Coca-Cola Co., an American multinational corporation founded in 1892 which specializes in the manufacturing, marketing and selling of non-alcoholic beverage concentrates and syrups, as well as alcoholic beverages, shall release its fourth quarter and full year 2023 financial results on 13th February (Tuesday), at pre-market open. With multiple billion-dollar brands across several beverage categories being sold worldwide, the company has secured its seat as the world’s 40th most valuable company by market cap, at approximately $260B.

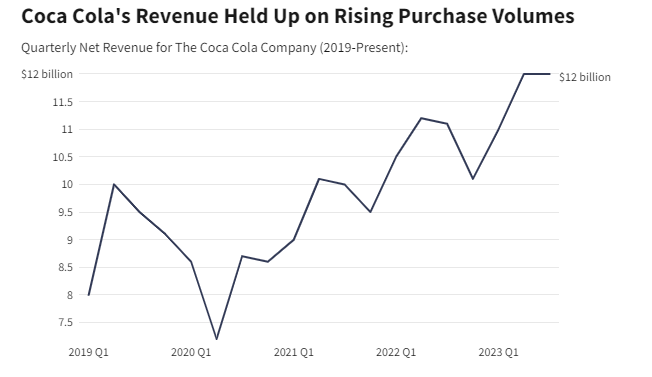

Coca Cola Revenue Trend. Source: Investopedia

In the previous quarter, the company reported 2% quarterly growth in unit case volume, mainly boosted by robust consumer spending on soft drinks and other beverages (except in the China region, but the management remained optimistic as they are expecting a “strong Lunar New Year in 2024”) despite the company’s price hikes on its products as a measure to offset the effects of higher inflation. The company brought in satisfying financial results, with net revenues growing 8% (y/y) to $12B (the graph above shows the company’s resilient growth in sales revenue since its rebound from the low in Q2 2020, at $7.2B). Operating income and net income grew 6% (y/y) and 7% (y/y), to $3.27B and $3.09B respectively.

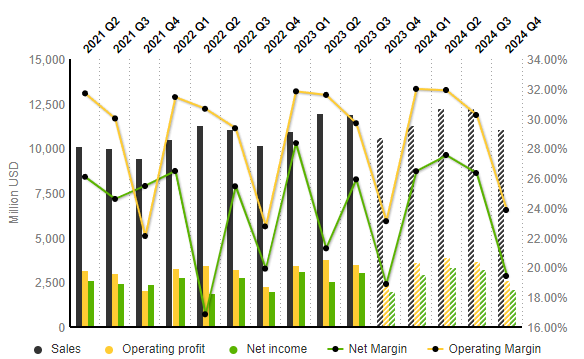

The Coca-Cola Company – Income Statement Evolution (Quarterly Data). Source: MarketScreener

Interestingly, the operating profit of the Coca-Cola company has displayed a repetitive pattern (yellow line) in recent financial years. The pattern shows the “best” performance in every first quarter of the year, then gradually declines throughout the second and the third quarter, then the “worst” result in the fourth quarter. If projection is to be done based on historical record, the S&P Global Market Intelligence expects the operating profit in the coming quarter to fall to $2.46B.

In addition, sales is expected to hit $10.65B, down -10.6% from the previous quarter, but up 4.4% from the same period last year. Operating margin and net margin is also expected to decline to 23.12% and 18.93% (was 29.69% and 25.92% respectively in Q3 2023).

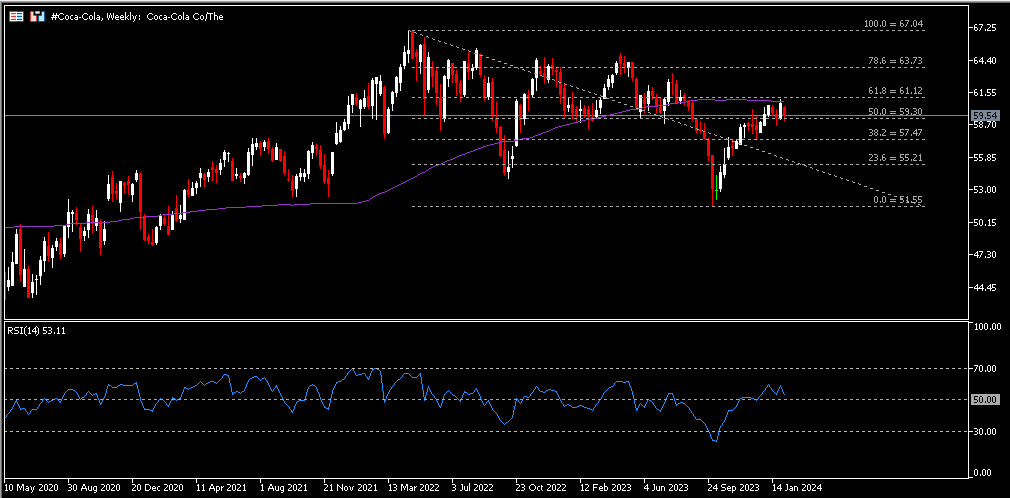

Technical Analysis:

The #Coca-Cola share price has closed bullish for four consecutive months, up over 15% from the session lows ($51.55). Last week, the company’s share price closed bearish, still remaining pressured under the 100-week SMA. An FR 50.0% at $59 is currently being tested. If this support is successfully broken through, the next target will be the FR 38.2% at $57.50, followed by FR 23.6% at $55. On the contrary, a better-than-expected earnings result may encourage the buyers, which could bring the asset price towards the dynamic 100-week SMA resistance and also $61 (FR 61.8%). The next resistance after these levels is $64 (FR 78.6%).

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.