Gold held below $2,300 per ounce on Thursday, at its lowest level in two weeks, weighed down by a stronger dollar and higher bond yields. Traders are now focused on US economic reports due later this week. Key focal points include Friday’s core PCE index data, the Federal Reserve’s preferred inflation measure, as well as the third estimate of Q1 GDP growth, in search of further clues as to the timing and scale of potential Fed rate cuts this year.

Precious metals have been supported by increased safe-haven demand from political uncertainty in France as polls show Marine Le Pen’s far-right National Rally party in the lead ahead of the first round of French legislative elections on Sunday. Also of interest is the crucial debate between President Joe Biden and his Republican rival Donald Trump scheduled for today.

In terms of US economic data, it has been less stable lately. For example, CPI data weakened and retail sales data weakened, but PMI data fluctuated. In addition, interest rate cut expectations have declined significantly compared to the beginning of this year, making the market jittery as each set of important data is very surprising.

Despite slowing US inflationary pressures, the market is betting on a possible rate cut mentioned by Fed official Bowman. Currently, the market reaction to good news is indifferent, but it is sensitive to bad news. Thus, gold will face more pressure in the short term.

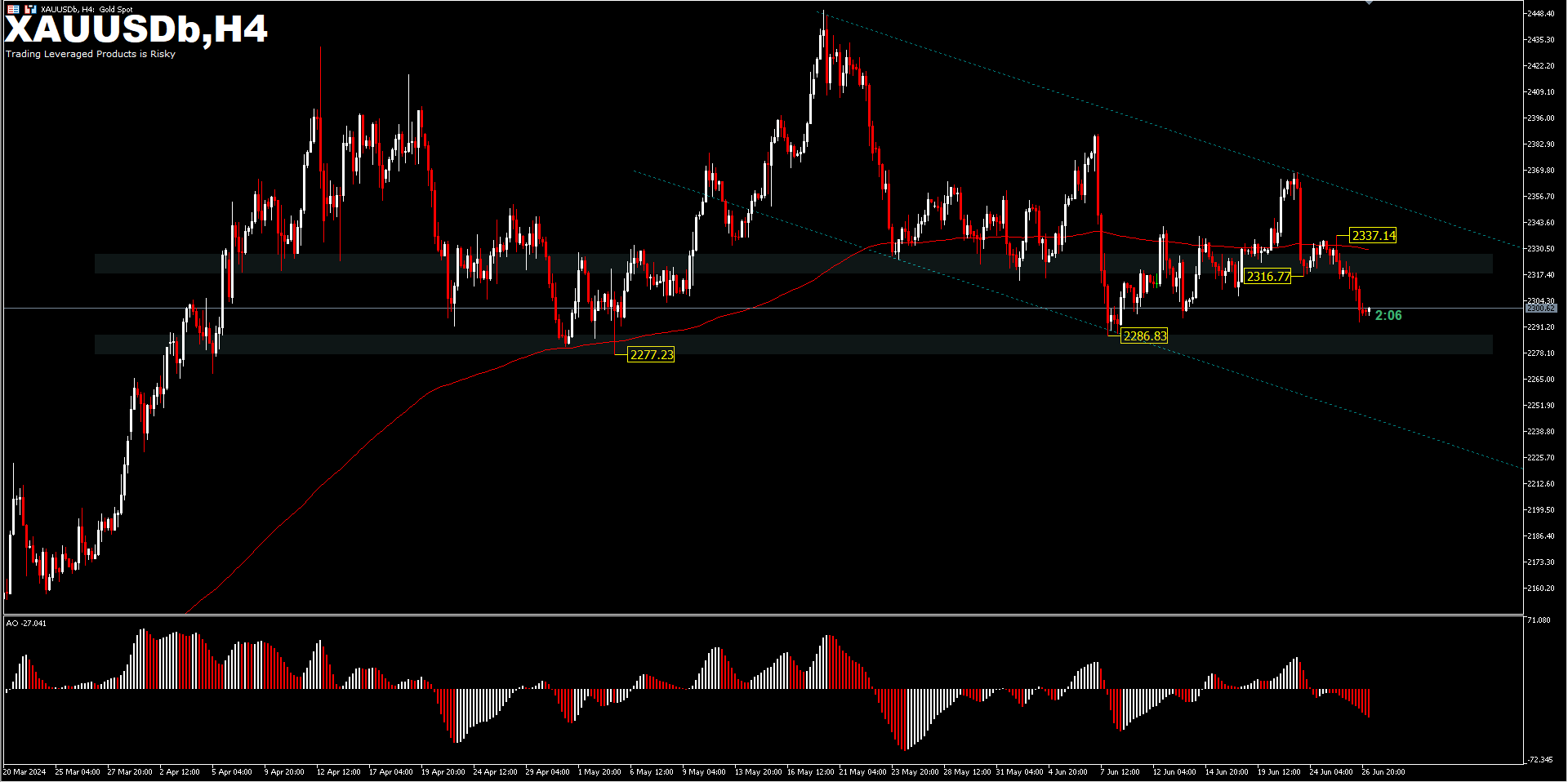

From a technical perspective, the XAUUSD price is currently consolidating at $2300, indicating a weaker rebound strength. As gold sellers dominate, gold is likely to fall further to test $2286 and $2277 support, if it fails to recover the move above $2300. On the upside, a short rebound could test $2316, to neutralise late-June selling pressure at 200-bar exponential moving average range.

The crucial support for gold is at $2277, whether the next month will be bearish or will return to consolidation. The monthly chart’s display of a swing high, as an indication of buyers’ reluctance at the top, will be confirmed if the break of the $2277 support is confirmed.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.