AUDNZD, H4 and Daily

The currency mover du jour is the Australian Dollar, so far, which rallied strongly after the RBA refrained from cutting interest rates, instead leaving the cash rate at 1.50% following its policy review today. AUDUSD rallied over 0.7% in pegging a high at 0.7048, which is the loftiest level seen since last Wednesday while putting in some distance from the four-month low seen yesterday at 0.6962.

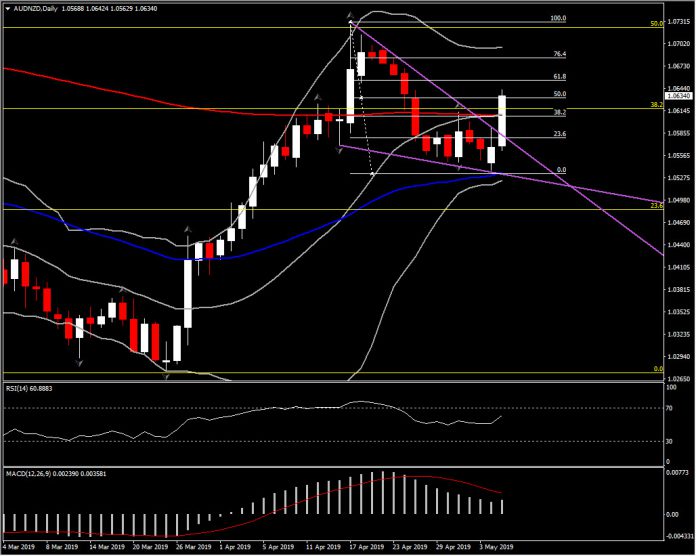

AUDNZD is the top currency of the day, with Kiwi losing more than 60% against Aussie since last night’s close. As shown above from today’s strong bull candle, the pair has broken above the 20-day SMA and 200-day EMA, while it has formed a Falling Wedge since the mid of April. Technically, a Falling wedge in a rising market suggest the continuation of the upwards movement. The break of MAs but also the positively configured momentum indicators support the upwards movement for the pair as well. The RSI has formed a bullish configuration with further steam to the upside, while MACD lines show that the latest weakness might be just a correction of this rising market.

As kiwi under-performing since the end of March, with a small break the past 2 weeks, it is now looking increasingly negative. Hence further shift northwards is expected if the asset sustains above 1.0609 level (confluence of 20-day SMA, 200-day EMA but also the 38.2% Fibonaccci level of the downleg from 1.0730 peak ). Next Resistance is set at 1.0655 and 1.0686. Initial support at 1.0609 and 1.0580.

Nevertheless, as RBNZ will announce its monetary policy early tomorrow morning, with markets anticipating a cut interest rates, the AUDNZD strength could reversed lower if a hawkish report comes out instead, in contrast with forecasts.The slowing in CPI to a 1.5% y/y pace in Q1 from 1.9% in Q4 is consistent with a reduction in the policy rate setting.

On the other hand, a rate cut could weigh further on Kiwi and could boost AUDNZD further.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.