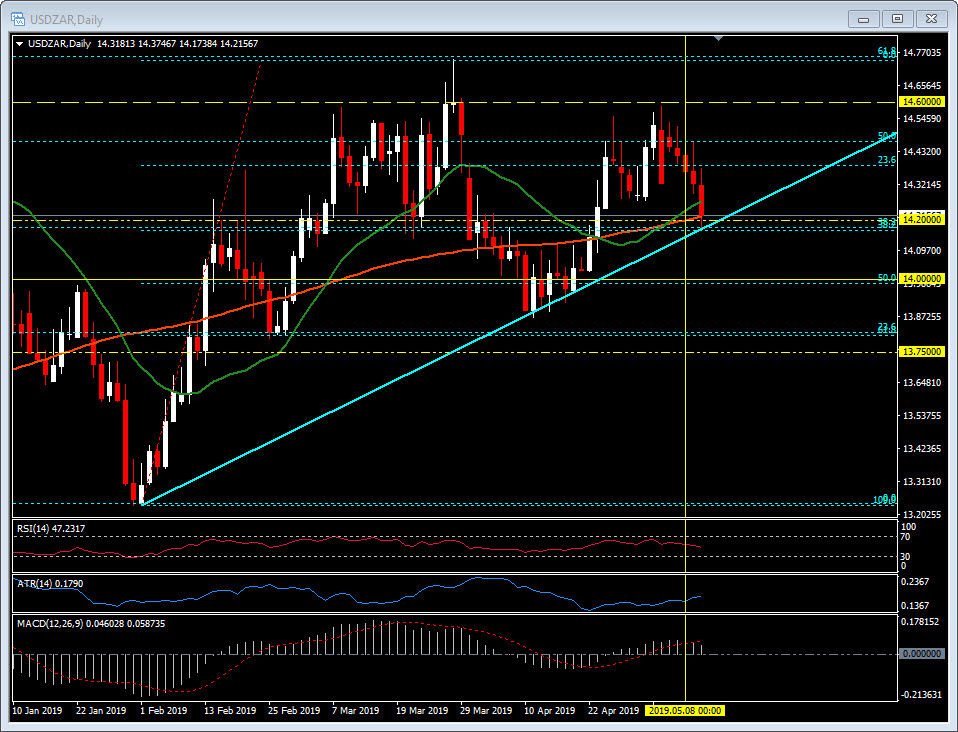

USDZAR, Daily

Last Friday, (May 3) ahead of NFP data and the SA Election we looked at the USZAR with the Daily chart and saw it attempting to test a key resistance area at 14.6000. With over 80% of the votes counted, the incumbent government of the African National Congress (ANC) has a 57% share of the vote, with its nearest rival, the Democratic Alliance (DA), at 22% and the Economic Freedom Fighters (EFF) at 10%.

Based on these figures, the ANC has lost support compared to the 2014 general election (62%), with support for the DA barely changed and the EFF has registering a 4% increase. This would be the first time the percentage of the ANC’s vote fell below 60% and a poor showing for the ANC would embolden opponents of President Cyril Ramaphosa and risk a potential challenge to his leadership, analysts have said.¹

However, the ZAR appears to be on track for a strong finish to the week as more of the results come in. The 14.6000 zone was rejected last week and with six consecutive down days USDZAR is approaching the key 14.2000 support zone. This represents the convergences of the important 200-day moving average, the 38.2 Fibonacci level, and trend line support. The psychological 14.0000 level represents the 50.0 Fibonacci level and a potential break lower, with last weeks 14.6000 high and 14.7500 as the key resistance levels.

¹https://uk.reuters.com/article/uk-safrica-election-anc/anc-takes-commanding-lead-in-south-africas-election-but-support-ebbs-idUKKCN1SF2O4

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.