Netflix Inc., one of the world’s leading entertainment services companies based in California which engages in paid streaming and the production of films and series, is scheduled to report its Q1 2024 earnings on 18th April (Thursday), after market close. Netflix is ranked the world’s 38th most valuable company by market cap.

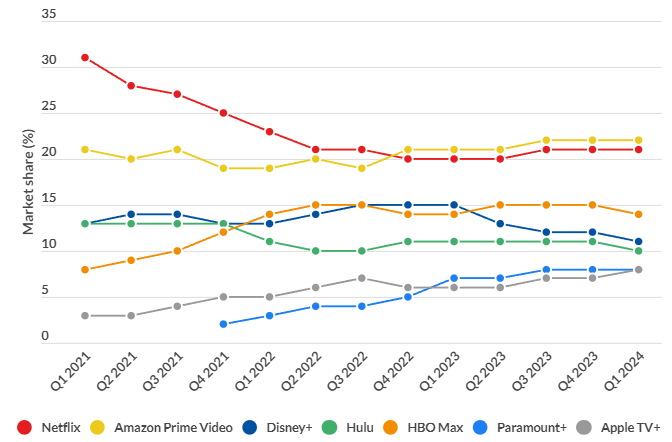

Despite being the lead for streaming app market share in the US, Netflix has been losing its market share every quarter since Q1 2021, following market dilution and increased competition by its peers. As of Q4 2023, Netflix occupies 21% of the market share, slightly behind Amazon Prime Video (22%). Combined, the market share of Disney+ and Hulu means that Disney occupies the largest market share, at 23%.

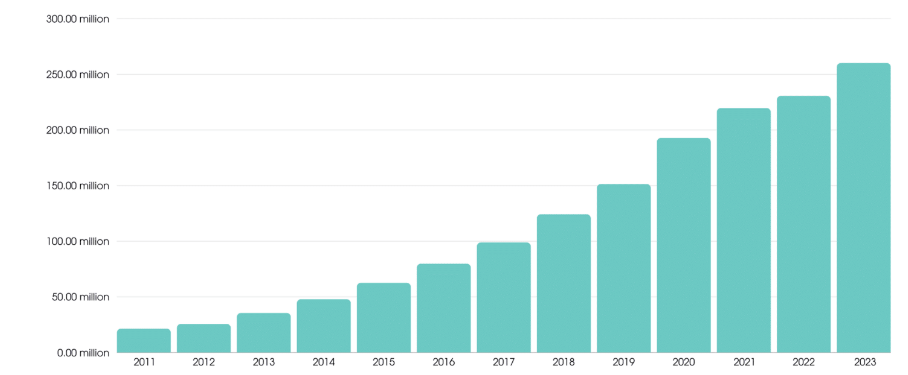

A significant measure taken by Netflix.Inc last year – a crackdown on password sharing and introduction of an ad-supported plan – has made a positive impact on boosting its subscribers. According to Antenna, 100k subscribers were added within 5 days of the announcement, with average daily signups increasing by 102% from the previous 60-day period. As a result, the company amassed over 260 million subscribers in 2023, up over 12% from the previous year. A decade ago, the number of subscribers was only 35.6 million.

Nevertheless, it is worth noting that the management has decided to strip away its cheapest ad-free plan for new subscribers, starting with Canada and the UK in Q2 2024. They are left with either the $6.99/month ad-supported Basic plan or the $22.99/month Premium tier. The management further highlighted that the ad- supported plan shall offer better value than the Basic plan, equipped with more attractive upgrades.

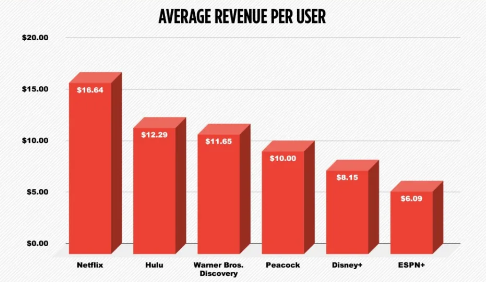

Netflix continues to top the competition in terms of average monthly revenue per streaming customer. In the US and Canada, its ARPU reached $16.64. In general, ARPU may serve as an indicator of long-term profitability. Following its strategies in serving ads to more viewers (which included the recent measure of taking away the ad-free plan), there is still room for raising ARPU, and thus the overall revenue and profitability.

