- UK inflation declines to the Bank of England’s target of 2.00%.

- The British Pound increases at first but the day’s best performing currency so far is the Australian Dollar.

- US Retail Sales decline and read lower than market expectations, applying pressure on the Dollar.

- The NASDAQ is increasing in value for an eighth consecutive day measuring more than 5.10%.

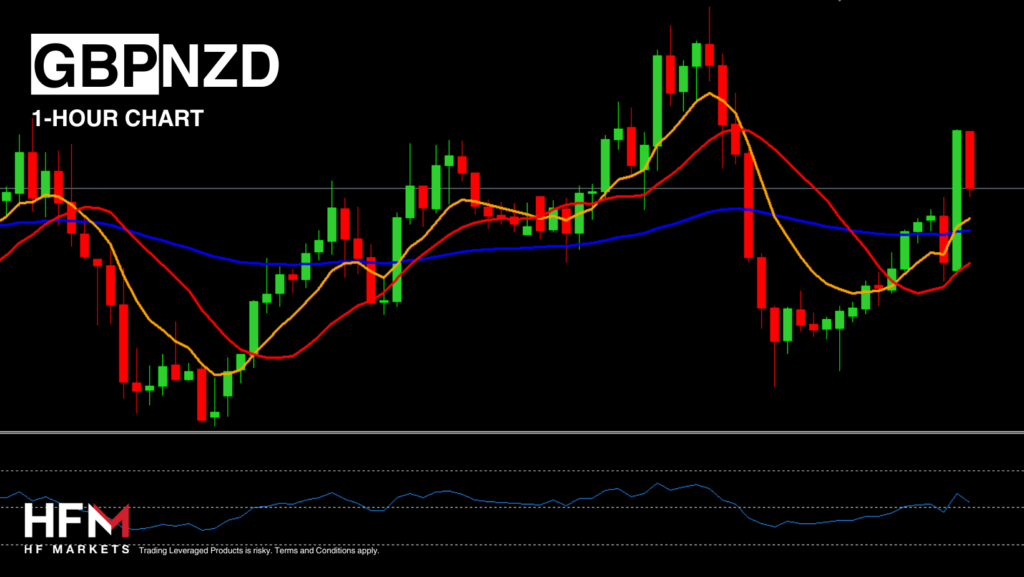

GBPNZD – UK Inflation Reaches Bank of England Target!

The GBPNZD is witnessing one of the clearest trends and strongest momentum of the day. This is due to the poor performance of the New Zealand Dollar and the UK inflation rate. The lower inflation in the UK potentially can be a positive factor despite traditionally lower inflation being negative. This is due to the weak economic growth needing an expansionary policy from the Bank of England. As a result, the lower inflation can improve investor sentiment towards the UK.

However, a rate cut from the Bank of England can nonetheless apply pressure. The UK inflation rate fell from 2.3% to 2.00% which is the Bank of England’s target. The UK’s core inflation rate which excludes food and energy products fell from 3.8% to 3.5%. This will now be the Bank of England’s main concern and may delay a rate cut. Tomorrow’s Bank of England rate decision, committee votes, and forward guidance will be key to the value of the Pound. Currently, experts still believe the Bank of England will keep rates unchanged but will signal a cut at the next meeting. However, if the Monetary Policy Committee does decide to adjust interest rates, the Pound can come under immense pressure.

The New Zealand Dollar on the other hand is coming under pressure from the upcoming Gross Domestic Product announcement which analysts expect to remain low. Experts believe the Gross Domestic Product will read 0.1%, but a lower figure will put the economy at risk of a recession. Over the past 2 quarters the economy has contracted 0.4%, another decline can worry investors and may even prompt a panic rate cut. However, a higher than expected, or inline with expectations, Gross Domestic Product can support the currency.

In terms of technical analysis, trend-based indicators are indicating an upward price movement. However, the only concern is the resistance level at 2.07553 which has pressured the exchange rate on four occasions over the past week.

USA100 – NVIDIA Carries The NASDAQ to an Eighth Day Rise.

The NASDAQ is increasing in value for an eighth consecutive day and is close to trading at its all-time high. Experts believe the index is likely to continue its upward trend in the longer term but may psychologically be too high for investors at the moment. For this reason, many technical analysts believe the trend may turn sideways after renewing its recent highs at $20,019.99.

What proof do we have that the price may psychologically be too high for investors at the moment? The first points are related to sentiment. The VIX is trading significantly higher and the NASDAQ’s High Low Index has fallen to 58.99 over the past month. This indicates a strong sentiment towards the index, but less confidence than before. In addition to this, investors should also note that the RSI is close to indicating overbought levels.

Lastly, the NASDAQ has renewed its all-time highs and is clearly forming a bullish trend pattern. However, when monitoring the components individually, 10 of the 20 most influential stocks fell in value on Tuesday. Analysts attribute the bullish candlestick solely to a 3.51% increase in NVIDIA’s stock price. As a result, NVIDIA has now emerged as the most valuable company in the world.

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.