The weaker than expected retail sales have added to the safe haven rally in Treasuries, where yields are dropping to new lows for 2019. The front end is leading the way as the market continues to look for a Fed rate cut down the road.

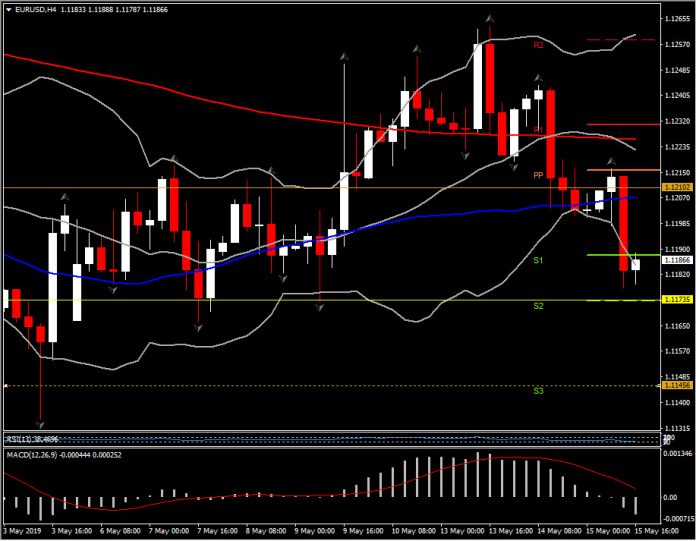

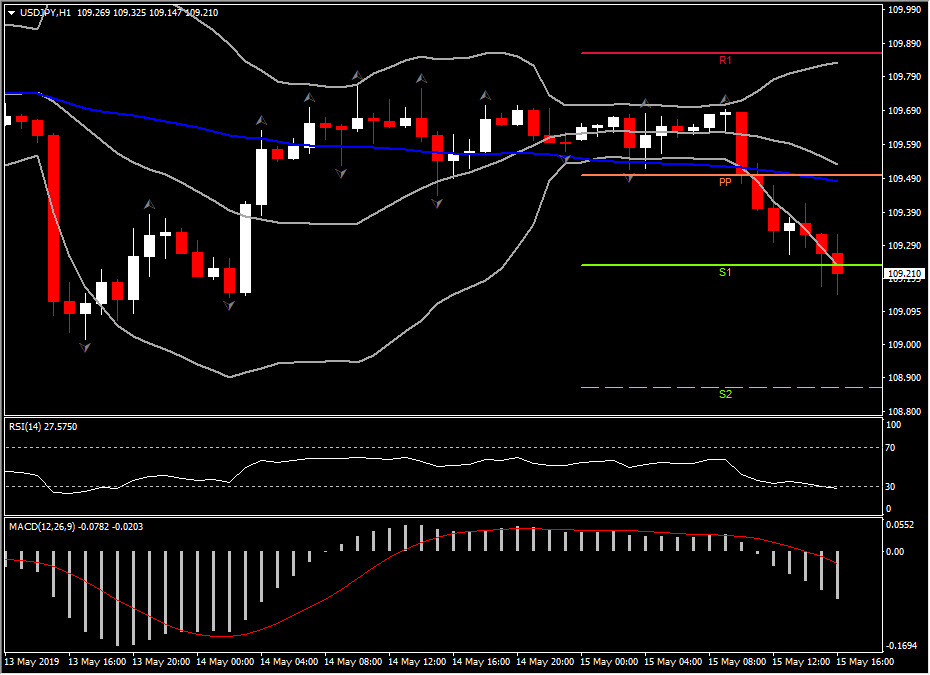

The Dollar slipped as well, with EURUSD recovering from lows of the week at 1.1178, topping at 1.1192, while USDJPY fell to 109.20 from 109.30.

U.S. April retail sales fell 0.2% overall, with a scant 0.1% gain in the ex-auto component, both weaker than forecast. And they follow respective March gains of 1.7% (revised from 1.6%) and 1.3% (revised from 1.2%). Excluding autos, gas, and building materials, sales were unchanged versus the prior 1.1% gain previously (revised from 1.0%). Weighing on the headline was a 1.1% drop in vehicle sales after a 3.2% March rebound (revised from 3.1%). Building materials tumbled 1.9%, with electronics sales sliding 1.3%. Gas station sales rose 1.8% versus 3.3% previously (revised from 3.5%). Clothing sales dipped 0.2%, with non-store retailers sales off 0.2% as well. Food sales edged up 0.2%, with healthcare declining 0.2%. The much weaker than expected report will add to worries over the U.S. consumer.

On the flip side, US Empire State manufacturing index increased 7.7 points to 17.8 in May, better than expected, after bouncing 6.4 points to 10.1 in April. The index is back close to where it was a year ago at 20.6. This was a solid report, with moderate inflation stats.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.