FX News Today

- Treasury yields dipped -1.4 bp overnight, JGB rates are down -0.5 bp as bond markets continue to rally amid the escalating US-Sino trade spat that saw Trump targeting Chinese telecom companies.

- Reports that the US President will hold off on auto tariffs for now helped European bourses to stage a late rally Wednesday.

- The US President signed an order that is expected to restrict the likes of Huawei and ZTE Corp from selling their equipment to the US. Huawei was also put on a blacklist that could forbid it from doing business with American companies and require US companies to obtain a special licence to sell products to the company, which if enforced strictly could halt even everyday operations at the Chinese company.

- The US and European stock futures are under pressure ahead of the official open.

- US-Sino trade tensions aside Brexit developments and Italian budget jitters remain in focus amid a pretty quiet local calendar that focuses on Eurozone trade numbers as well as the final reading of Italian HICP inflation.

- The unexpected pick up in Australian unemployment fuelled speculation of a rate cut from the RBA.

- The front end WTI future is trading at $62.40 per barrel.

Charts of the Day

Technician’s Corner

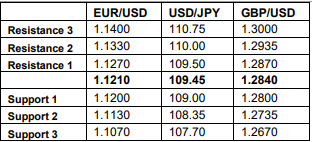

- EURUSD found Resistance at 1.1217 level for 2 consecutive days. The pair has mostly been stuck between its 20-day moving average at 1.1200 and its 50-day moving average at 1.1245 since the start of the week. A close above or below these levels may help determine direction for the remainder of the week.

- GBPUSD has extended losses which s now in its 9th consecutive down day, after it broke yesterday April’s lows. Next support for the asset is coming at January’s low Resistance at 1.2772.

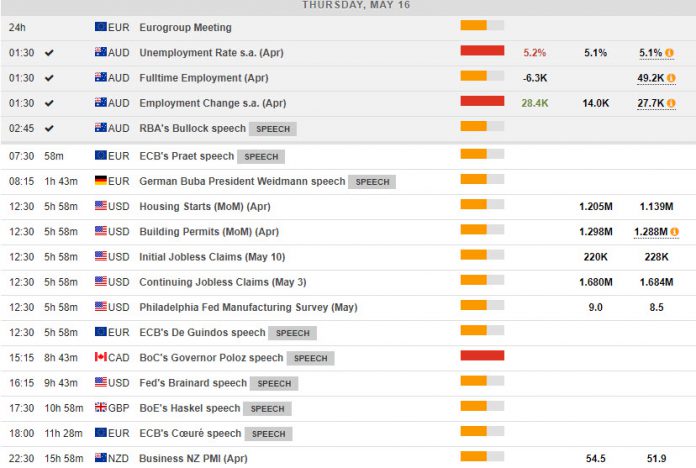

Main Macro Events Today

- Housing Data (USD, GMT 12:30) – Both Building Permits and Housing Starts should jump in April, to a 1.215 mln pace and to 1.298 mln respectively, after a 0.3% and 0.2% decline seen in March. Overall, a stronger trajectory is expected for starts with a positive but slower pace for permits.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.