FX News Today

- Asian stock markets traded mixed in quiet trade, with China and Japan still on holiday.

- The Fed held rates steady, as expected but it dealt a blow to hopes of an “insurance” rate cut, while stressing patience and data dependence for the policy outlook.

- Fed chair Powell indicated that low inflation might be transitory, and that global growth concerns had eased.

- The USA30 was down -0.61% while the USA500 lost -0.75%.

- The ASX also dipped -0.74% after the nation’s biggest lender cut its dividend, but benchmarks in South Korea and Hong Kong ticked higher after reports from CNBC saying the US and China could announce a trade deal as soon as next Friday.

- Oil prices fell to USD 63.39 overnight with US stockpiles weighing.

- Gold futures rallied slightly after the FOMC announcement, as the USD fell, and yields headed lower, topping at $1,289.05 from $1,285.00. The contract later fell under $1,275.00, a one-week low.

- Sterling has outperformed for a 2nd day, floated by optimism on the Brexit front.

Charts of the Day

Technician’s Corner

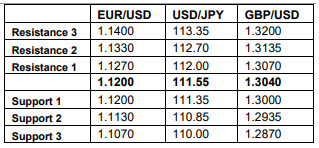

- GBPUSD has Support at 1.3010, and Resistance at 1.3103, the latter levels encompassing the current situation of the 50-day moving average.

- XAUUSD is trading below 1,272.00. after Fed chair Powell indicated that low inflation might be transitory, and that global growth concerns had eased. This saw the USD and Treasury yields head higher, both weighing on gold prices. Given the strong ADP number, the USD expected to remain underpinned into tomorrow’s release of the April US payrolls report.

- EURUSD fell from a high of 1.1264 to a post-Powell low of 1.1187 before settling to a narrow range around 1.1200. Support holds at 1.1160-1.1185 and Resistance is set at 1.1210-1.1215.

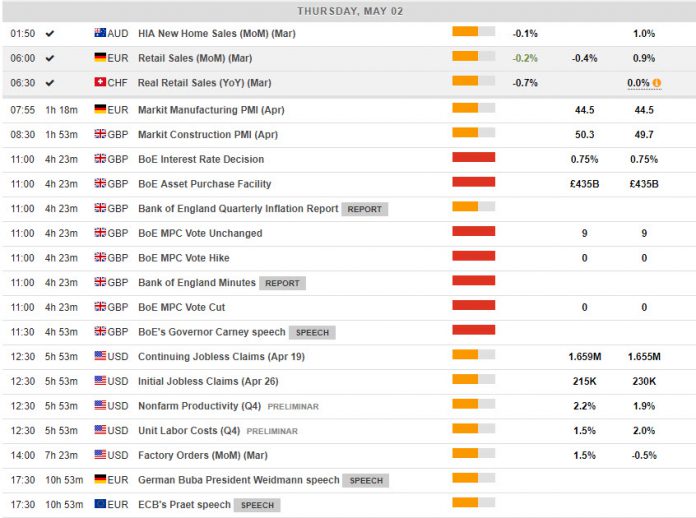

Main Macro Events Today

- Interest rate Decision and Conference (GBP, GMT 11:00) – BoE should remain on hold now until the Brexit D-day. If the transition runs smoothly we might see another 25 bp hike in May 2019. The BoE has cautioned that the outlook will “depend significantly on the nature of EU withdrawal,” and noted that “uncertainty has intensified.” Thus, consensus forecasts suggest no change in the policy rate in this meeting and an unchanged 9-0 MPC voting.

- US Q1 Nonfarm Productivity (USD, GMT 12:30) – Q1 productivity should post a 1.2% rate of growth, down from 1.9%, with unit labor costs rising 2.3% from 2.0%.

Support and Resistance

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.