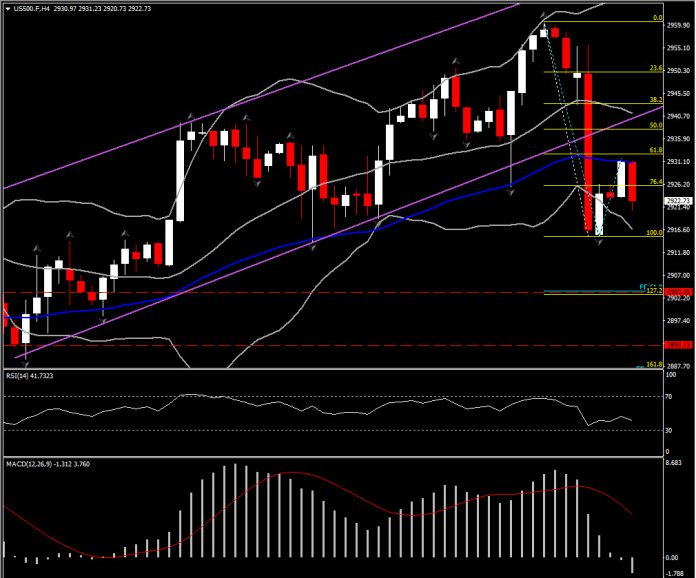

USA500, H4 and Daily

Treasuries remain heavy as they continue to digest the FOMC. EGB yields are choppy after falling from earlier highs in the wake of the BoE. The markets initially perceived the BoE comments as less hawkish than expected, though the Bank not only left policy unchanged, but also said “ongoing tightening of monetary policy over the forecast period” would be appropriate.

Meanwhile in US, following the much higher productivity print, at 3.6% in Q1 after 1.3% gain in Q4 and the firmer than expected jobless claims, US Equities continue being underwater.

The USA 500, after posting a 15% gain, turned southwards again around 2,920.75. After the solid negative daily candle yesterday well below the upchannel, another negative session today could confirm the turn of the medium term outlook into a negative one.

Already in the 4-hour chart, the RSI has dropped to 41, while MACD has begun to track lower into the negative area, presenting that bulls are facing a real leadership challenge. Initial support of the 20-day MA and overnight low at 2,913-2,915 needs caution now.

The key area at the break of this barrier is between the round 2,900 and the 61.8% Fibonacci extension of today’s correction, at 2,903.35. Next Support is at 2-week low, at 2,889.20. Resistance is set at the 50-period SMA, at 2,931.00 and 2,938 (50% Fibonacci retracement level.)

The overall outlook however remains strongly positive, as the asset has been moving above all 3 daily MAs since December 2018, with momentum indicators suggesting neutral-positive bias.

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.