GBPJPY, Daily

UK preliminary Q1 GDP met expectations with growth of 0.5% q/q, rebounding significantly from 0.2% growth in Q4. The y/y figure worked out at 1.9%, up from 1.4% y/y in the prior quarter. Most of the headline gain reflected one-off stockpiling ahead of the then Brexit deadline of March 29 (before the extension to October 31 came to be), which drove a 2.2% q/q expansion in manufacturing. One positive was business investment, which increased by 0.5% on the quarter following a run of four quarters of contraction. March production and trade data were also released. Industrial output increased by 0.7% m/m and by 1.9% y/y, above the respective median forecasts for 0.2% and 0.6%. Trade data showed a widening in the total deficit of GBP 8.9 bln to GBP 18.3 bln in Q1.

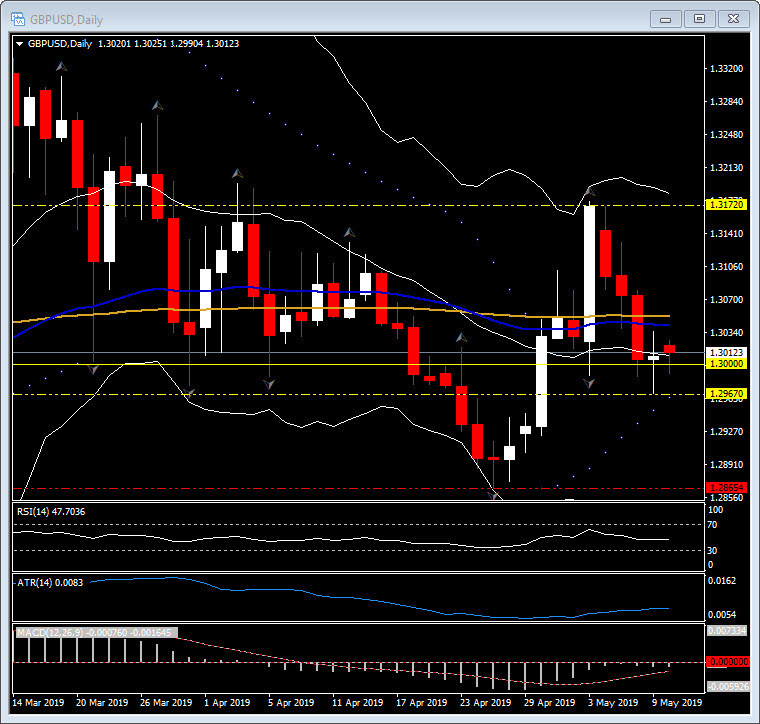

However, overall the data remains lacklustre and subdued by the protracted Brexit uncertainty. Sterling got a bounce from the data as Cable rose to 1.3020 from the key 1.3000 pivot and GBPJPY spiked to 142.98.

However, both crosses remain in significant down trends this week. Cable closed at 1.3172 last Friday and touched 1.2967 yesterday (a -1.6% move) to post a new low for May as the talks between the Government and the main opposition Labour party seem to have stalled. The Labour leader Jeremy Corbyn reiterating that Labour won’t back down and that the Government has made no “Big Offer In Brexit Talks”. GBPJPY has performed even worse with a risk-off bid driving the Yen this week, the pair have fallen from Fridays close at 146.29 to a 9-day low yesterday at 142.22 for a near -2.8% decline. With RSI at 35 and MACD under the 0 line and gaining momentum, next support could be the February low at 141.40, the 200-day moving average and R3 at 144.50 and the psychological 145.00 at key resistance levels to a move higher.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.