FX News Today

- The BoJ left rates unchanged, but clarified its forward guidance, saying it will keep rates very low at least through spring of next year.

- Also, they will expand the eligible collateral and also consider the introduction of an Exchange-Traded Fund (ETF) lending facility, that would allow to temporarily lend ETFs that the Bank holds to market participants.

- Japanese stock markets outperformed going into the announcement, but mainland China indices were under pressure.

- Stock futures are moving higher in Europe and the US. The weaker than expected Ifo reading yesterday and a negative GDP print from South Korea overnight added to concerns about the outlook for world growth, which means rates will stay low for longer.

- The Swedish Riksbank is widely expected to keep monetary policy on hold today.

- The front end WTI future is trading at USD 65.91 per barrel.

Charts of the Day

Technician’s Corner

- USDCHF is consolidating since last night within 1.01970-1.02190 range. However, the pair still holds above 1.0200, suggesting the continuation of the uptrend, as the pair remains well above the medium term Support at 1.0123 level (6 month Resistance converted to Support). Intraday, however, and as momentum indicators have been flattened, consolidation mode could possibly hold within the day. A cross below 1.0200 could retest yesterday’s lows.

- AUDUSD within the strong 3-year Support, 0.7000-0.7020. It could react as a retracement level for the asset. However, the 3 black crows in the daily chart suggest that negative bias is increasing for AUDUSD.

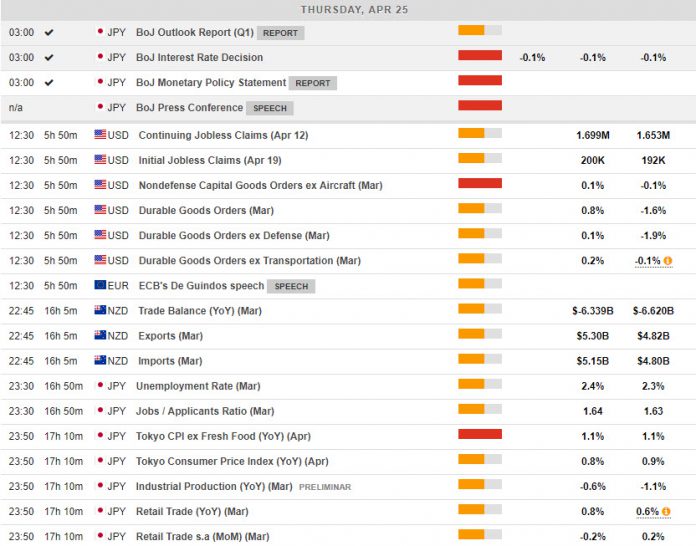

Main Macro Events Today

- Durable Goods (USD, GMT 12:30) – March durable goods orders are expected to rise 0.2%, following a 1.6% February decline. Shipments are expected to fall 1.5% in March, after a 0.2% reading in February.

- NZ Trade Balance (NZD, GMT 22:45) – The trade report is expected to show an improvement in the surplus to NZ$300 mln in March from NZ$12 mln in February.

- Tokyo CPI and Production Data (JPY, GMT 23:30) – The country’s main leading indicator of inflation is expected to have remained at 1.1% y/y in April. Industrial Production is expected to have improved, growing by 0.6% m/m in March, compared to -1.1% m/m in February, while Retail Sales are expected to have increased by 1.2% y/y, compared to 0.6% in March.

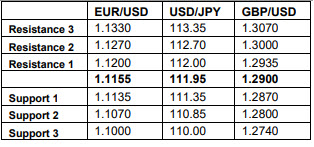

Support and Resistance

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.