Oil prices stabilized in Tuesday’s trading, with USOil crude futures holding at $78 per barrel after hitting a fresh 4-month peak of $80.79 as investors balanced OPEC+ supply cuts with lingering demand concerns. Although China announced an economic growth target of 5% by 2024, in line with the previous year, the market remains unconvinced, due to the lack of substantial stimulus measures. In addition, uncertainty surrounding interest rate changes in developed economies also added to market concerns. Meanwhile, major oil producers including Saudi Arabia, Russia, Iraq and the UAE extended voluntary oil production cuts into the second quarter.

The 2-day decline in oil prices was due to the pressure of weaker-than-expected US economic data on Tuesday, regarding factory orders in January and ISM services in February which increased concerns on energy demand. In addition, falling equities reduced confidence in the economic outlook, which negatively impacted energy demand. Meanwhile, crude oil inventories in the United States increased by 423,000 barrels in the week ended March 1, according to private data from the American Petroleum Institute (API) reported on Tuesday also pressured prices.

Russian President Vladimir Putin said on Tuesday that Russia, OPEC+ and other major oil producing countries, do not intend to raise prices “indefinitely”. Instead, their focus is on stabilizing the market.

“We will not raise prices indefinitely, because it is not good for producers and consumers. But we want to achieve stability and so far we have succeeded,” Putin said.

Despite all the obstacles, crude oil has continued to rise this year, USOil has increased by almost 11%. This upward trend is facilitated by OPEC+ efforts to limit supply, global shipping avoiding the Red Sea and strength in the physical market. However, strong output from non-OPEC producers, weak demand in China, and the possibility that central banks may delay monetary easing, diminish the positives.

At the same time, China has announced plans to implement stimulus measures to bolster confidence in its flagging economy by setting an annual growth target of around 5%. In addition, the country is setting higher standards in energy intensity reduction with the aim of improving the efficiency of economic growth.

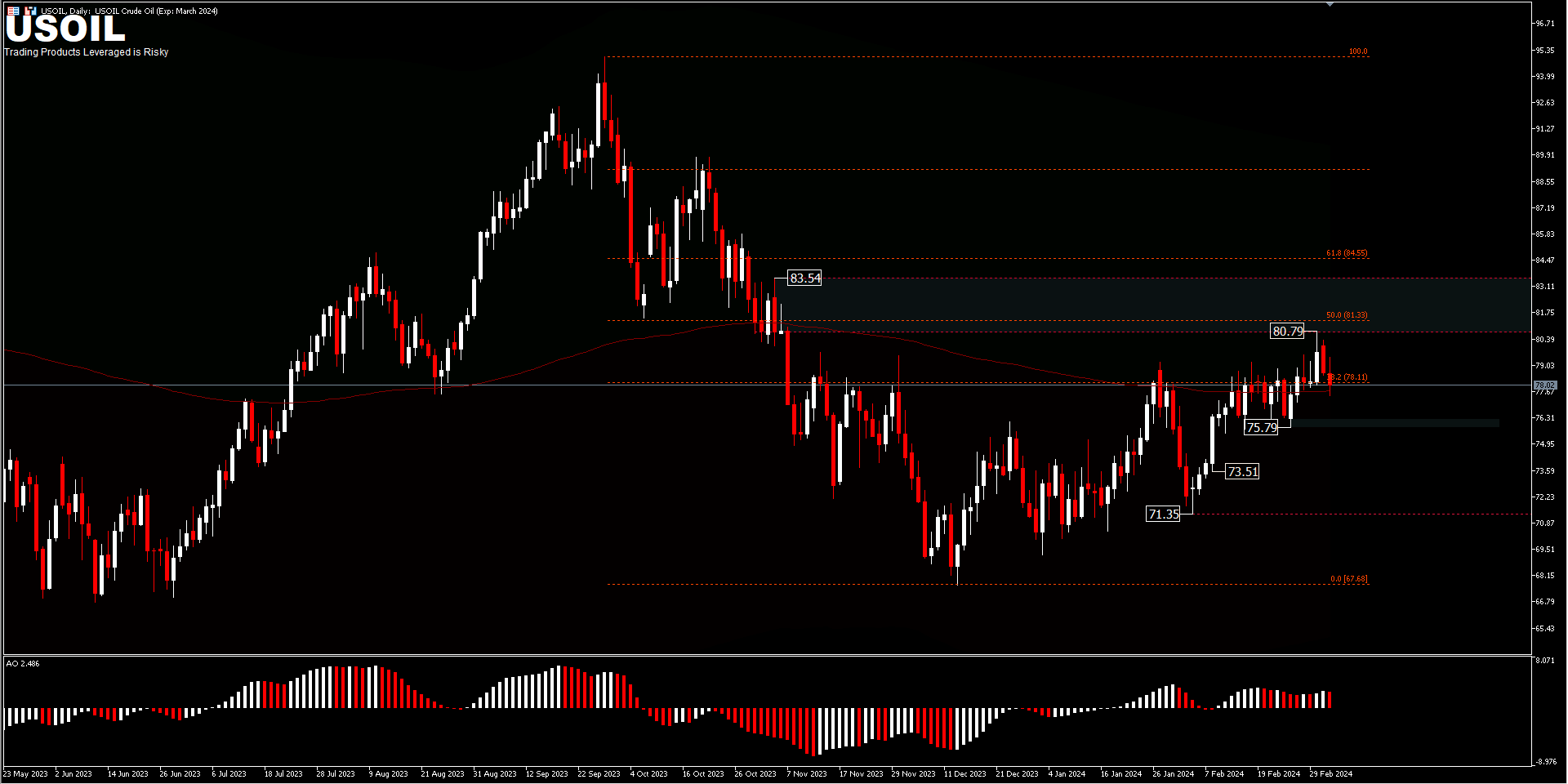

From a technical perspective, USOIL looked quite stable above $75 during mid-February until today. The price is oscillating at the 200-day exponential moving average. Minor support is seen at 75.79; a drop below this price level could bring a test down to 73.51 or 71.35. Meanwhile, a move above the recent peak, will bring the price for a test of the further upper level at 83.54. For now, price is neutral and consolidating between 75.79 – 80.79.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.