In Australia, the RBA meets on Tuesday at 04:30 GMT. A change in the monetary policy is expected amid softer Q1 inflation and a slowing economy. The RBA’s Statement on Monetary Policy will be published on Friday.

Markets have been factoring in a high probability for the RBA cutting its cash rate by 25 bp at its policy review since the release of Q1 CPI, which came at 0.0% q/q. The CPI y/y rate came in at 1.3%, down sharply from 1.8% y/y in Q4, while underlying CPI was the lowest on record, at 1.4% y/y. The RBA targets underlying CPI at 2%-3%. The trimmed mean inflation rate came in at 1.6% y/y, down on the RBA’s February forecast for this metric to reach 1.8% by June.

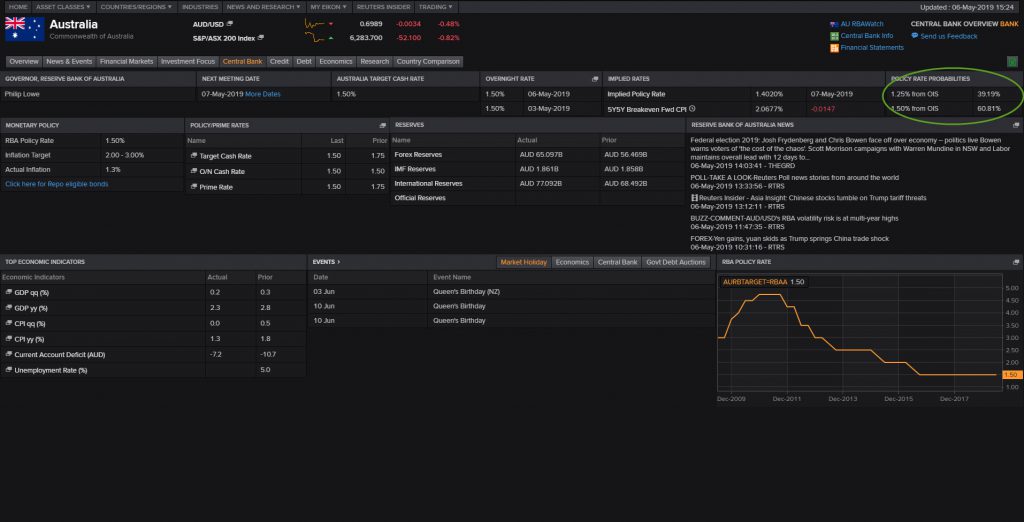

The data had catalysed calls for the RBA to cut interest rates with many bank analysts also calling for a follow-up easing by August. The RBA stated in April that a rate cut “would be appropriate” should inflation remain weak. Meanwhile as per the Reuters Eikon terminal below, OIS pricing is now discounting about a 60.81% probability for a 25 bp cut in the cash rate at tomorrow’s RBA policy meeting, and is fully discounting such a move by June.

The Australian Dollar, was observed to have remained in the range it has been in over the past two years, however it has been seen in a continuous depreciation since January 2018. AUDUSD has dropped over 14% since then, while further losses could suggest a retest of 4-year low area, at the 0.68 territory. Fundamentally, a rate cut could suggest the strengthening of the bearish bias for Aussie.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.