- The day’s best-performing currency is the US Dollar which has increased34% so far and continues pressuring Gold.

- The US Dollar continues to obtain support from the latest US economic data. Investors question if markets are pricing in a higher Core PCE Price Index.

- The price of Gold declines to its longer-term support level at $2,291.50.

- The market shows a strong risk-on sentiment which can be seen with global stocks rising and most safe-haven assets declining.

XAUUSD – A Strengthening Dollar Pressures Gold!

The price of Gold is largely coming under pressure from the rise in risk appetite and the strengthening US Dollar. However, technical analysts point out that the price can receive support from the Support Level at $2,291.50. The price has failed to fall below this level on 6 occasions over the past 3 months.

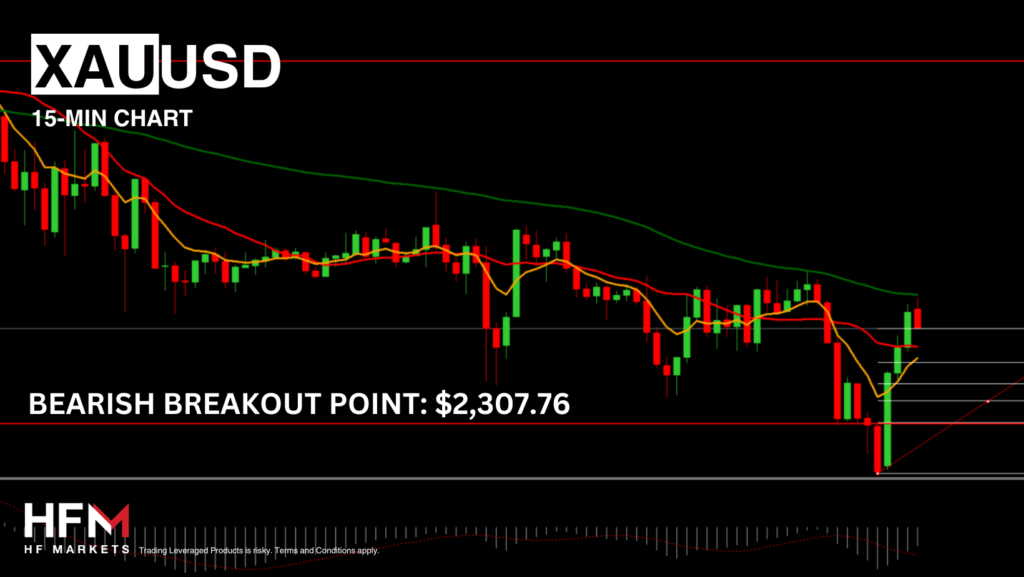

However, even though the price is trading close to the support level, traders will ideally look for a price signalling a change in the trend. Currently the price is trading below most sentimental indicators including the 75-Bar EMA and 100-Bar SMA. However, if the price rises above $2,318.05, a correction may be signaled. According to the 75-Bar EMA a correction can rise as high as $2,326.83. However, if the price drops below $2,307.76, without crossing onto a new high, a sell signal will become active. This can be seen in the 15-Minute timeframe which also shows the price below most moving averages and below the neutral on the MACD.

Though there are longer term elements which can potentially keep the price high or push it to a new high, the primary factor keeping metal prices high continues to be elevated geopolitical risks. In addition to the conflicts in Ukraine and the Middle East, the potential worsening of US-China relations has also contributed. A Bank of America survey of portfolio managers in June revealed that 29% of respondents identified this risk as crucial for the global economy in the coming year. In response, central banks worldwide are actively increasing their reserves. According to the World Gold Council, reserves grew by 290.0 tons in the first quarter, maintaining last year’s positive trend of 286 tons. Lastly, another positive factor is the higher price of Silver which is positively correlated with the price of Gold.

One of the main drivers has been economic data pushing the price of the Dollar higher. For example, yesterday’s Consumer Confidence Index read 0.4 points higher than expectations. this afternoon investors will be monitoring the US New Home Sales. Thereafter, investors will turn their attention to the Pending Home Sales (tomorrow) and Core PCE Price Index (Friday). For the price of Gold to rise, traders will ideally look for weaker data which is likely to pressure the Dollar. In addition to this, the weaker data will prompt investors to mitigate risk away from the Dollar into “competitors” such as Gold.

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.