SNB’s Unexpected Rate Cut

The Swiss National Bank (SNB) surprised markets once again with a second consecutive 25 basis point rate cut. This move, reducing the policy rate to 1.25%, caught many off guard, especially against the backdrop of the Fed’s persistent high-rate stance. Despite recent inflation data, the SNB noted that underlying inflationary pressures had decreased, justifying the rate cut to maintain appropriate monetary conditions.

BoE Holds Rates Steady, Hints at Future Cuts

The Bank of England (BoE) kept its policy settings unchanged, with a 7-2 vote to maintain the Bank Rate at 5.25%. The minutes revealed a split among the members favoring unchanged rates, with some needing more evidence of diminishing inflation persistence before reducing rates. However, the central bank is edging closer to a rate cut, potentially at the next meeting, as Governor Bailey expressed confidence in the inflation outlook. Indeed, we suspect that reluctance to move ahead of the July 4 election was part of the reasoning behind today’s decision. The BoE flagged in the statement though that “as part of the August forecast round, members of the Committee will consider all the information available and this affects the assessment that the risks from inflation persistence are receding. On that basis, the Committee will keep under review for how long Bank Rate should be maintained at its current level.” The comments seem to back our forecast for a 25 bp cut in Bank Rate at the next policy meeting on August 1.

The BoE’s statement highlighted moderating short-term inflation expectations and stronger-than-expected GDP growth, projecting a 0.5% increase through the second quarter. However, labor market data remain unreliable, complicating assessments of employment trends. Despite easing headline inflation to 2.0% in May, the central bank remains cautious due to potential base effects later in the year.

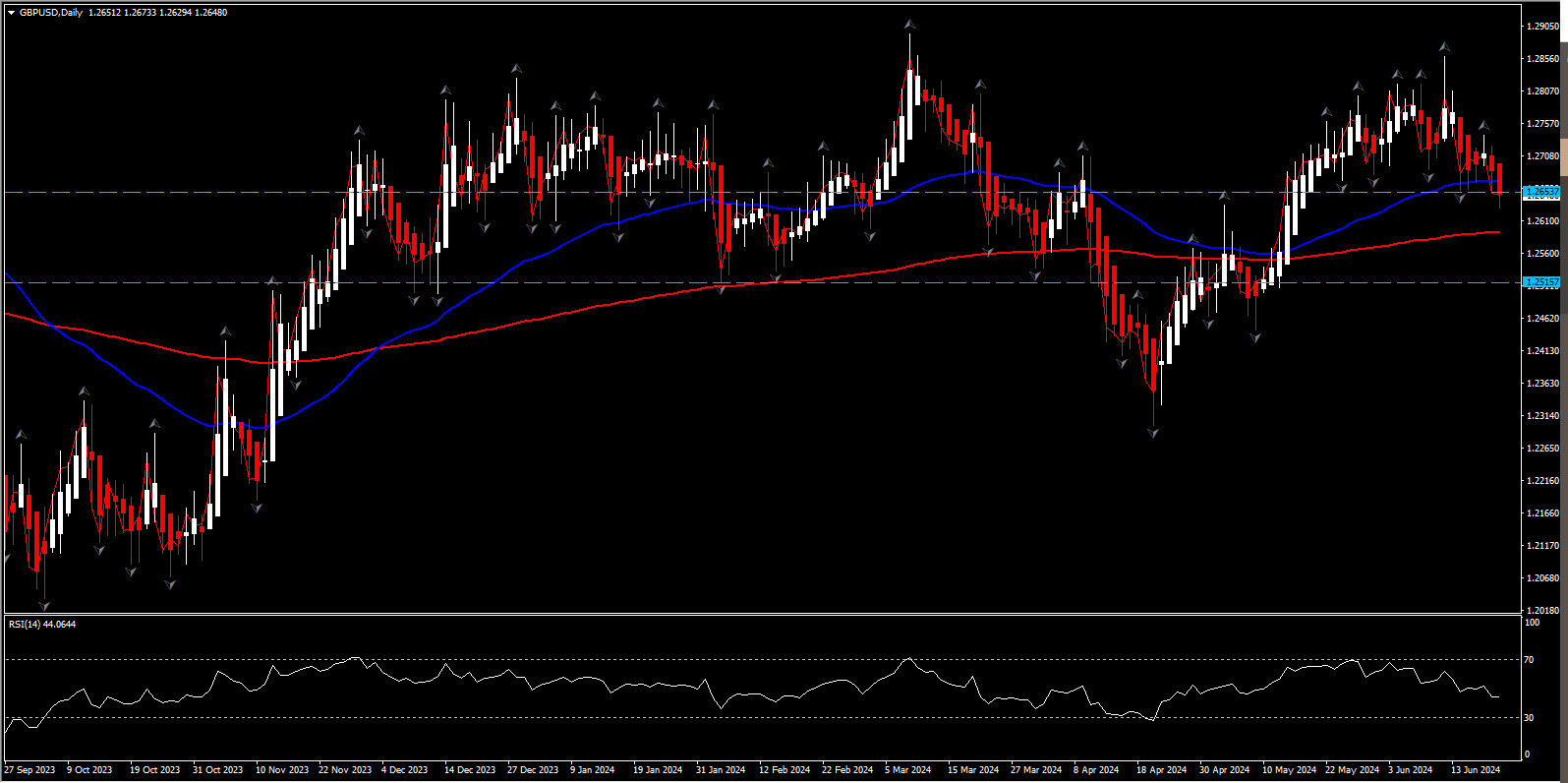

They hinted that a cut is underway, which put pressure on Sterling. Cable dropped below the 1.27 mark. Even though Pound is finding temporary support today near 1.2670 following the positive UK Retail Sales data for May, however, its short-term outlook remains uncertain as the GBPUSD pair is trading below the 20-day and 50-day Exponential Moving Averages (EMAs).

The pair struggles to maintain the 61.8% Fibonacci retracement level at 1.2667, drawn from the March 8 high of 1.2900 to the April 22 low of 1.2300.

Additionally, the RSI (14) has slipped back into the 40.00-60.00 range, signaling a loss of upward momentum.

Norges Bank Maintains Hawkish Stance

Norges Bank left its policy rate unchanged at 4.5%, signaling a more hawkish stance than expected. The central bank indicated that the rate would likely stay at this level for the rest of the year, with projections showing inflation nearing 2% only by the end of 2027. Governor Ida Wolden Bache emphasized the potential for rate increases if capacity utilization rises or the krone depreciates.

The statement noted that if unemployment rises more than expected or inflation declines rapidly, the policy rate could be lowered sooner. Despite the hawkish tone, the rate path suggests a slight risk of a rise this year, with potential cuts in 2024/25.

The latest decisions from the SNB, BoE, and Norges Bank reflect diverse approaches to current economic conditions and inflation trends. While the SNB continues to cut rates to address inflationary pressures, the BoE is cautiously preparing for a potential cut, and Norges Bank maintains a steady, hawkish stance. These varied strategies underscore the complexities faced by central banks in navigating post-pandemic economic landscapes.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.