The Dollar has consolidated after running higher yesterday.

The narrow trade-weighted USD index settled under the 22-month high printed at 98.19, while EURUSD concurrently settled around 1.1135 on EU open, below the 22-month low seen yesterday at 1.1140.

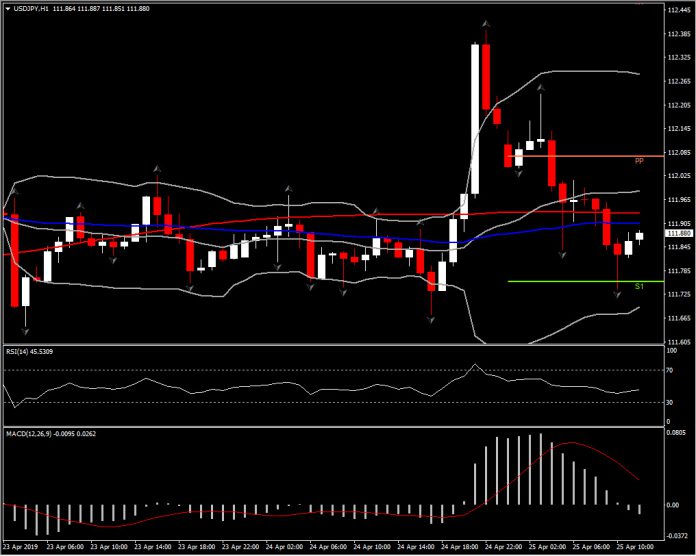

USDJPY retreated back under 112.00 after yesterday running to a 4-month high at 112.40. The peak was product of broad run higher in the Dollar, which has benefited from recent firm data out of the US. Stock markets, especially in Asia, have continued to sputter, which seem to given the Yen a safe-haven bid today, helping USDJPY to correct.

The BoJ’s announcement and statement today had little impact on the Yen. The BoJ left rates unchanged, but clarified its forward guidance, saying it will keep rates very low at least through spring of next year. The central bank also stated it will expand eligible collateral and consider the introduction of an Exchange-Traded Fund (ETF) lending facility, that would allow to temporarily lend ETFs that the Bank holds to market participants.

As stated above, USDJPY drifted below 112.00, to 111.73, after the announcement, as there was a position trimming ahead of Japan’s golden week holiday break. The Golden Week starts at the end of this week. Despite this decline the asset holds within the 111.64-112.15 range.

However, as long as 111.64 Support holds and as 4-hour, daily and weekly momentum indicators have flattened around/close to neutral zone, the USDJPY is expected to remain within 3-week range.

In the hourly chart meanwhile, the asset rebounded from S1 of the day and it is currently moving to the upside. Meanwhile, today we expected US durable goods to rise. This could add further strength on Dollar and could lift USDJPY higher.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.