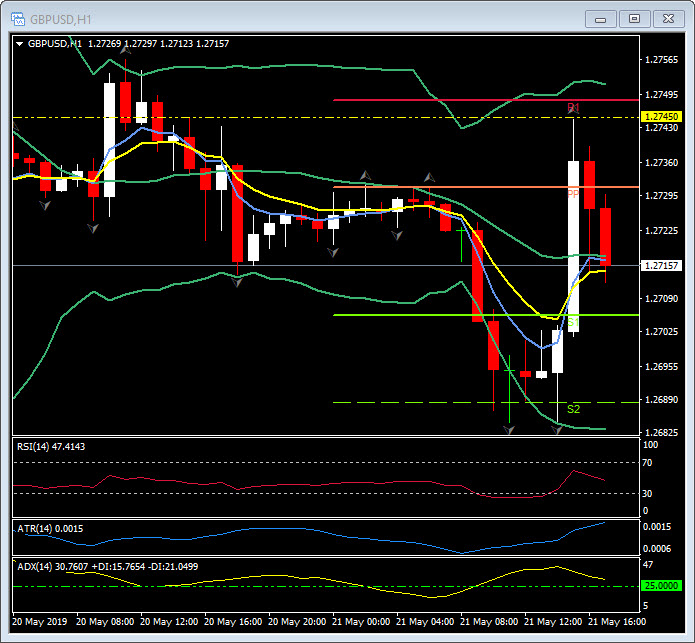

GBPUSD, H1

US existing home sales slipped 0.4% to 5.190 mln in April, disappointing expectations for a strong rebound following the 4.9% drop to a 5.210 mln rate in March. It’s the slowest pace since September’s 5.180 mln, which was the worst since April 2015. The weakness was in single family sales which declined 1.1% after March’s 4.9% tumble. Condo/coop sales jumped 5.6%, more than erasing March’s 5.3% decline. Regionally, sales were down 4.5% in the Northeast and 0.4% in the South, but rose 1.8% in the West and were unchanged in the Midwest. The months’ supply increased to 4.2 from 3.8 (revised from 3.9). The median sales price increased to $267,300 versus $259,700 (revised from $259,400).

Across the Atlantic, Sterling rotated higher on Brexit-related news, specifically news that UK Prime Minister May will address reporters at 4 PM in London (13:00 GMT) regarding details of a new Brexit deal. Cable rallied by over 50 pips in making a high of 1.2745, though has since pulled back under 1.2720. There is also news, stemming from Sky, that the Prime Minister will concede to the UK remaining in the EU’s customs union, although it’s not clear for how long (whether permanent or up until the next general election). It’s also unclear if Labour will be willing be to play ball after stating last week that it doesn’t wish to do a deal with the Tories due to the party’s instability.

The Dollar slipped slightly after the modest existing home sales miss, taking EURUSD a few points higher toward 1.1155, and USDJPY to 110.55 from 110.60.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.