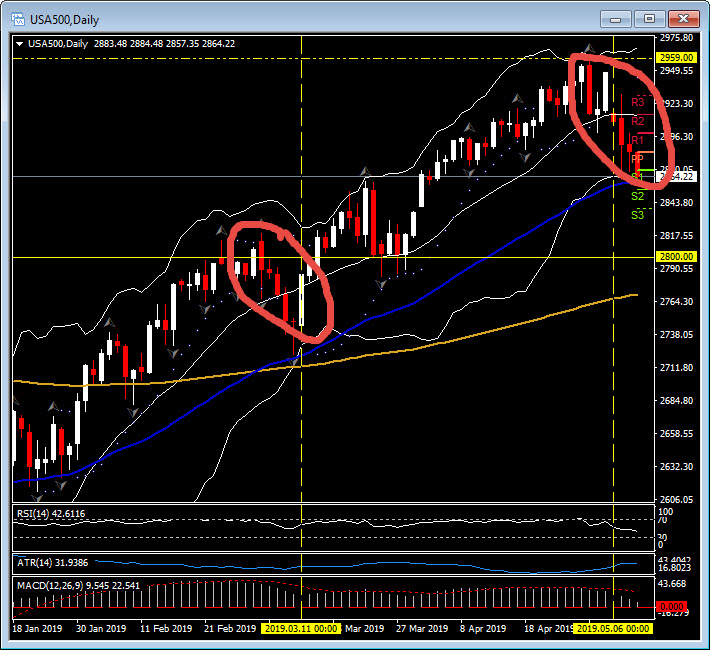

USA500, H1 & Daily

Wall Street was slammed on Tuesday (May 7), down close to 2%, as the threat of increased tariffs come Friday, with a concomitant hit to global growth, continued to unnerve investors. Every sector on the USA500 and the USA30 was in the red, with nearly all over 1% to 2% lower. The USA500 closed down 48.42 points (-1.65%), the USA30 was down 473.39 points (-1.79%) and the tech heavy USA 100 was down 159.53 points (-1.96%). Yesterday (May 8) the sell-off came in the final hour of cash trading with the US markets closing down into the close.

The Crossing EMA Strategy (H1) for the USA500 triggered lower last night at 2881 with T1 (100% ATR) at 2870, T2 (250% ATR) 2854 and with the Stop Loss, above the turn in the market, at 2895.

At the Daily time frame, the key 20-day moving average was breached and broken this week, following the new intra-day all-time high last week. The last time the USA500 broke below the 20-day moving average was for two days at the beginning of March when, once again, the spectre of “US-China trade talk tensions” spooked the markets. However, on that occasion it was for only two trading days. Today the 50-day moving average is being tested too, something that has not happened since January. All eyes on Washington DC for the next two days.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.