US equities are mixed but with modest changes in cautious pre-market dealings.

The USA30 is 0.1% in the green, while the USA500 is 0.03% weaker and the USA100 is down just 0.3% after both indexes posted record high closes on Tuesday.

The earnings flood continues today — EBAY (+4.1%) beat expectations, Snap’s (+2.8%) Q1 update was encouraging, Robert Half disappointed, Superior Energy reported a larger than expected loss and Owens Corning missed estimates. Boeing delayed its full year 2019 financial forecast as it evaluates the impact of the grounding of the 737 Max jetliner. However the company delivered first-quarter earnings that came in line with Wall Street expectations while revenue was lighter than expected.

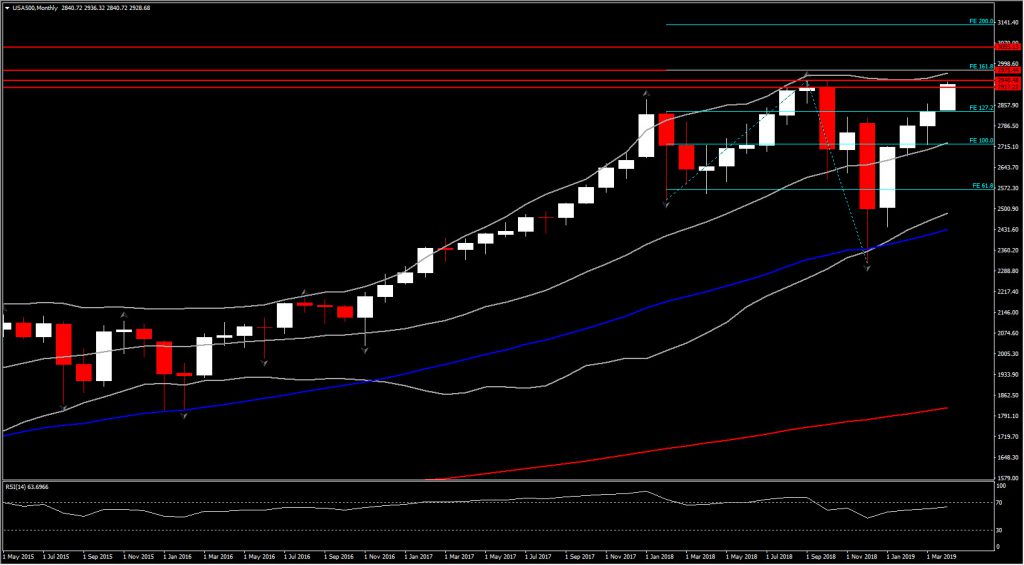

After topping at 2,936.00, the USA500 is consolidating around 2,930.00 area since then, keeping immediate Support at 2,928.00. The overall outlook however remains strongly positive, as the asset has been moving above all 3 daily MAs since December 2018, with momentum indicators suggesting neutral-positive bias.

RSI is at 68, with further space to the upside, while MACD is suggesting strong positive bias , however with signs of consolidation in the near future , as the signal line has flattened on MACD positive histogram.

Hence on the break of record highs at 2,940.48 the asset could retest the next Resistance area at 2,975.40. Further gains could shift to the 3,055 area (midpoint of FE161.8 and FE 200.0 from the reversal seen on September 2019).

In the near term however, indicators suggest consolidation or even a correction to the downside of this 4-month rally. Immediate Support stands at 2,919.00 (last week’s peak). Next Support is at March Resistance, at 2,860.00.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.