FX News Today

- Asian stock markets drifted mostly lower as Japan heads for a long holiday week, and with earnings reports and data releases weighing in sentiment.

- Japan production unexpectedly contracted, which after the correction in South Korea GDP yesterday, added to signs of weakness in the region and also highlighted the contrasting strength of the US economy, after robust durable goods orders yesterday.

- President Xi Jinping said China won’t engage in currency depreciation that harms other nations.

- YEN: has been underpinned by safe haven demand amid growth concerns in Asia and European and flagging stock markets.

- The WTI future is trading slightly under USD 65 per barrel.

- Earnings reports and US GDP numbers will provide the main focus for markets today, with the local calendar holding only the UK CBI industrial trends survey.

Charts of the Day

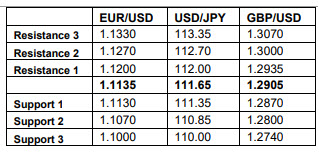

Technician’s Corner

- USDJPY fell to 2-week lows of 111.38 before rebounding again between the Pivot Point of the day and the 20-day SMa, at 111.60-111.75 area. The pairing fell from the 2019 highs seen into the Wednesday close, and ahead of what was expected to be and was, a dovish BoJ announcement. USDJPY has tried, and failed to hold the 112 mark for several weeks now, and may be entering a phase of shaking out some long positions, before being able to make fresh gains. Overall, risk sentiment will be a determining factor going forward, though with the BoJ on hold, and a chance for further easing ahead, USDJPY can be expected to eventually head higher.

- EURUSD bounced from its trend low of 1.1118 seen after the early round of US data, peaking at 1.1154. The USD generally turned lower through the morning session, appearing to be driven by a round of position squaring following earlier 2-year DXY highs. The Euro is expected to remain in sell-the-rally mode based on the fundamentals. The ECB economic bulletin signaled risks remain to the downside, underscoring the Bank will be “low for longer”. The next downside level remains at the 1.1100 level.

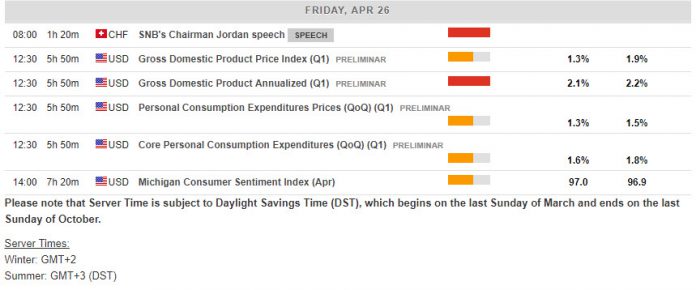

Main Macro Events Today

- US Gross Domestic Product (USD, GMT 12:30) – The economy’s most important figure, Q1 GDP, is expected to rise 2.6%, following a 2.2% pace in Q4 and 3.4% growth in Q3.

Support and Resistance

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.