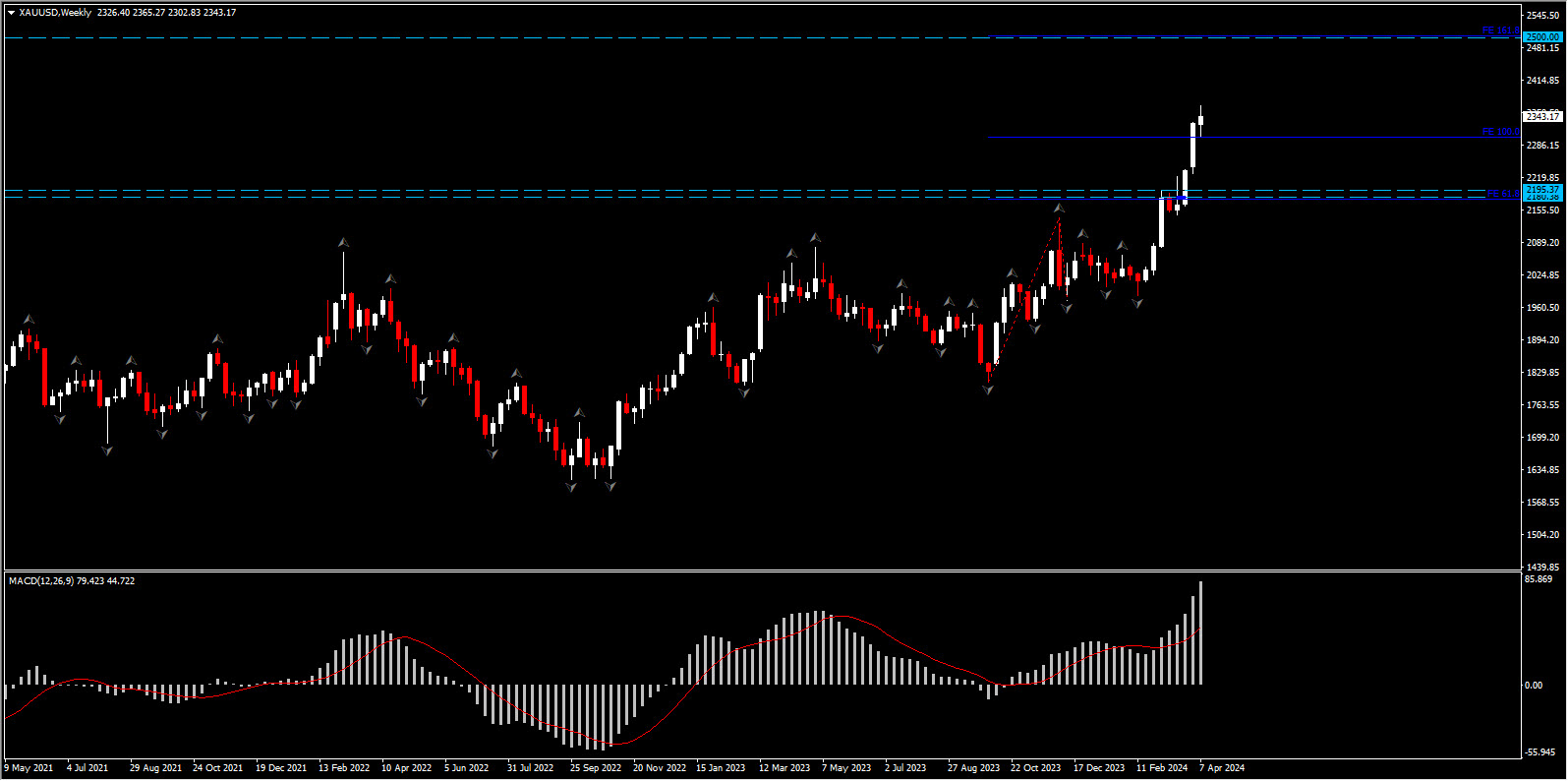

Gold has entered a remarkable rally mode since the beginning of February, surpassing previous record highs despite the strong US Dollar and Treasury yields. So far in April, the gold price has continued to set new record highs and briefly touched a high of $2365 per ounce.

What are the driving factors? Why does gold price ignore Central Banks’ potential easing? Why are market correlations weak in Q2?

The gold’s unprecedented surge can be attributed to various factors, with central bank policies, geopolitical tensions, Chinese demand, and inflation hedging strategies playing significant roles.

Central Banks policy

So far in April, the gold price has continued to set new record highs and briefly touched a high of $2365 per ounce. Confidence in the Fed’s easing cycle may have eroded somewhat, but safe haven demand and central bank buying have continued to keep prices underpinned.

Remember that the market opened this year with expectations for 150 bps in easing beginning in March. However currently Fed funds futures were hammered on March US Inflation data, repricing for fewer rate cuts this year and a later start date.

