- The Euro has increased in value over the past 24 hours, but inflation is declining and indicates a weaker Euro.

- Economists now believe the European Central Bank is likely to take earlier action and adjust the Main Refinancing Rate.

- German monthly inflation increases to 0.4%, lower than the 0.5% prediction, and European inflation drops to 2.4% from 2.6%. Can the Euro maintain momentum with lower inflation data?

- The German DAX increases in value throughout the European session despite the strong collapse the day before.

EURUSD – How Long Can The ECB Hold Off Rate Adjustments?

The EURUSD yesterday saw the strongest and clearest bullish impulse wave when comparing price action of all pairs. This is largely due to no conflicting price conditions. At the time the Euro rose in value against all currencies while the US Dollar Index clearly fell. However, investors should note that factors continue to indicate Dollar strength.

Of main concern is the inflation rate within the Eurozone. German inflation fell to almost its lowest point in 3 years and trades more or less at its target. After yesterday’s data, inflation fell from 2.7% to 2.3% and Core Inflation fell to 3.3%. Therefore, inflation continues to decline in Europe despite the higher energy prices. Economists therefore are now predicting a faster adjustment to interest rates in order to ensure certain targets are met. These include the return of economic growth and avoiding disinflation. If interest rates do indeed decline, the Euro is likely to come under pressure as it did in 2022 when the ECB refused to increase rates.

The European Central Bank will announce their interest rate decision on the 11th. As no more data is in line to be released for the EU over the remaining two days, investors will largely turn their attention to the US and if the Fed will indeed cut rates. To help determine these possibilities, traders will monitor the following releases:

ADP Non-Farm Payroll Change – 12:15 GMT – 148,000 Expected (today)

ISM Services PMI – 14:00 GMT – 52.8 Expected (today)

US Employment Change, Average Hourly Earnings & Unemployment Rate – 212,000, 0.3% & 3.9% Expected (tomorrow)

If the data reads higher than expectations and signals indicate a resilient economy, the US Dollar may gain momentum. The most important event will be Friday’s official employment data and any comments from members of the Federal Open Market Committee. Later this evening the Fed Chairman will be at a more informal event and is likely to speak to journalists. At this point, investors will closely scrutinise any comments regarding the regulator’s intentions.

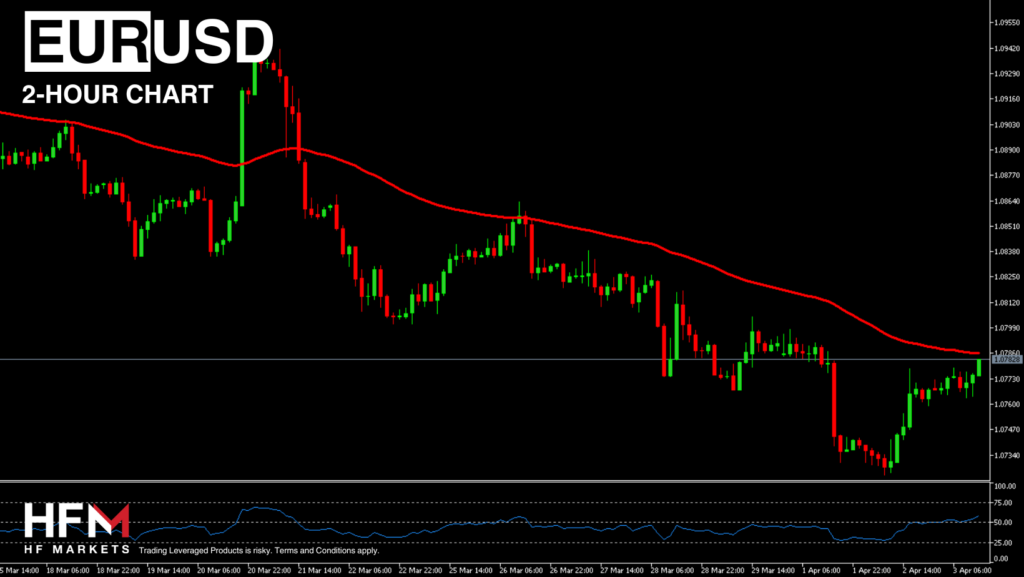

On longer term timeframes, for example, the popular 2-hour chart, the price of the EURUSD continues to point towards a downward price movement. The price trades below the 75-bar EMA and price action continues to follow the bearish trend pattern. If the price declines below 1.07682 sell signals will start to materialize and point to an imminent decline.

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.