WTI crude ended the week with modest losses, with Dollar strength prompting some pre-weekend position paring. The front-month contract bottomed at $63.52, after peaking at $64.16.

However, the contract managed to break the $65.00 barrier overnight, peaking to $65.97, after the reports for a complete cutoff to Iran Oil exports. This report from the Washington Post will be confirmed later today from the US Secretary of state Mike Pompeo, who will announce that all countries that continue to import Iranian oil will be subject to US sanctions, as The Washington Post reported on Sunday.

The overall picture should continue to support oil prices, as the US is getting aggressive, with the US inventories declining, OPEC+ production cuts and Saudi Arabia export reductions.

Despite the sharp rally, which was followed by reversal below the $66.00 barrier and a consolidation in the past few hours, bulls are expected to continue boosting to the upside,since fundamentals support the asset.

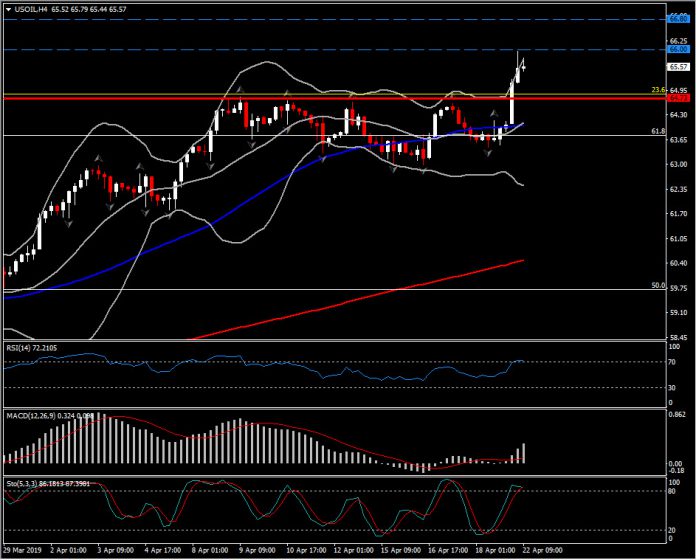

Currently, the asset is trading within a range $65.40-$66.00. Hence, consolidation mode is on after the overnight spike. This is expected to hold for a few sessions before the next upside attempt, with momentum indicators supporting strongly the positive bias in the near term and medium term.

Intraday, RSI is set at 70 with further space upwards, while MACD extended lines way above signal line suggesting further gains for USOIL. Fast line in Stochastic indicator on the other hand, is turning slightly lower, implying that in the short-term we could face some weakness. However, as long as the asset holds above the $64.73 Support level (2-day rally midpoint and 9-day Resistance converted into Support), any weakness could be interpreted as a correction of this 3-month incline.

A breakout of $66.00 would turn the attention towards $66.80 Resistance level.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.