FX News Today

- Asian equities moved up in line with higher closes on the European markets and buoyed by the muted merger of US_Italian Fiat Chrysler and French peer Renault.

- New Zealand and Australian Dollar continues to recover, the was AUD bolstered by a rise in Iron Ore prices.

- US President Trump seemed to keep hopes of a trade deal alive, but it is pretty clear that any agreement is still a way off and that will likely keep market volatile for now.

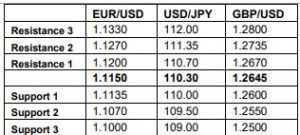

- USD a touch firmer – EUR dips to support at 1.1180, JPY continues to pivot around 109.50 and GBP gave up 1.2700 handle and sits at 161.8 Fib level 1.2670

- Gold declined in the H1 200 ema at $1282.35, breaching the key $1285 psychological area.

- The Oil prices have breached $59.00 per barrel rising 1% on Monday on tensions in the Middle East, and OPEC-led supply cuts, capped by Russian supply coming back on stream after a contamination problem discovered last month.

Charts of the Day

Technician’s Corner

- EURUSD – H1 EMA crossing strategy triggered at 10:00 at 1.1204 (May 27) and has moved down to 200 EMA and S1 at 1.1181. S2 sits at 1.1170 and the daily pivot sits at 1.1198

- XAUUSD – H1 EMA crossing strategy triggered at 18:00 at 1285.12 and has run down through S1 (1283.40) to touch 200 EMA at 1282.35. S2 and lower Bollinger band $1281.75. Daily pivot at 1285.35

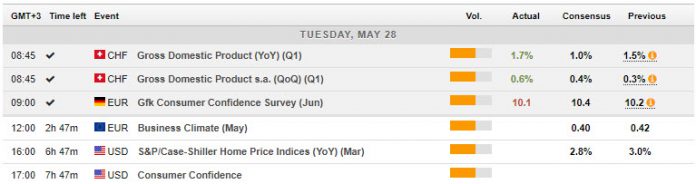

Main Macro Events Today

- CB Consumer Confidence (USD, GMT 14:00) – The Consumer Confidence is expected to rise to 130.0 in May, from 129.2 in April and a 16-month low of 121.7 as recently as January, versus an 18-year high of 137.9 in October. Overall, confidence measures remain historically high.

- RBNZ Financial Stability Report (NZD, GMT 20:00) – After RBNZ did the expected in March, leaving the official cash rate 1.75% following its policy review and surprised by stating “the more likely direction of our next OCR move is down.”, it is now expected to remain on the dovish side along with the rest of the central banks.

Support and Resistance levels

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.