Most major stock market indices in Asia traded lower on Tuesday [28 May], with mainland stocks struggling for clear direction amid a lack of fresh catalysts. Investors will be keeping a close eye on important economic data releases, including the Federal Reserve’s Beige Book and Tokyo CPI later this week, which promise to offer valuable insights into the economic landscape.

Meanwhile, on Monday [27 May] banks and most markets were closed in observance of Memorial Day in the US. Half-day trading with low transaction volumes was seen. Looking back, the Nasdaq 100 Index [USA100] tracked a gain of around 1.4% last week. The index was fuelled by positive sentiment surrounding the performance of the technology industry, amidst AI-driven hype. NVIDIA’s record-breaking earnings released last week, as well as Qualcomm’s impressive presentation at Microsoft Build 2024, have sent a strong signal that the tech industry still has more fuel to keep rising, despite concerns that some stocks may be overvalued.

Healthcare companies, which make up 7.1% of the Nasdaq 100, are expected to maintain their spectacular gains following last week’s huge gains fuelled by optimism over the bird flu vaccine. Large vaccine orders are now more likely, as European and American countries have stepped up their surveillance and preparedness for a possible spike in bird flu cases. Australia reported its first human case of H5N1 flu last week, while two Americans and two farm animals were infected with the virus.

Given that there have been no reports of human-to-human transmission so far, many argue that agricultural workers will probably be the first group to receive mass vaccinations in an effort to stop the spread of the disease. The US government is already in discussions with Moderna and Pfizer/BioNTech about launching clinical injections. May saw a 51% increase in Moderna shares, with a recent gain of 25.3%. In addition, BioNTech saw a 7% increase last week, while Novavax saw a 19.1% increase. The Nasdaq 100 Index is expected to continue its upward trend this week, due to the positive outlook surrounding the technology and healthcare sectors.

Economic Calendar

Furthermore, this week’s data that will receive attention amidst a quiet economic calendar is Consumer confidence on Tuesday. With inflation returning to the news cycle in a big way, consumer data has had a lot of potential to move markets in recent weeks. If consumer confidence is in line with expectations or lower, we could see the market rally with hopes of a rate cut happening this year. If earnings are higher than expected, we could see a sell-off, as the market realises that a weak economy and higher inflation could force a delay in the rate cut.

Pending Home Sales: Housing data really helped move the market last week with the decline in new home sales and it is likely that the same will happen this week. Pending home sales will be released on Thursday and a contraction of 0.6% is expected. If expectations miss, we could see some additional selling repeating last week’s action. If the result is higher than expected, we could see a market rally on better-than-expected news.

Prelim GDP q/q and Unemployment Claim data on Thursday may dampen some market participants’ enthusiasm until actual core PCE data is published. Core PCE, the Fed’s official inflation measurement tool, will be released on Friday. Given all the news surrounding inflation lately, this has the potential to move markets and determine the direction of price action now and possibly the next few weeks, until the next FOMC meeting. If the PCE is hotter than expected, it may be a major challenge proving that inflation is still not under control. If it’s cooler then, we could see the market actually potentially rally on potential positive interest rate news.

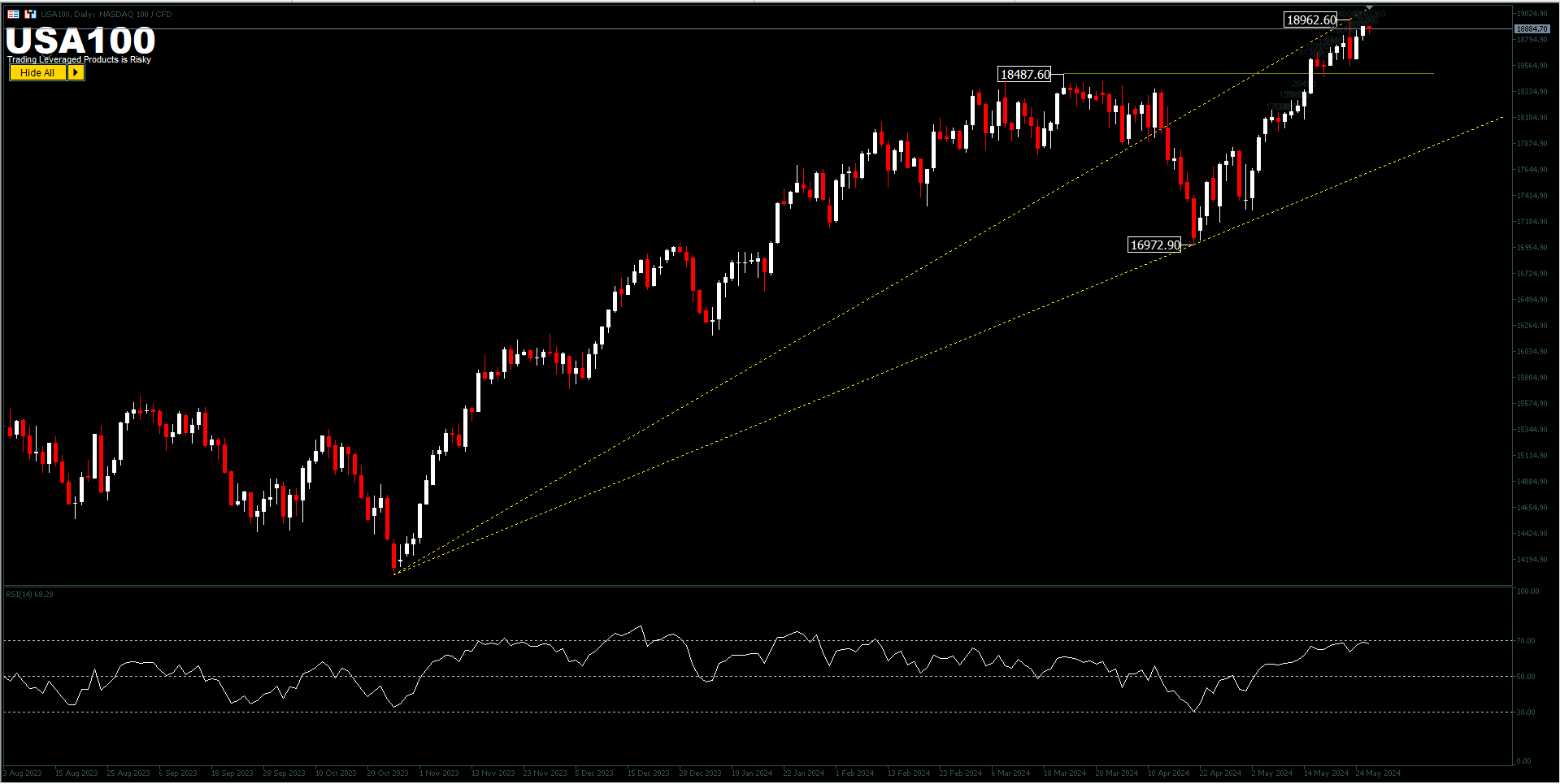

The momentum of the USA100 is still signalling a continuation of the uptrend, with the RSI showing that buyers are currently in control near the overbought area. The uptrend is likely to continue, if the Index holds above 18,487.60 with a possible test of the 18,962.60 ATH. A move above 18,962.60 will only confirm the continuation of the main trend for the psychological mark of 19,000.00 and above. A drop below 18,487.60 will send a short-term bearish signal for a correction to the continued rise from 16,972.90.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.