EURUSD, H1

There were significant misses for the final reading of Spanish and Italian Services PMI data but with an in line report from France and a beat by Germany, the overall Eurozone area posted a gain. The final figure was revised higher to 52.8 from expectations and an initial Flash figure of 52.5. Although far from stellar, (the US number on Friday was only 53.0 and the more important ISM Non-manufacturing was a significant miss, pulling the USD down into close) the service sector in Europe is holding up relatively well. Markit highlighted that as overall growth remains subdued, cross country differences are becoming more notable.

At the same time, it is interesting that while the focus has been on the weakness in the German manufacturing sector in particular, the German composite actually remains relatively high at 52.2, which signals ongoing expansion, while the French reading of 50.1 indicates stagnation and Italy’s 49.5 number a slight contraction in economic activity.

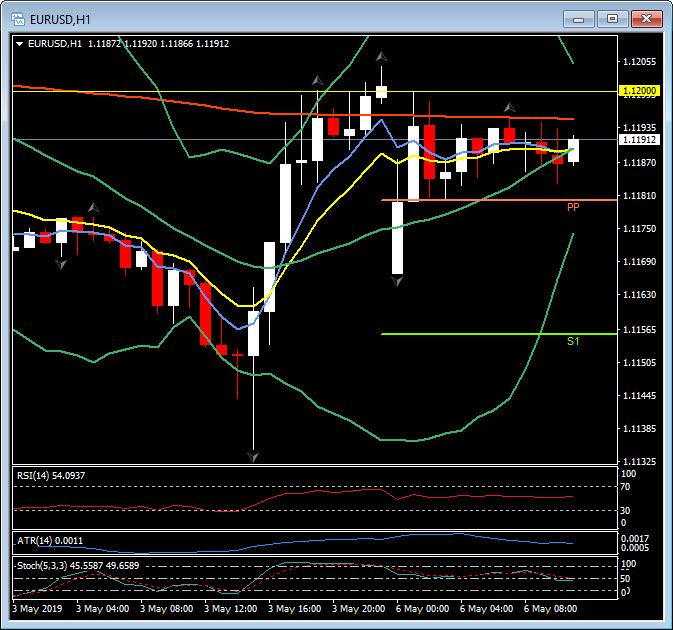

EURUSD barely moved on the data as all eyes remain transfixed by the trade war rhetoric between Washington and Beijing. EURUSD has support at 1.1180, 1.1170 and 1.1155 today with resistance at the 200-period moving average at 1.1195, the psychological 1.1200 and R1 at 1.1225. Eurozone Retail Sales are due at 10:00 GMT with expectations of a decline of -0.1% from a +0.4% last month.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.