Nvidia Corp., an American multinational technology behemoth with market cap over $2.2T (the third most valuable company in the world) which specializes in the design and manufacture of computer graphics processors, chipsets and related multimedia software, shall release its earnings report for the fiscal quarter ending April 2024, on 22nd May (Wednesday) after market close. After being regarded as “an inflation hedge tool comparable to gold”, could Nvidia continue to prove this statement through its earnings result this time?

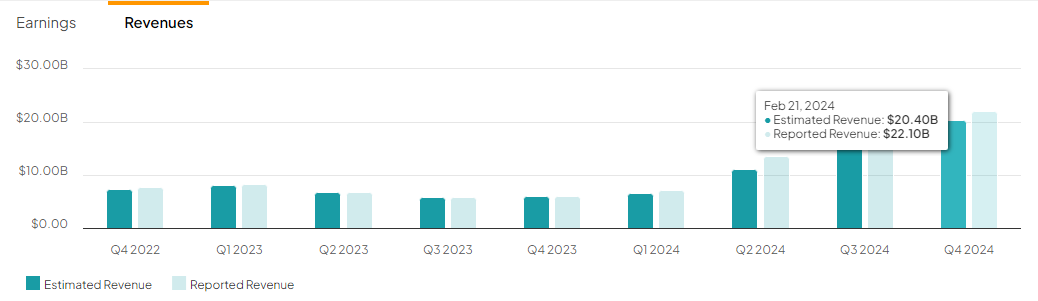

The latest revenue reported by Nvidia hit $22.1B, up 22% and 265%, from Q3 2024 and prior year ago, respectively. Revenue for FY 2024 was up 126% (y/y), to $60.9B. Operating income was up 31% (q/q) and up 983% (y/y), to $13.62B. Gross margin was also up 2.0 points quarterly and up 12.7 points from the same period last year, to 76.0%.

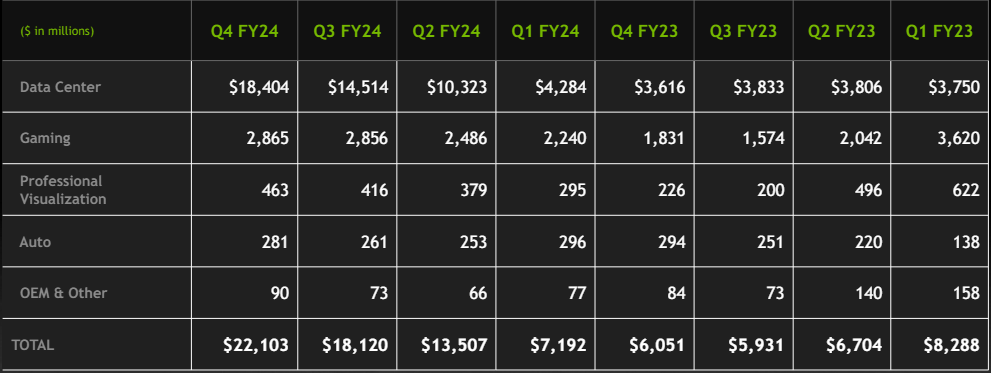

Nvidia Quarterly Revenue Trend: Revenue by Market. Source: Financial Presentation

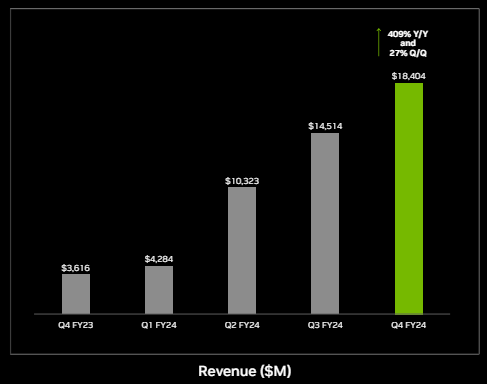

In general, the Data Center segment continued to drive most of the gains. In the previous quarter, it recorded sales revenue worth $18.4B, up 27% from the previous quarter, and up 409% from a year ago.

Contribution from the Auto segment exceeded $1B last year, whereas Software/services also reached an annualized revenue run rate of $1B. Demand for chips and relevant products remains “very strong”, in which the management also expected the next-generation products to be supply-constrained. More sectors including healthcare and financial services adopted AI technology significantly, serving as another positive catalyst for the chip maker.

