Bank of Canada pushed aside its rate hike desires as the economy slows, with the dropping of the tightening bias matching expectations.

The policy setting was held at 1.75%, as expected. While the abandonment of the mild tightening bias opens the door to both rate hikes and rate cuts, depending on the flow of data, we note that officials maintained their view that the economy will rebound from the current soft patch.

The Bank lowered its estimate of the neutral range to 2.25% to 3.25% (was 2.50% to 3.50%). Officials have repeatedly stated that any change in the neutral estimate is a procedural move. Of course, with the lower bound now at 2.25%, a smaller rate rise is needed to get back to neutral than was previously the case, which could be construed as dovish.

Meanwhile, officials maintained that rates remain accommodative, which would presumably be inappropriate if the economy was not suffering from the lingering oil shock headwinds. The dropping of the mild tightening bias provides more room for the Bank to maneuver as the economy gradually recovers, and puts the BoC in line with the Fed and ECB. Yet expectations remain for rate increase late in 2020.

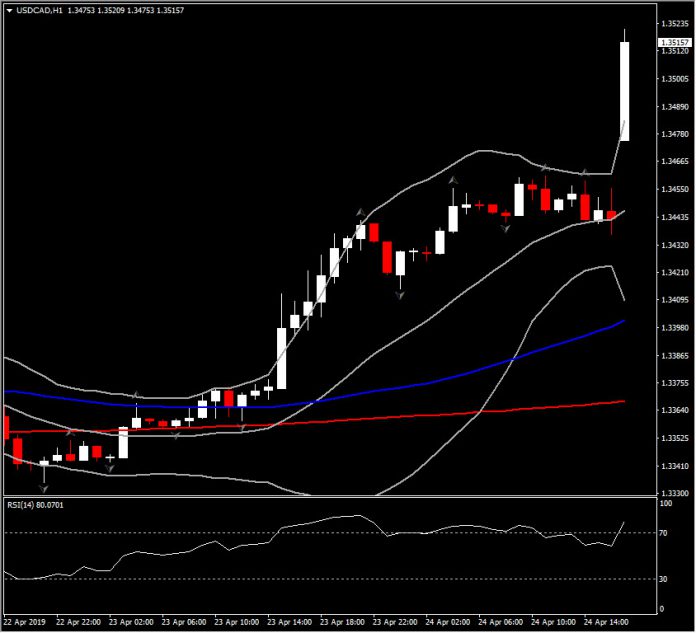

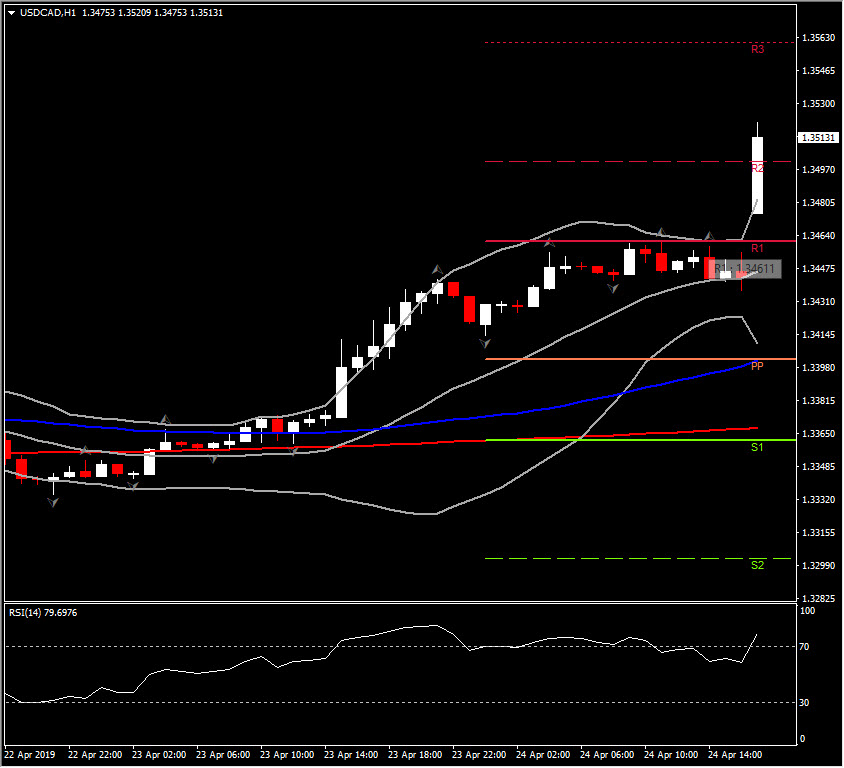

Meanwhile, USDCAD soared to 1.3520, levels last seen in early January, from 1.3440 following the BoC announcement, where there were no policy changes, though the Bank’s statement came in with a decidedly dovish slant, removing any hint of a tightening bias looking forward.

The CAD is liable to remain under pressure, despite higher oil prices (BoC said “Last year’s oil price decline and ongoing transportation constraints have curbed investment and exports in the energy sector”), as the BoC shifts to a neutral bias.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.