Amazon, an American multinational technology company which actively engages in e-commerce, cloud computing, digital streaming, online advertising and artificial intelligence, has just announced its new move – a discount section featuring cheap items from warehouses in China that could be shipped directly to overseas consumers (Previously, Chinese sellers have relied on Amazon’s fulfilment service to deliver goods to US warehouses before shipping them to customers). The service is open for merchant sign ups this summer, then will begin accepting inventory (ranges from unbranded fashion, home goods to daily necessities) in the fall. According to the officials, the delivery of products takes between nine to eleven days.

The introduction of this new feature shall delight customers with “lower prices, more selection and greater convenience”. Also, this may serve as Amazon’s strategic approach to compete with bargain sites such as Temu and Shein. Thanks to aggressive marketing, these two Chinese-owned e-commerce platforms have successfully attracted new customers by offering steep discounts or free products, especially in exchange for referring friends and family to the platform. Moreover, the sites being designed in a way of “a digital arcade or casino (for instance, spinning wheel game to win 100% OFF for 3 items; Multiplier Card for “700% OFF valued coupon bundle, etc)” instead of the traditional way of “selecting, checking out and pay” which is seen in current e-commerce sites including Amazon has successfully grabbed global attention in a shorter timespan.

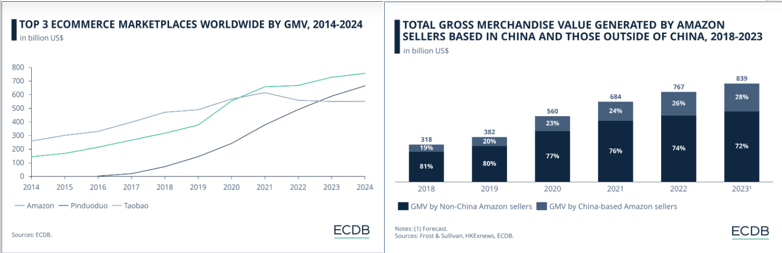

Amazon GMV. Source: ECDB

In fact, Chinese sellers make up over 63% of all third-party sellers on Amazon. In general, Amazon ranked the first place in gross merchandise value (GMV) last year, at $728.8B. The right side of the chart above displays that GMV produced by Chinese sellers have been increasing steadily over the past few years, from below 20% in 2018 to nearly 30% in 2023.

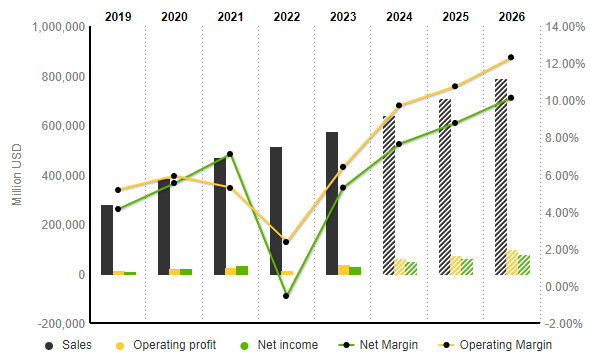

Amazon: Income Statement Evolution (Annual Data). Source: Market Screener

In FY 2023, Amazon hit $574.79B in sales revenue, up 11.8% from the previous year. Its operating profit has doubled to $36.85B, while net income has turned from losses (-$2.72B) in the previous year to gains at $30.43B. The S&P Global Market Intelligence projected a brighter future for the company in the coming years. It is expected that by the end of FY 2024, the company shall reach $638.77B in sales revenue. Operating profit and net income shall hit $62.1B and $48.8B respectively. This would increase the operating margin and net margin to 9.72% (was 6.41%) and 7.64% (was 5.29%) respectively.

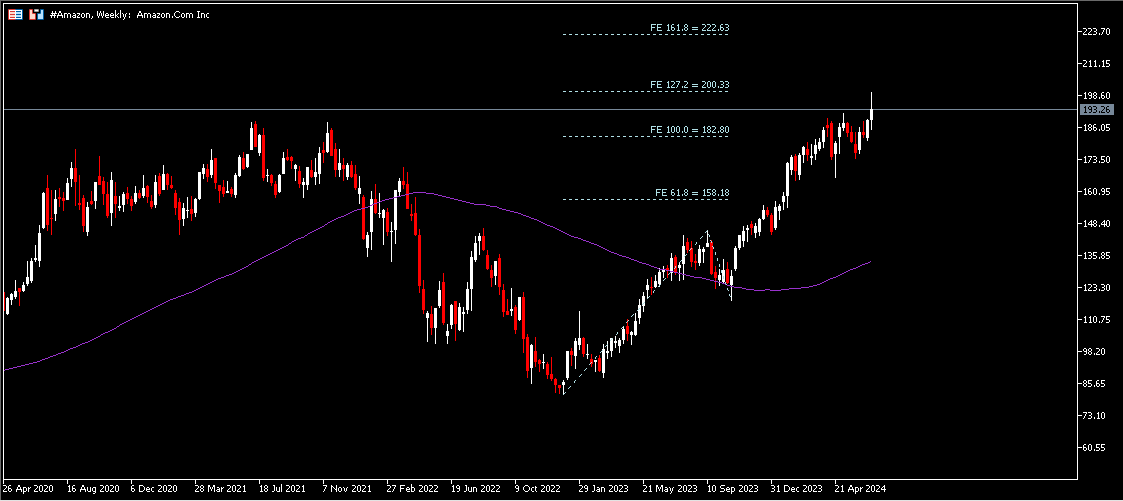

Technical Analysis:

#Amazon, Weekly: The company share price has been traded in an uptrend since gaining support in early January last year. Year-to-date, the asset has risen over 60%, with a new ATH at $199.81. The ATH and the FE 127.2% at $200.30 serve as the nearest resistance to watch, followed by $222.60. Otherwise, $182.80 serves as the nearest support. A close below this level may indicate technical correction, with the next focus on $158.20.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.