Sales revenue in the Gaming segment reported at $2.9B, flat from the previous quarter, and up 56% (y/y) from the same period last year. The company has a massive installed base of over 100 million AI-ready RTX PCs and workstations shipped. On the other hand, Professional Visualization recorded revenue up 11% (q/q) and up 105% (y/y) to $463 million. Automotive reported revenue at $281 million, up 8% from the previous quarter, but down -4% from a year ago. To date, some of the EV makers which have been using Nvidia’s AI car computer include Li Auto, Great Wall Motor, ZEEKR (the premium EV subsidiary of Geely) and Xiaomi.

Throughout FY 2024, all segments reported gains in revenue compared to the previous year, with Data Center, Gaming, Professional Visualization and Automotive accounting for $47.5B (up 217%), $10.4B (up 15%), $1.6B (up 1%) and $1.1B (up 21%).

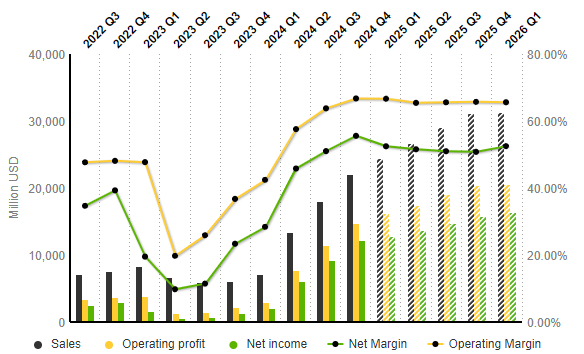

Nvidia: Income Statement Evolution (Quarterly Data). Source: Market Screener

According to projections by S&P Global Market Intelligence, sales revenue is expected to reach $24.5B in the coming quarter, up 10.7% from the previous quarter, and up over 240% from the same period last year. Operating profit and net income are projected to edge higher from the previous quarter, to $16.3B and $12.8B respectively. Net margin is expected to be down by -3.13% from the previous quarter, to 52.45%. Operating margin is also expected to lower slightly towards 66.65%, previously 66.73%.

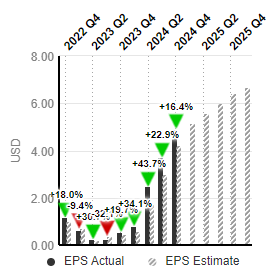

Nvidia: EPS. Source: Market Screener

EPS is estimated to hit $5.18, up over 5% from previous quarter $4.93. It was $0.82 in Q1 2024.

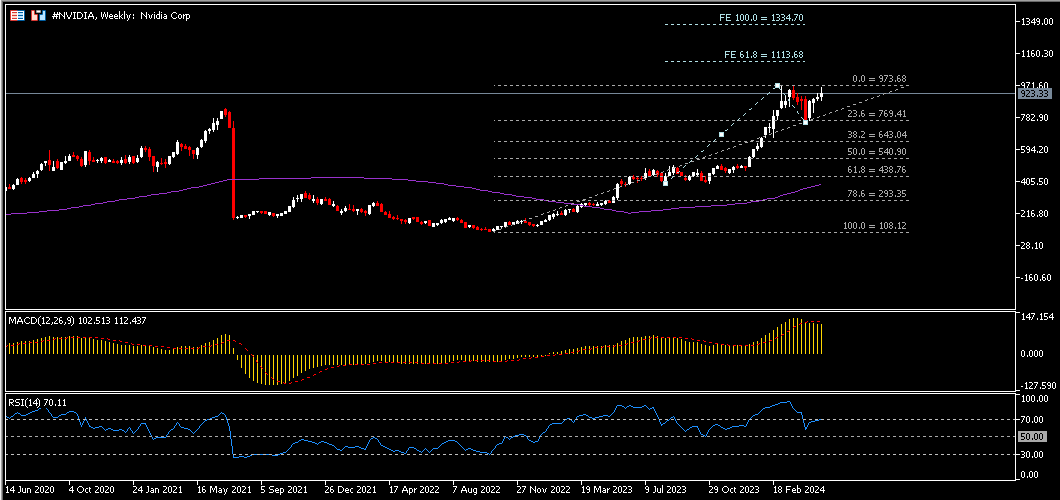

Technical Analysis:

#NVIDIA share price resumes its upward trend after gaining support above $769.40 (FR 23.6% extended from the lows in October 2022 to the ATH formed in March 2024). MACD indicator remains in positive territory, while RSI hovers around 70 (yet to be at overbought zone). The ATH at $973.68 serves as the nearest resistance. A break above this level may lead the bulls to continue testing $1113.70 and $1334.70, levels projected via Fibonacci Expansion.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.