FX News Today

- Stock markets continued to recover during the Asian session, after a positive close on Wall Street on Tuesday. Topix and Nikkei gained 0.41% and 0.45% respectively.

- Volumes were thin indicating that there is not much conviction in the recovery as investors evaluate trade developments.

- Chinese data releases from Industrial output to Retail Sales data and investment all slowed last month and together with the fallout from tariff hikes that saw markets buying into hopes of further stimulus measures in China.

- President Trump overnight called on the Fed to “match” what he said China would do to offset the economic impact of the US tariffs

- US stock futures are also moving higher.

- The AUD was pressured by the weak China data.

- The USOIL struggled with source stories saying the API will report a 8.63 million Dollar increase in US stockpiles and is trading at USD 61.38 per barrel.

- German GDP growth expanded 0.4% q/q in Q1, in line with expectations and coming back from stagnation in the last quarter of 2018. The construction and machinery investment as well as private consumption were the main drivers of growth.

Charts of the Day

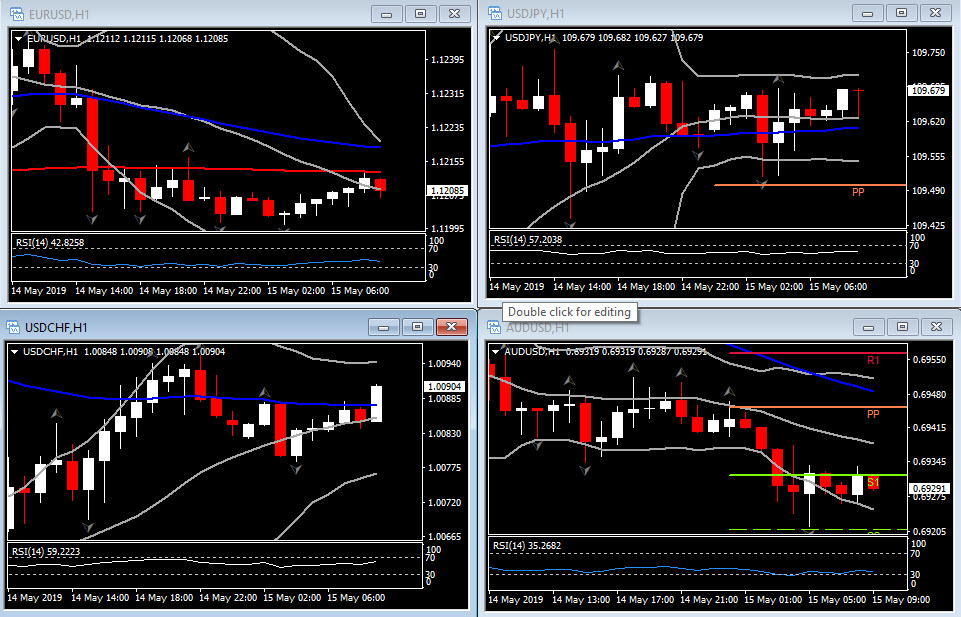

Technician’s Corner

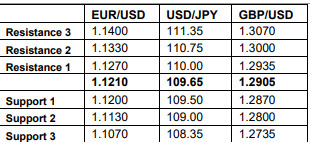

- EURUSD found Support into the 1.1200 level. The pair has mostly been stuck between its 20-day moving average at 1.1200 and its 50-day moving average at 1.1245 since the start of the week. A close above or below these levels may help determine direction for the remainder of the week.

- USDJPY has recovered slightly from earlier lows of 109.45, making its way to 109.67 highs so far. The rally on Wall Street, which has so far wiped out about a third of Monday’s sharp losses has provided some Support, as have steadier Treasury yields which were hammered lower yesterday as well. The uncertainty of the outcome of the US-China trade war however, will likely keep USDJPY upside limited for now.

- GBPUSD is back on a weakening path. A generally firmer Dollar has seen Cable lead the way in the latest phase, with the pair printing fresh 2-week lows under 1.2910. This extends the quite-steep decline from the early May peak at 1.3176, which is the loftiest point reached over the last six weeks. As the risk of a disorderly no-deal Brexit remains a possibility, if not a probability and as the pair is in a sharp decline for the 8th day in a row, bearish outlook looks to hold strongly. Intraday, Cable has Resistance at 1.2928-1.1235 and Support at 1.2860 on the break of 1.2900 level.

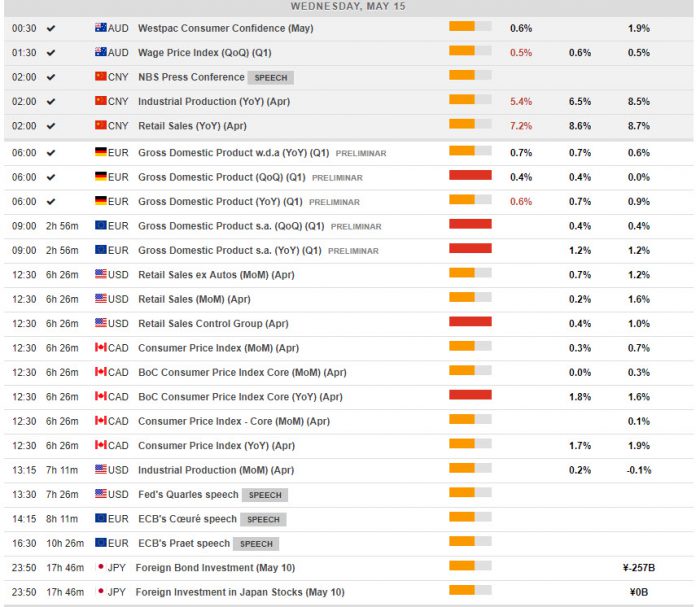

Main Macro Events Today

- Gross Domestic Product (EUR, GMT 06:00) – Eurozone prelim. Q1 GDP growth expected to be confirmed at 0.4% q/q.

- Retail Sales and Core (USD, GMT 12:30) – We expect readings of 0.2% for April retail sales and 0.7% for ex-auto sales, following a 1.6% increase for the March headline and a 1.2% increase ex-autos. Unit vehicle sales slowed in April, and gasoline prices should continue to boost retail activity given an estimated 5.5% increase in the CPI for gasoline.

- Consumer Price Index (CAD, GMT 12:30) – The Canadian CPI is expected to slip to 0.3% from the 0.7% reading in the past 2 months.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.