With Swiss inflation hitting its lowest point in almost 2.5 years in February, expectations that the SNB will cut interest rates by the end of this month are growing.

Despite indications by the ECB at its meeting this week, according to private bank J. Safra Sarasin, the Swiss National Bank (SNB) should cut its policy rate in March. The call was seen to gain support from weaker-than-expected Swiss inflation data, indicating weaker economic growth potential and deteriorating labor market conditions as well as a real appreciation of the Swiss currency, all of which justify a rate cut to support Swiss economic policy.

The annual inflation rate in Switzerland edged down to 1.2% in February 2024 from 1.3% in the previous month, and compared to the forecast of 1.1%. However, it was the lowest rate since October 2021. On a monthly basis, CPI rose 0.6% in February, following a 0.2% increase in January. The core rate, which excludes volatile items such as unprocessed food and energy, fell slightly to 1.1% from 1.2% previously.

The SNB has achieved its goal since May 2023 despite rising rents, sales taxes and higher energy prices. The reduction in inflation figures supports the prospect of the SNB cutting interest rates at its next meeting on March 21, according to economists at EFG Bank.

If the SNB cuts rates in March, the Swiss franc is likely to face further devaluation, as this will weigh on the ECB and other central banks in the months ahead. The ECB, BOE and Fed are expected to cut rates for the first time in June.

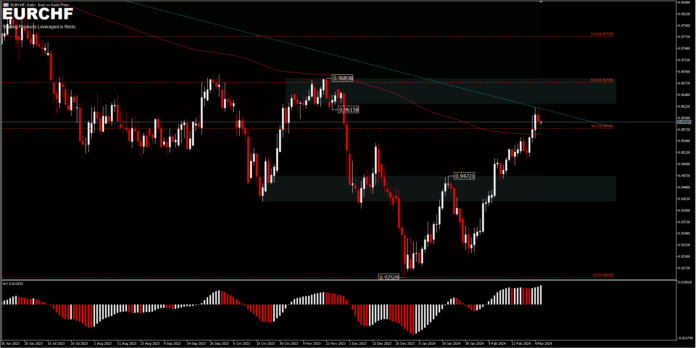

Meanwhile in the FX market, EURCHF is trading at a price range of 0.9588. The current price position is above the 200-day EMA, since rebounding from 0.9525 in December last year. Further rallies face a major obstacle from the equilibrium zone between 0.9615 and 0.9683.

As long as 0.9683 resistance holds, the rebound from 0.9252 is seen as a corrective move only. A decline is still possible to test 0.9472 if the price fails to cross the resistance level. However, a strong break of 0.9683 and sustained trading above the 200 EMA, would suggest that 0.9252 is already a medium-term low. A stronger rise would then be seen at the 61.8% retracement of the pullback from 1.0096 – 0.9252 at 0.9773 and could be more above it.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.