- US inflation data confirms the recent spike in inflation may have passed its peak and is now declining.

- Producer inflation reads significantly lower. Producer inflation excluding food and energy products also falls to recent lows.

- US Producer Inflation falls to 2.2% and Core Producer Inflation to 2.3%.

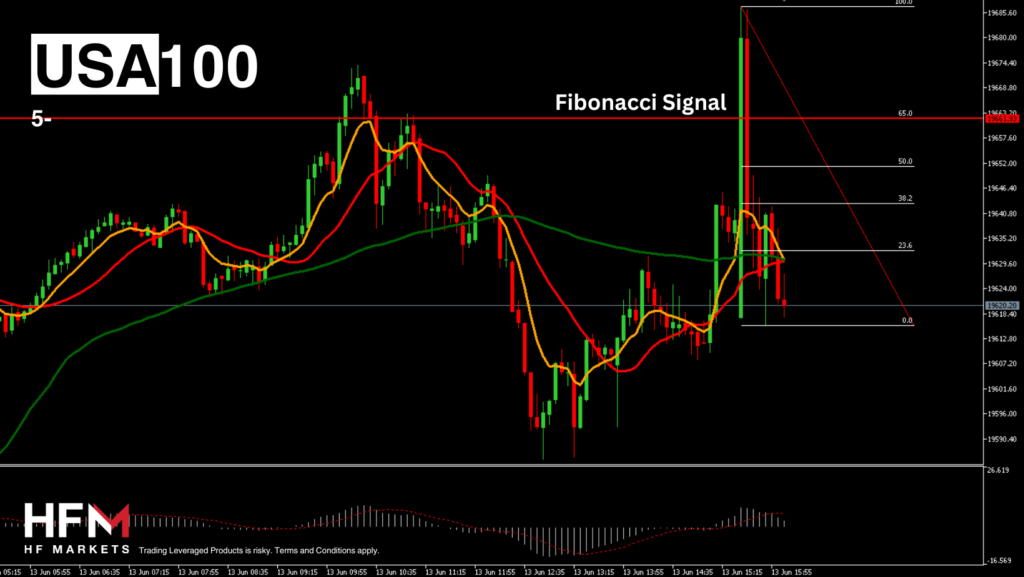

- The NASDAQ renews its recent highs for a second consecutive day. The index rises 0.40% after the US releases their producer inflation data.

USA100

The NASDAQ saw a weaker retracement compared to the SNP500 and Dow Jones during yesterday’s bullish trend which shows investor faith in the technology market. Most analysts and institutions have raised their target price and the intrinsic value of stocks due to the inflation data.

Consumer inflation has fallen to 3.4% and now producer inflation has fallen to an all-time low. Producer Inflation fell to 2.2% and Core Producer Inflation to 2.3%. Due to the lower inflation reading, more than 60% of traders believe the Federal Reserve will cut in September 2024. Previously, this figure was less than 37%. The lower inflation and the higher possibility of a rate adjustment is known to be positive for the NASDAQ.

However, investors are also partially reacting negatively to the Unemployment Claims which continue to read higher than the first quarter’s average. The Weekly Unemployment Claims rose to a 10-month high.

The maximum volume of government bonds, upon repayment of which the US Federal Reserve will not reinvest funds, will now amount to $25 billion per month, which is significantly less than the $60 billion previously, and the similar limit for mortgage-backed securities was maintained at $35 billion. So, the buyback program now looks like 25/35, which indicates a slight tightening within the framework of the current monetary policy to put even more pressure on inflation.

The 10-Year US Bond Yields have fallen by 0.026 points which also supports the stock market. However, investors will monitor the individual performance of the most influential stocks once the US market opens. These include Apple, Microsoft, NVIDIA, Alphabet and Amazon.

Technical analysis continues to point towards the price being controlled by buyers. In addition to this, the price is forming a bullish crossover and remains above price sentiment indicators. The VIX is trading 0.84% lower and the High Low Index is rising which points towards a “risk-on” appetite. According to Fibonacci, buy signals will strengthen with the price crossing above the $19,661.76 level.

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.