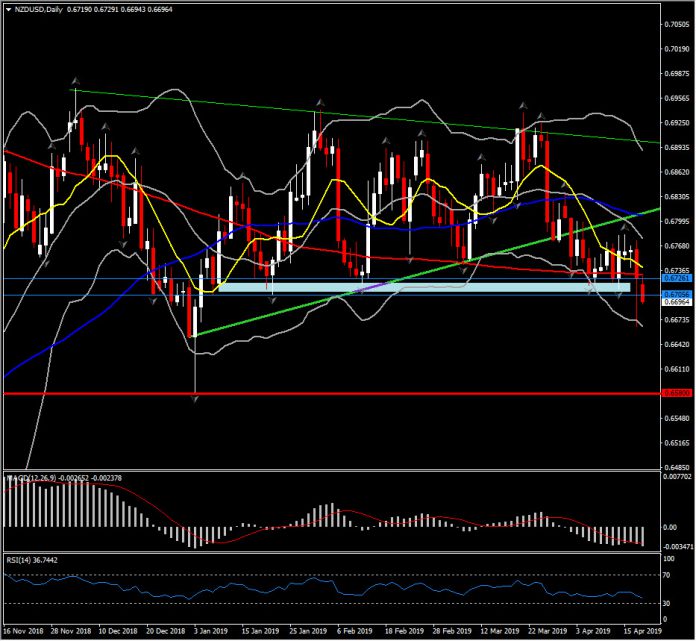

Since November, the 0.6700 has been a key Support level for the asset. Even though yesterday Kiwi’s bulls managed to lift it back above the 0.6700 hurdle, this sharp decline, along with the continuous drop of the pair for a 4th week in a row (outside of a descending triangle), strengthens negative bias.

The pair holds for a second consecutive day below 200-DSMA, while it’s been below 10-, 20- and 50-day SMA since March 27. This, along with the Moving averages pointing to the downside and momentum indicators being negatively configured, suggest more possible losses in the near and medium term picture.

The RSI indicator is looking south, while MACD keeps extending in the negative area, implying a negative momentum rising.

Hence, a confirmed close below 0.6700, could propose the end of the sideways movement as the bears have taken the control of the market. Therefore the doors towards January’s low at 0.6580 level will open.

On the flip-side, a rebound could face an immediate Resistance at 20-day SMA and week’s peak, at 0.6770-0.6780 area.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.