USDZAR, Daily

The South African Rand appreciated towards 18.9 per US, after the finance minister said the government would withdraw ZAR 150 billion from an emergency account managed by the central bank, thereby lowering the government’s debt trajectory and borrowing requirements.

South African Reserve Bank Governor Lesetja Kganyago told reporters before the budget speech, that the actual reserves would not be disbursed to raise funds for the Treasury. Instead, the central bank would generate new liabilities, which would then have to be repaid. The move allows President Cyril Ramaphosa to show fiscal prudence while avoiding cuts to public spending programs during an election year. Financial market reaction suggests investors were relieved that the government did not push for higher spending ahead of the election, which was confirmed on May 29.

Meanwhile, South African inflation accelerated to 5.3% in January, from 5.1% in December, moving away from the midpoint of 4.5% and from the target range of 3-6%. This could lead policymakers to keep the key interest rate at its 15-year high of 8.25% for longer.

The State Treasury is still raising its expenditure ceiling to reflect the higher wage settlement achieved in 2023. While the wage bill is still one of the largest items of expenditure, it is projected to grow in line with inflation over the medium term, suggesting no real increase.

In the FX market, the Rand strengthened against major and emerging market currencies after the government set out a spending and tax plan that will see the country’s budget deficit peak in absolute terms by 2025/26. The risk is that the government chooses to announce increased spending ahead of the May 29 elections, which could result in a South African debt downgrade and a drop in the ZAR.

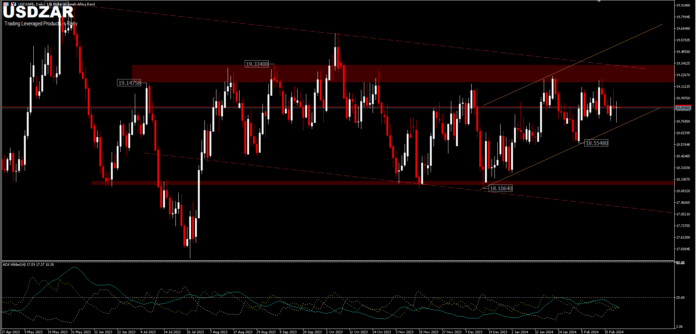

From a technical perspective, the USDZAR exotic pair has shown no significant changes since the beginning of 2024. The strengthening of the USD due to expectations of a longer rate cut time, led the USDZAR pair to move sideways in an ascending consolidation within the corridor of a descending channel. The decline from the June 2024 peak at 19.92 did not bring the change the market wanted. The pair is immersed in consolidation, with the ADX diving below the 25 level, with no notable changes since August last year. The 19.14 – 19.33 price zone seems to be a calculated resistance area on the upside, as it has been tested many times. Support is seen at the 18.55 price level; a drop below this level offers a slight change to the bearish side for 18.10.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.