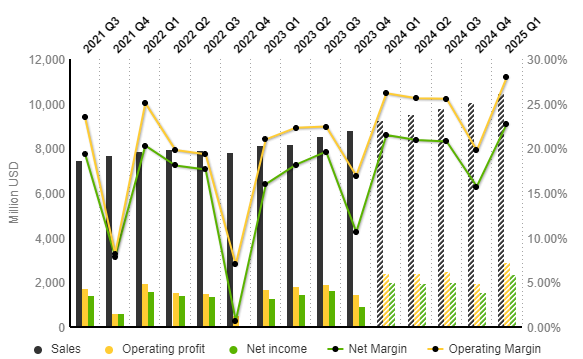

In the previous quarter, Netflix.Inc reported $8.83B in revenue, up 3.4% from the previous quarter, and up over 12% from the same period last year. In contrast to Q3 2023, the company saw a decline in operating profit and net income, to $1.5B and $0.94B, respectively. This has also resulted in operating margin and net margin dropping, towards 16.94% (was 22.44%) and 10.62% (19.64%).

However, projection for the coming earnings result remains positive, with sales revenue expected to hit $9.28B. Operating profit and net income is estimated to hit $2.43B and $1.99B, while operating margin and net margin are also expected to incline towards 26.16% and 21.49%.

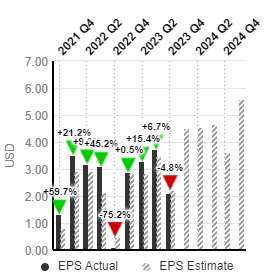

EPS is estimated to hit $4.52, doubled from the previous quarter’s $2.11. It was $2.88 in Q1 2023.

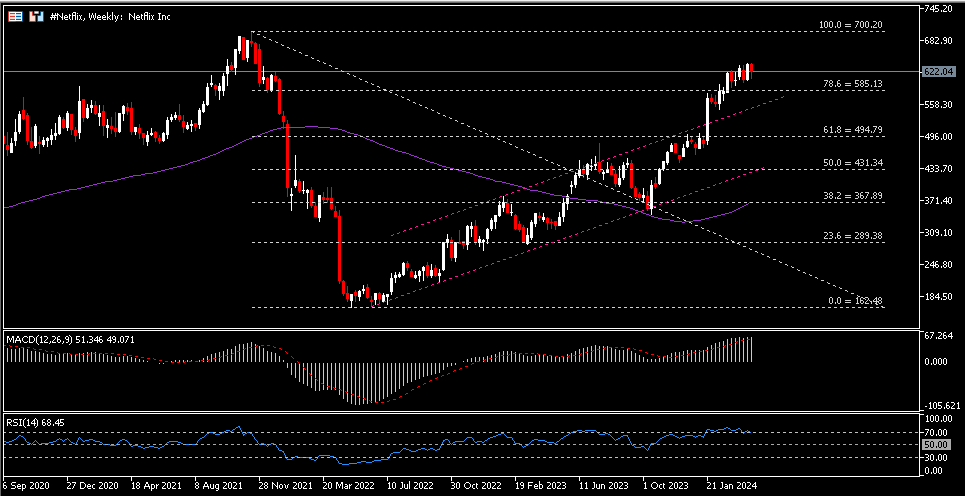

The #Netflix share price has been traded higher since breaking the upper line of ascending channel in late January this year. Technical indicators showed declining bullish momentum of the company’s share price, and that it is now within an overbought zone. Nearest support is found at $585, a 78.6% Fibonacci Retracement level which extended from the highs of November 2021 to the lows of May 2022. As long as the support remains intact, trend remains upward, with the next resistance to focus on the ATH, $700.20.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.