FX News Today

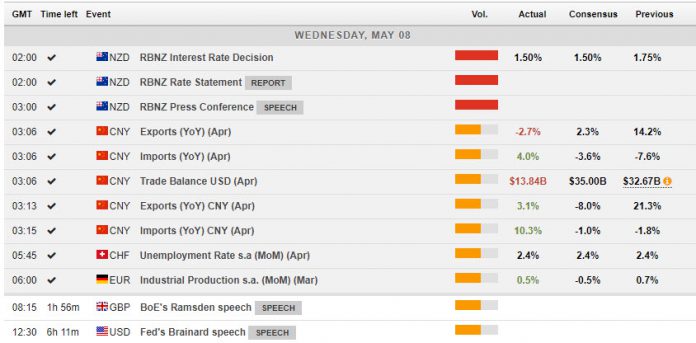

- The RBNZ became the first central bank in the developed world to begin loosening policy this cycle. NZDUSD drifted to 6-month low at 0.6525.

- German industrial production unexpectedly rose 0.5% m/m in March.

- Given the correction in orders in Q1 and manufacturing PMI readings that show the manufacturing sector in recession, not just in Germany, the better than expected German production number for March doesn’t change the overall picture of weakness in a sector that clearly is pressured by the combination of geopolitical trade tensions and Brexit jitters, with no sign of improvement, despite today’s upside surprise in the headline reading.

- The weaker than expected trade data out of China showed exports contracting and the trade surplus falling sharply added to ongoing concerns about developments in world trad.

- Brexit fatigue has driven the pound lower vs most other currencies today

- The front end WTI future is trading at USD 61.78 per barrel.

Charts of the Day

Technician’s Corner

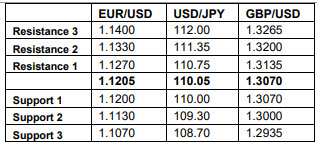

- EURUSD dropped to lows under 1.1170 after opening near 1.1200. The downward move came partly on safe-haven flows into the Dollar. Resistance comes at 1.1222, the 20-day MA, with support seen at 1.1135, Friday’s low.

- USDJPY has fallen to 110.16 lows, just below Monday’s 1-month base of 110.29. The pairing has been weighed down by another risk-off session, related to the escalating US/China trade war. Wall Street is sharply lower, while Treasury yields are down again today as well. Further equity losses will likely see the Dollar head below yesterday’s low, which them brings the March 25 bottom of 109.70 into focus

Main Macro Events Today

- Canadian Housing Starts – April housing starts are expected to improve to 195.0k from 192.5k in March.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.