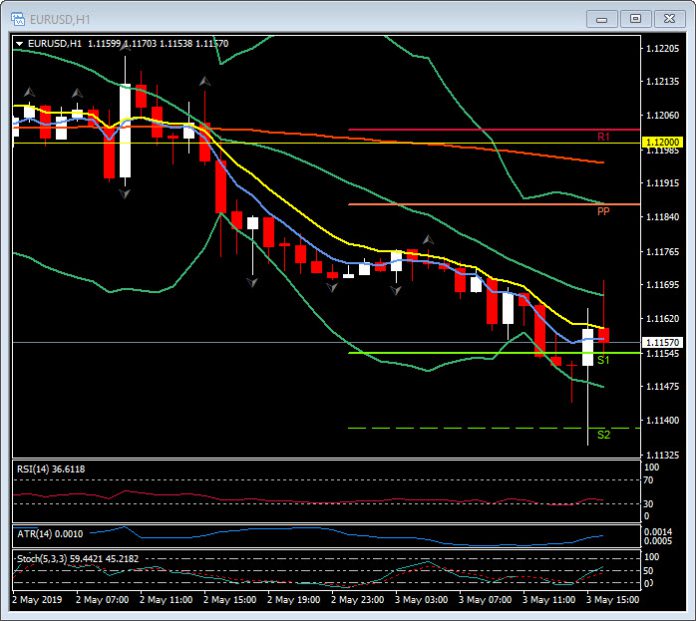

EURUSD, H1

US nonfarm payrolls climbed 263k in April, another beat, after a revised 189k March gain (was 196k), while February was bumped up to 56k (from 20k previously). Private payrolls were up 236k, close to the 275k from ADP. The unemployment rate dropped to 3.6% (December 1969 lows and virtual full employment) versus 3.8% previously. Average hourly earnings increased 0.2%, the same as March’s 0.2% gain (revised from 0.1%), leaving a steady 3.2% y/y. Hours worked fell to 34.4 from 34.5. The labor force participation rate dipped again to 62.8%, after slipping to 63.0% in March from 63.2% in February. Other data show manufacturing employment up 4k, with construction up 33k, while the service sector added 202k. Government employment was up 27k. This is another very good report (especially the headlines) although some softness is evident in the details, that should support equities and to a lesser degree USD.

The Dollar headed higher following the jobs report, and the advance goods trade deficit was narrower than expected, which supported the USD as well. EURUSD dipped to 1.1135 from 1.1155, as USDJPY popped to four-session highs of 111.68 from 111.50.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.