FX News Today

- US President Trump confirmed that tariffs on a large chunk of China imports will rise to 25% on Friday from currently 10%, saying that China “broke the deal” and would pay.

- Fears that the hard line stance on China will also put the spotlight on imports from other countries put pressure on automakers in Japan and will also keep European stock markets in suspense.

- European stock futures are heading south in tandem with US futures, after a broad sell off in Asia.

- Ongoing Brexit jitters are adding to the risk-off backdrop in Europe, with no breakthrough in cross-party talks on a Brexit deal in sight and RICS house price data overnight showing that the housing market remains pressured.

- The WTI future is trading at USD 61.67 per barrel.

Charts of the Day

Technician’s Corner

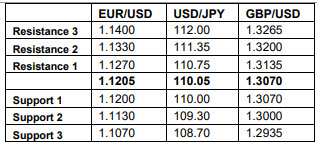

- EURUSD is moving higher into the EU session. It is currently retesting the 1.1200 area. The Euro was supported by stronger German industrial production released overnight, though the Dollar has since perked up slightly on safe-haven flows, as the US and China continue to play chicken with trade negotiations. EUR-USD resistance comes at 1.1217, which represents the 20-day moving average, with support at Tuesday’s 1.1167 low.

- EURCHF has settled into a choppy consolidation centred on 1.1400 after a 4-week rally, bellow the 6-month peak at 1.1476 in late April. The pronounced Swiss Franc underperformance that was seen during most of April was accompanied by narratives talking about the market being in the process of giving up on the Franc’s role as a safe haven currency, which has been afflicted by the SNB’s -0.75% deposit rate, and which finally seemed to have elicited down-weighting of Franc by reserve and portfolio overlay managers. On the year-to-date, the Swissie remains down by over 3.5% against the Dollar and by nearly 1.5% versus the Euro. Overall, Swiss policymakers’ efforts to both weaken the Franc and dethrone the currency from its safe-haven status look to be working.

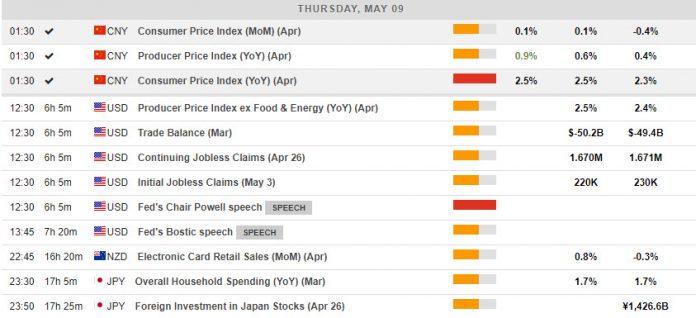

Main Macro Events Today

- Trade Balance (USD, GMT 12:30) – Although less important than in other economies, the US trade balance still provides a useful overview of the overall economy and the Dollar supply in the world, especially as reducing it has been one of Trump’s main targets. Still, consensus forecasts suggest that the shortfall should widen slightly to -$49.9 bln from -$49.4 bln in February. A 0.7% rise for exports to $211.2 bln is expected and a 0.8% increase for imports to $261.1 bln.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.