This week, one of the behemoths of the retail trade sector – Walmart – shall report its Q4 2023 earnings result on 20th February (Tuesday), before market open. Walmart operates a chain of hypermarkets, discount department stores and grocery stores, and by market capitalization in the global retail sector, Walmart is ranked 2nd, right after Amazon.

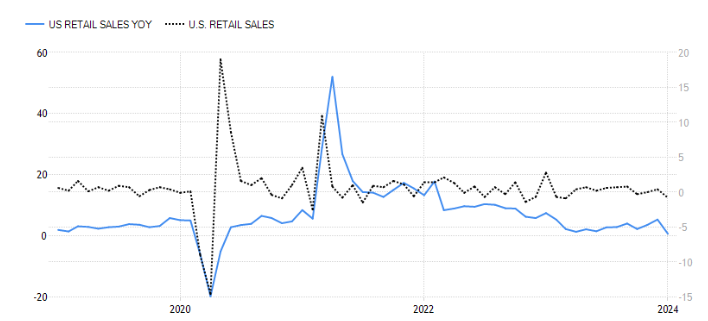

US Retail Sales. Source: Trading Economics

The latest US retail sales data reported the lowest annual gain since the fall in May 2020, at 0.6%, following a downwardly revised 5.3% rise in December. It is below the average figure from 1993 to 2024, which is 4.81%. Monthly, the data shrank -0.8%, below market forecast at -0.1%. This is the largest decline in retail sales since March last year. According to the officials, the aftermath of the holiday shopping season and cold weather could be the primary factor. As the recent data suggests inflation continues to run hotter than anticipated, most economists expect the Fed to keep its benchmark rate at the 22-year high for an extended period, until May or June, before beginning its first rate cut.

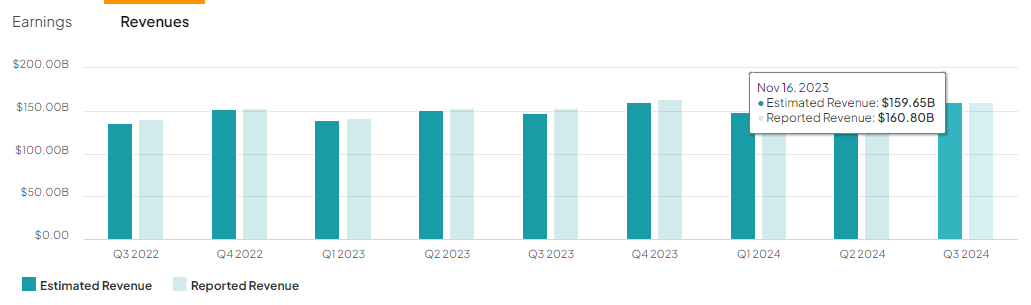

Walmart: Revenues & Earnings (After Deduction of Tax and Expenses). Source: Tipranks

Key financial metrics of Walmart remained solid in the previous quarter. Sales revenue were up 5.2% (y/y) to $160.8B.

The company continued to see robust growth both in-store and digitally. In the US, the company saw strength in grocery and health & wellness, partially offset by softness in general merchandise; whereas its international sales were mainly led by Walmex and China. On the other hand, e-commerce in the US has seen a double-digit growth (+24% (y/y)), thanks to its store-fulfilled pickup and delivery as well as an improvement in Walmart Connect; internationally, its e-commerce sales are down -3%, negatively affected by the timing of Flipkart’s The Big Billion Days event.

In addition, a division of Walmart – Sam’s Club (paid membership based warehouse, which sells groceries and household items in bulk amounts) – reported net sales up +2.8% (y/y), led by food and consumables, health care as well as positive unit growth in general. The division also reported 16% sales growth in e-commerce, led by curbside and delivery. Besides that, growth in membership income remains robust, up 7.2% from the year ago period.

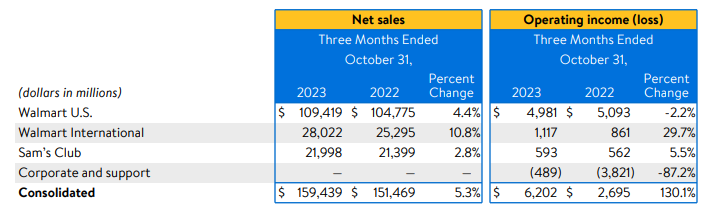

Walmart: Net Sales and Operating Income. Source: Walmart Earnings Report

Operating income was up over +130.0% (y/y) (before adjustment) to $6.2B. By business segments, the main contribution came from Walmart International which saw a leap of 29.7% (y/y) at $1.12B. Sam’s Club reported fair gains of 5.5% (y/y) to $593 million. Walmart US contributed the most at $4.98B, despite a minor loss of -2.2% from the same period last year. Corporate and support has seen losses being narrowed down to -$0.49B, previously -$3.82B.

All in all, the management remains hopeful in its business outlook despite continued pressure from its mix of products and formats globally. The company raised its guidance for FY 2024 net sales to increase approximately 5.0%-5.5%; operating income up 7.0%-7.5%; while adjusted EPS is expected to be around $6.40-$6.48.

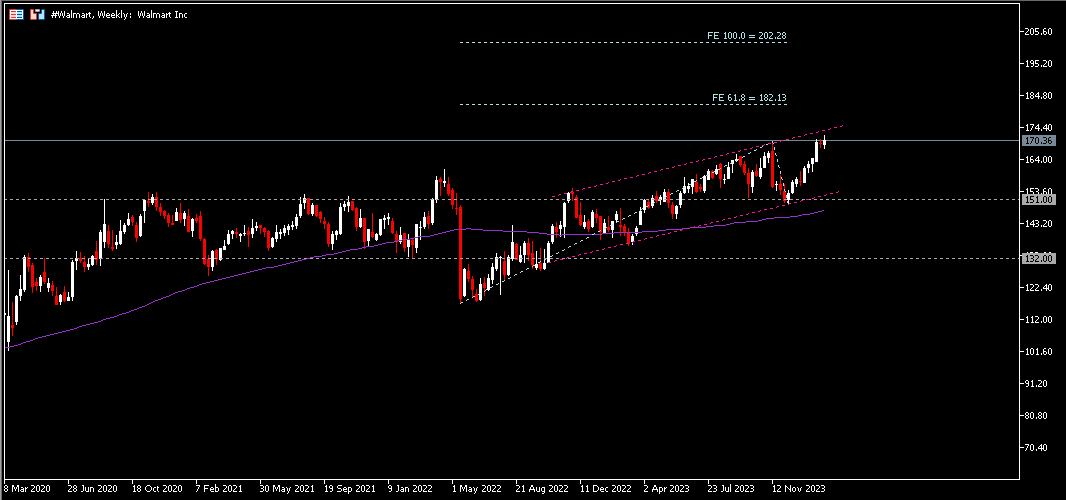

Technical Analysis:

The #Walmart share price continued to trade higher after it found support at the lower line of ascending channel (which coincides with support $151), leaving an ATH at $171.91. The upper line of the channel serves as the nearest resistance, followed by FE projection at $182 and $202. On the other hand, the lower line of the channel serves as the nearest support. Breaking below this line may encourage technical correction towards the next support at $151, and the dynamic support 100-week SMA.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.