The Fed has long warned that the cooling in inflation will not be on a linear path and the report reflected the stubbornness of price pressures. And while energy and housing contributed over half of the strength, there were modest gains in many other components, suggesting a broadening. Indeed, Powell’s “supercore” rate which also takes out housing, rose 0.65% on the month, after gains of 0.47% in February and 0.85% in January, according to Bloomberg.

Implied rates reflect negligible risk for the June rate cut, put July in doubt and suggest fewer than the 3 reductions posited by the Fed’s median dot for 2024. Indeed, it is now the case that the market is looking at September for the initial move. It is doubtful the FOMC would act in November. Even though Chair Powell has stressed the Fed is apolitical, the meeting comes the day after the elections. And interestingly, the December contract shows only 44 bps in cuts versus the 75 bps in the dots, but the latter was a very close call. We now expect the FOMC to make its first cut in September and follow it up with a second in December.

Central Banks Gold reserves

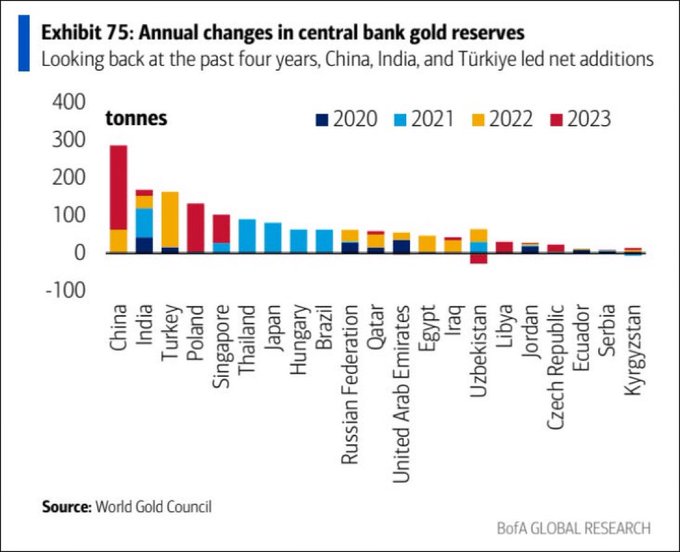

Central bank purchases exert a stronger influence on the gold market worldwide, as demonstrated by the consistent high demand seen over the past three years.

More precisely, the People’s Bank of China purchased gold for its reserves for a 17th straight month in March, while last month Bullion held by the People’s Bank of China rose by about 390,000 troy ounces. That takes total holdings to 72.58 million troy ounces, equivalent to about 2,257 tons, which is China’s central bank’s largest annual purchase in 2023 since 1977.

The World Gold Council flagged that China is not the only country purchasing Gold. Russia, Turkey and India also ramping up its gold purchases.

This surge in gold purchasing is partly attributed to reduced confidence in immediate interest rate cuts from Central banks, positioning gold as an investment for stability and a potential hedge against inflation.

According to The Kobeissi Letter, this significant rise in central bank gold acquisitions since early 2022 which continues to strongly support Gold reaching new highs, is a diversification strategy from Central banks in response to global economic pressures.

Particularly in China, the increase of gold reserves at unprecedented rates, is an attempt to lessen reliance on the US Dollar and the US debt crisis, to face economic challenges, particularly in the property market.

However, this growing preference for physical gold over paper claims and derivatives indicates a return to gold’s historical role as a crucial financial asset. This transition is further underscored by BRICS countries gradually moving away from the dollar in international trade, suggesting a resurgence of gold as a neutral reserve asset for balancing trade imbalances.

The transfer of gold from the West to the East signifies not only a wealth transfer but also a significant moment in the financial landscape. As Eastern nations accumulate gold, they safeguard their economies against currency devaluation and challenge the longstanding financial supremacy of the West.

Safe-haven demand

Geopolitical tensions, such as conflict between Israel and Hamas and between Ukraine and Russia have driven investors towards safe-haven assets like gold. The Ukraine’s attacks on the Russia’s oil infrastructures and concerns that the conflict between Israel and Hamas could widen keep haven flows higher.

With geopolitical tensions unresolved and traditional safe havens like the Yen showing weakness, gold remains a preferred choice for investors seeking refuge.

Quarterly Outlook:

Looking ahead, the prospect of lower US interest rates, sustained Chinese demand, and geopolitical uncertainties are expected to continue bolstering gold prices. Immediate Resistance levels for gold remain at latest record high, at $2,365 barrier, while a break above that level could attract more bulls into the market towards the psychological threshold of $2,500 which represents the 161.8% Fibonacci extension level of the August 2023 rebound.

For the gold rally to ease or even reversed, fundamental shifts such as growth of the Chinese economy, ease of geopolitical conflicts, or a reversal in Fed rate cut expectations would be necessary. However, such changes seem unlikely in the near future, suggesting continued support for the ongoing gold rally.

In the long term meanwhile, Bank of America predicts that gold prices could hit $3,000 by 2025, citing the continuation of its record-breaking rally fueled by speculative trading. Additionally, Citi has raised its upper price targets for the next 6 to 12 months, setting them at $3,000 per ounce for gold as well and $32 per ounce for silver.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.