Last week, Bloomberg reported that Apple. Inc shall wind down its decade-long, multi billion-dollar project Titan, which was initially started with the aim to produce a fully autonomous electric vehicle. There are two main reasons that have led to this breaking point:

- Executives are worried about the profit margins that the vehicles could potentially bring about as the global demand towards EV vehicles has been seen slipping recently (including in China), in addition to the continuously saturated market – “the project may never see the light of day”.

- More prominently, a strong focus on generative AI is seen as a better strategic move, which could potentially bring long-term profitability to the company.

Just as Li Xiang, CEO of Li Auto mentioned: “With ToC artificial intelligence, Apple will become a $10T company; if it makes a car and achieves a great success, Apple shall increase its market value by $2T, but still the AI is the necessary condition for success”.

Following project Titan coming to a halt, around 1400 core employees shall be transferred to Apple’s AI department, while the hundreds of remaining employees may be facing lay-offs – the cost of severance may reflect in the next quarterly earnings report.

All in all, this marks a public announcement of the tech behemoth that the company is to join the AI competition, as CEO Tim Cook mentioned that the new breakthroughs in generative AI could help with “redefining the future”. In fact, Apple. Inc has incorporated AI technology in some of its existing products, including the Apple Watch, Vision Pro and MacBook.

Acquisition of AI Start-Ups by Tech Giants. Source: Financial Times

In fact, one thing that we should not overlook is that Apple was indeed been the most active tech company in the acquisition of AI start-ups since the beginning of 2017 and until 2021 as reported by the Financial Times. This could result in Apple. Inc having a competitive advantage over its peers.

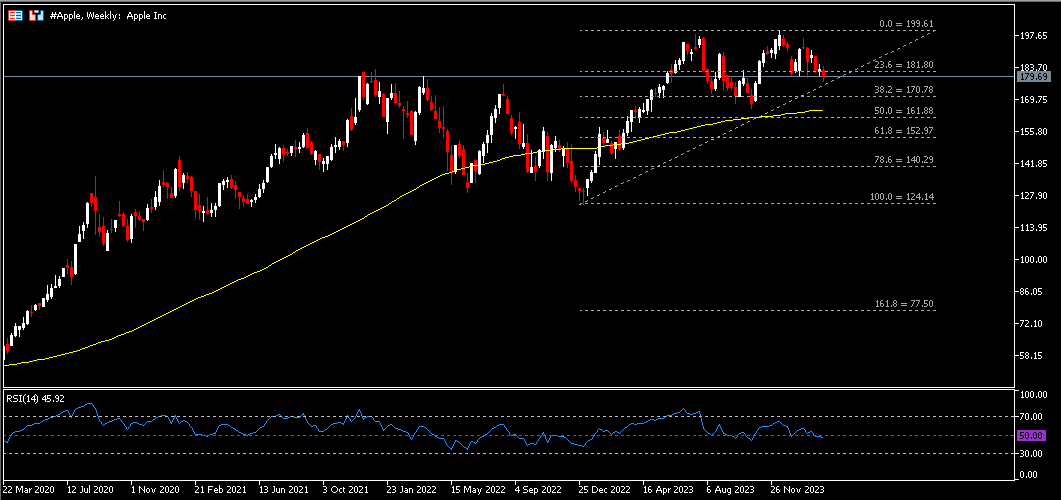

Technical Analysis:

The #Apple share price has experienced a technical correction since its retrace from ATH $199.61 seen in mid December last year. The asset last closed below FR 23.6%, or $182. Considering a lack of price momentum as displayed by the RSI indicator, the asset is expected to oscillate between $182 and the nearest support $171 (FR 38.2%). As long as the dynamic support 100-week SMA remains intact, any downside movement is seen as a temporary correction. The ATH remains the nearest resistance to be closely watched.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.