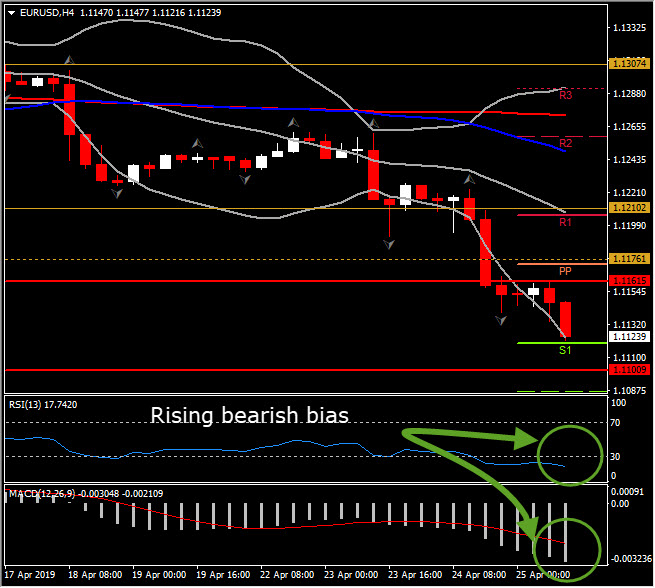

EURUSD is down for a third straight day, this time printing a 22-month low at 1.1125. The decline has been concurrent with the narrow trade-weighted USD index clocking a 22-month high, at 98.23.

The ECB’s bulletin flagged downside risks to Eurozone growth output, while sub-forecast German Ifo sentiment and French business confidence data yesterday, which followed last week’s release of disappointing preliminary Eurozone PMI survey data for April, have clouded the outlook. A favourable yield differential dynamic should keep EURUSD directionally biased to the downside for now.

EURUSD is down by 1% from month-ago levels and is lower by over 2.5% on the year-to-date. The pairing has been in a bear trend that’s been unfolding since early 2018. Trend support comes in at 1.1108-1.1110. Today’s US data are expected to be Dollar positive: March Durables are expected to rise 0.2% versus the previous outsized fall of 1.6%, while weekly jobless claims are seen steady at a near 5-decade low of 192k.

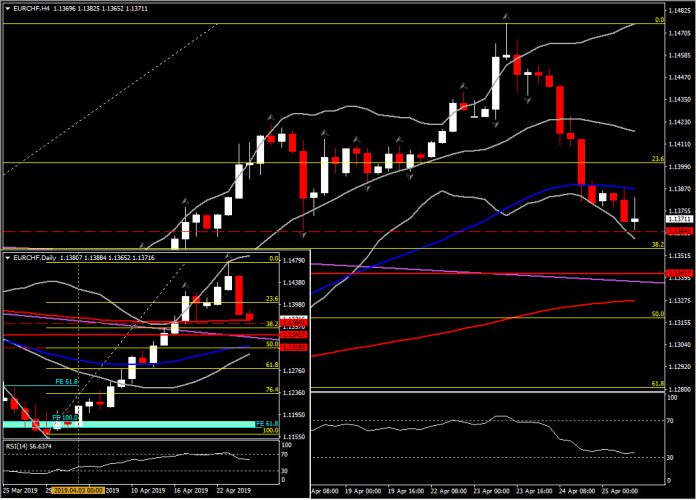

EURCHF’s near four-week rally finally broke yesterday, when the cross took a swan dive from the mid-1.1400 heights the mid-to-upper 1.1300s in what was only the third down day since March 29.

The cross extended to a fresh 1-week low earlier, at 1.1365 (retesting the 200-day EMA). The catalyst was EURUSD, which has dived to 22-month lows under 1.1140. EURCHF left a trend high at 1.1476, seen on Tuesday, and which is loftiest level seen since early November.

The pronounced underperformance of the Swiss franc over the last month was accompanied by narratives talking about the market being in the process of giving up on the franc’s role as a safe haven currency, which has been afflicted by the SNB’s -0.75% deposit rate, and which seems to have finally led to down-weighting of the Swiss currency by reserve and portfolio overlay managers.

On the year-to-date, the Swissie is down by over 4% against the Dollar and by 1.2% versus the Euro. Overall, Swiss policymakers’ efforts to both weaken the franc and dethrone the currency from its safe-haven status look to be working.

Hence as the fundamentals add further pressure on CHF, the EURCHF could be seen retracing from 1.1364 lows back to the week’s peak. However a continuation of the pair southwards and a break of 1.1364 Support could open the way to the next Support levels at: 1.1340 (8-day low) and 1.1318 (50-day EMA and 50% Fib. level on March rally).

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.