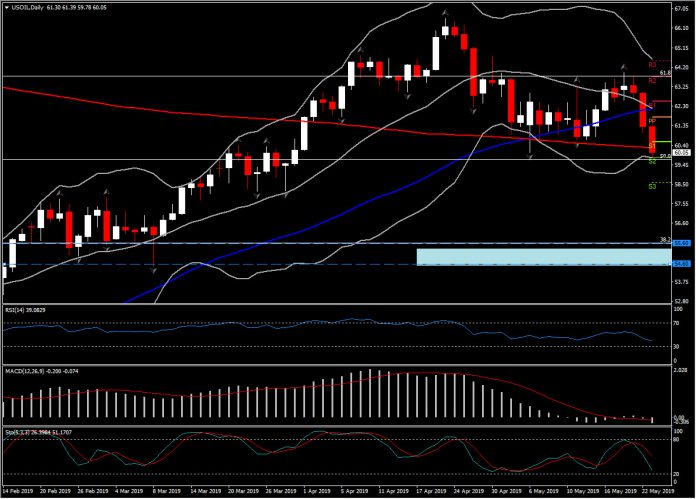

USOIL crude prices are down 1.6% at $60. A low was printed earlier at $59.78, which is 22 cents shy of the low recorded on May 6. Below here would put crude prices at a near 2-month low.

The decline today is the third consecutive daily loss. EIA inventory data yesterday showed an unexpected, and large, 4.7 mln bbl increase in the US crude stockpile, which is mixing with a sharp rise in risk aversion in global markets to produce a strong Oil-price bearish cocktail.

The US-China standoff on trade has remained the dominant sentiment influencer. China’s Commerce Ministry said today that the US needs to “correct its wrong actions” if it wants to continue negotiations on trade in a fresh sign of Beijing digging in for a protracted trade war. Two US Navy ships reportedly passed through the Taiwan Strait, which if true would be seen as an antagonizing move by Beijing.

WTI benchmark prices are down over 5% from levels seen late last week, and are down 8.4% from month-ago levels. The next USOIL downside level on a confirmed break of the $60.00 (50.0% Fibonacci level since October 2018 downleg) comes at $54.60-55.50 area, the 2-month Resistance area which has not converted to Support, coinciding with the 38.2% Fib.level.

Nevertheless, from the technical perspective, daily momentum indicators are presenting a neutral to negative bias, suggesting that an intraday consolidation could follow in the short term.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.